After 3 months of endless kite flying, the UK budget was not as bad as many feared. But to paraphrase fellow private investor ‘topvest’, it will undoubtedly hinder the nation’s prosperity as we follow the path to becoming a world leading welfare state attached to a smaller, low-growth economy.

At the time of writing, it seems as though Presidents Putin and Trump have hatched a plan to end the war with the proverbial gun held to Ukraine’s head. Meanwhile, the Coalition of the Willing (WTAF) have rocked up to this particular gunfight armed with a pitchfork and some mildly strong rhetoric. Checkmate to Russia I suspect and just as worryingly, the rest of Europe does not feel any safer as a result.

In other news, US debt has surpassed $38 trillion while the market threatened to correct in November before resuming its upward trajectory. Tether have been major buyers of gold, now holding over 100 tonnes, placing it above Australia and Denmark but a little below Hungary and Greece for gold reserves (it’s probably nothing, right!). The Yen carry trade (borrowing money at near zero interest rates from Japan to invest or lend more productively elsewhere) is over as the Japanese 10-year bond yield flies past 1.5% with some commentators predicting 2% by year end. Meanwhile, President Trump is set to appoint a dove into the role of Fed Chair for what promises to be the wildest of wild rides in 2026.

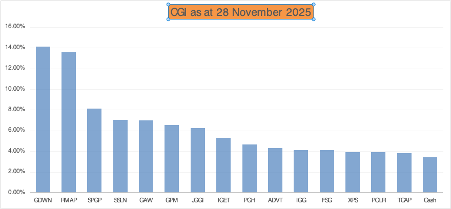

Against this backdrop, I am thankful that my Compound Growth & Income (CGI) portfolio has returned over 20% YTD. Hopefully, it can hang onto those gains through to year-end.

Portfolio Changes

I exited Me International (MEGP) on a stop-loss (alongside an inline full year trading update) and reinvested most of the proceeds into Rolls-Royce (RR.) which I have subsequently sold on a stop-loss. Despite posting decent results and an inline outlook, Rolls-Royce appears to have sold off along with other defence players as the Russia-Ukraine war seemingly draws to a close. I am now suffering sellers remorse over Me International which I might or might not buy back into once the requisite period of self-flagellation has passed.

Company News

Advanced Technology (ADVT) – Interim Results – Revenue up 28% of which 10% was organic which led to adjusted EBITDA increasing 76% (45% organic), EPS up 73.5% and cash up from £88.5m to £97m. Given these stellar results, one might wonder why the share price has fallen from 190p to 170p over the month. I suspect it is a combination of a lack of further acquisitions alongside a profit warning from M&C Saatchi (SAA) in which ADVT continue to hold a legacy strategic stake.

TP Icap (TCAP) – Q3 Trading Update – Against a record comparative period, Group revenue for the third quarter was £560m, up 3% year-on-year and the full year outlook remains inline with market expectations. “The Board remains focused on Parameta’s sustainable growth and will continue to assess the appropriate timing for a potential minority US listing.” The financial performance is decent enough given a low volatility quarter (TCAP thrives on volatility) but the listing of Parameta Solutions in the US seems to be taking an age. I shall try to remain patient which is aided by a near 7% dividend yield.

Polar Capital (POLR) – Interim Results – Assets under Management (AuM) +25% to £26.7bn, basic EPS up 22% and the interim dividend maintained. POLR currently yields 8.8%.

Games Workshop (GAW) – Interim Trading Update – Once again, GAW have exceeded analyst forecasts with not less than £326m revenue and Profit Before Tax of not less than £135m and have declared another dividend of 100p per share. Despite this excellent performance, I can only rate them as the second-best company in my portfolio and have weighted them accordingly.

XPS Pensions (XPS) – Interim Results – Group revenue +13%, Diluted EPS +9%, Interim Dividend +11%. The day prior to these results the company also announced a significant contract win with the Metropolitan Police Pension Scheme which will run for at least seven years.

Goodwin (GDWN) – Family Share Sales – Members of the Goodwin family, including directors of the company, sold around 1.6% of the company’s shares to institutional investors while retaining control of over 53% of the company’s shares. As with the timing of the special dividend, this probably had more to do with financial planning around the UK’s budget than anything else.

Dividends

November was another strong dividend month with receipts from TP Icap (TCAP), Games Workshop (GAW), Me International (MEGP), Invesco Global Equity Income (IGET) and a whopper of a special dividend from Goodwin (GDWN). Dividends are currently running at around 15% above my annual forecast which is rather pleasing given my significant allocation to non-yielding assets such as gold, silver and mining funds during the year.

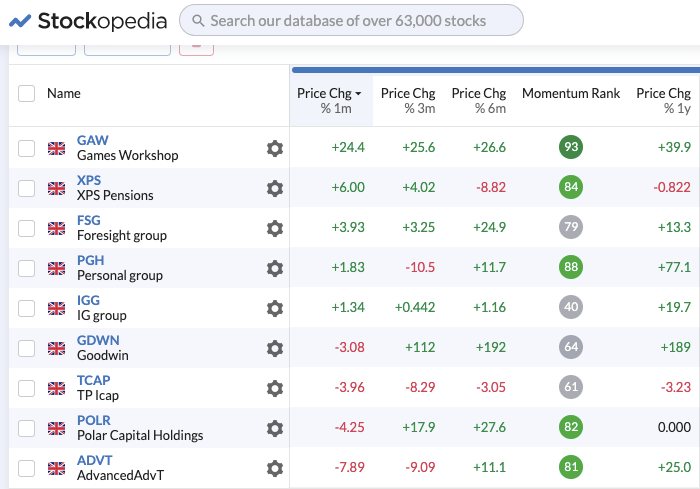

Monthly Momentum

Games Workshop (GAW) leading the way this month with a near 25% gain. There were a few detractors but mostly just background noise.

Screen(s) of the Month

I have missed a couple of months in this series so here is a bumper catch up. These will be the last three screens that I’ll be sharing this year but I will be spending more time exploring these screens and others on my new substack site, The Compounding Machine (see section below).

This month’s screens are all inspired by things I have read and heard from three of the people that have most influenced my growth and development as an investor; Warren Buffett, Phil Oakley and Terry Smith. However, I must emphasise that each of these screens were only inspired by this trio and errors of inclusion or omission are entirely mine.

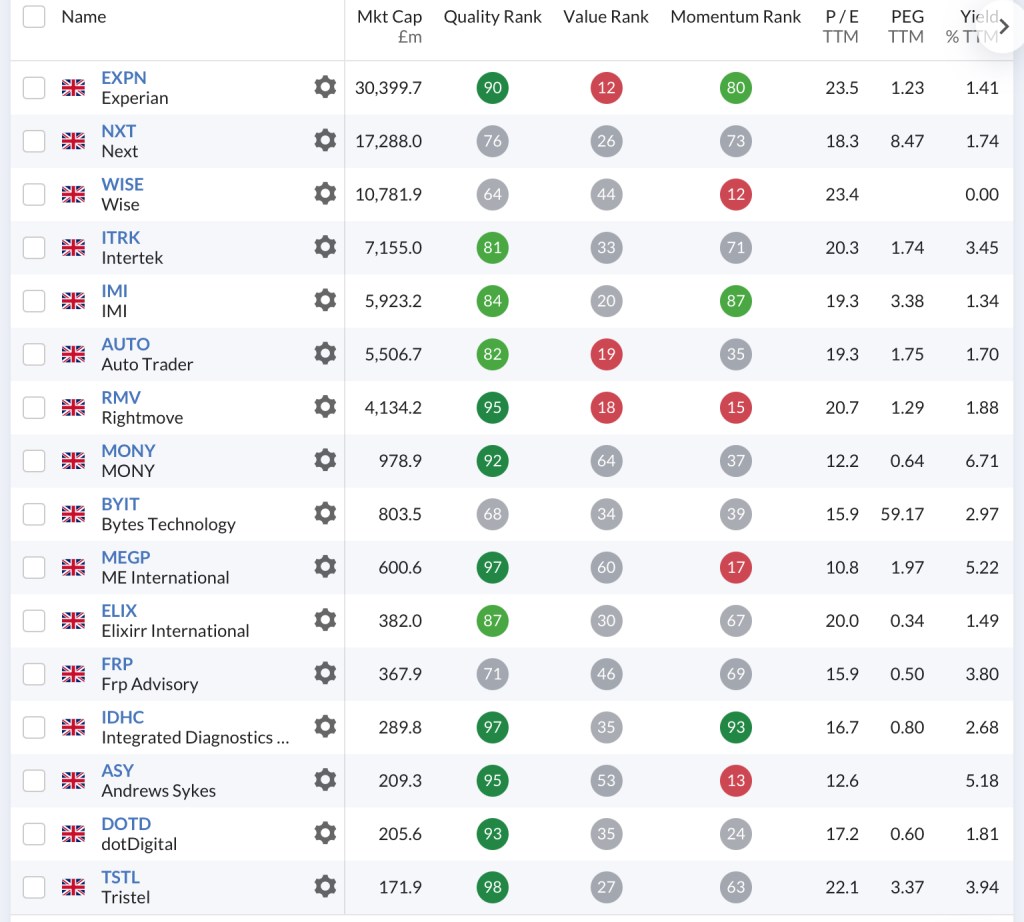

Warren Buffett Screen

Here is the checklist.

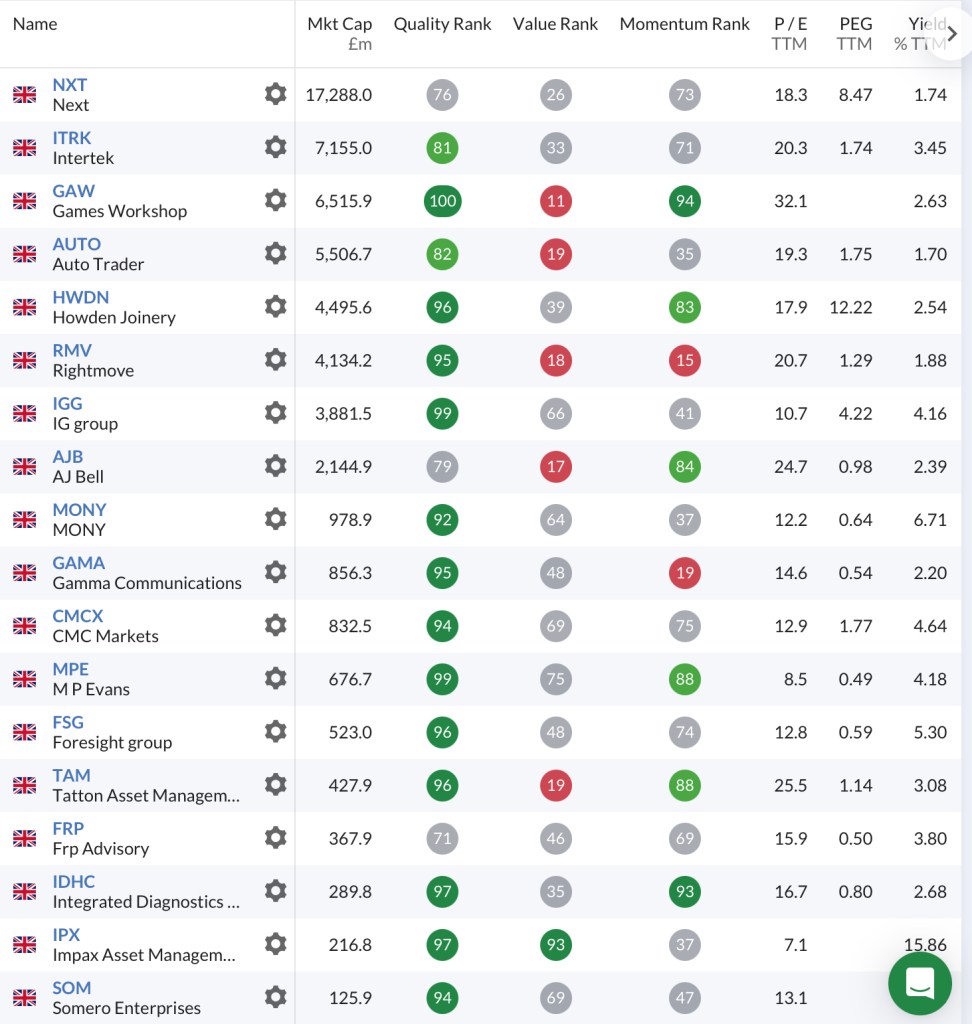

There are currently 18 UK companies that pass this screen of which I currently own 4 in my own portfolio – Games Workshop (GAW), IG Group (IGG), Polar Capital (POLR) and Foresight Group (FSG).

Phil Oakley Screen

Here is the checklist.

There are 18 UK companies that currently pass this screen of which I own 3 in my portfolio – Games Workshop (GAW), IG Group (IGG) and Foresight Group (FSG).

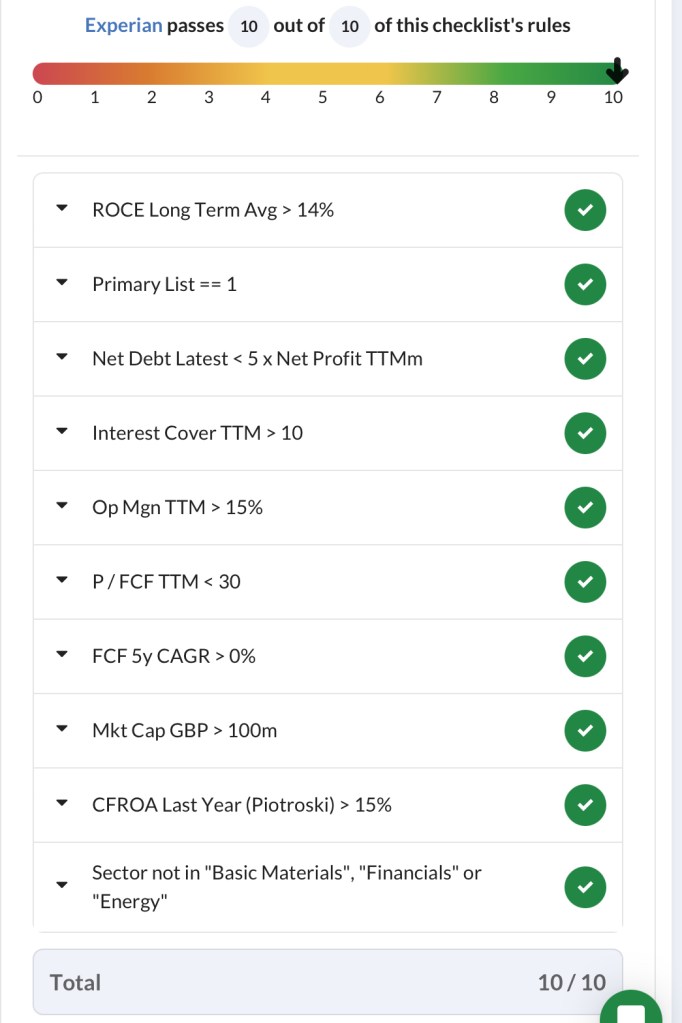

Terry Smith Screen

Here is the checklist.

There are currently 16 UK companies that pass this screen of which I don’t currently own any.

The Compounding Machine

Some readers will already be aware that I have recently started a new substack called The Compounding Machine. While I’m going to keep this site here running to continue diarising my own investment journey, I felt that it would be useful to set up a separate site to help others learn about and build their own compounding portfolio. I’ll be covering things like portfolio structure, risk management, building a portfolio, stock screening and I’ll be running a model portfolio. In addition, there is a deep dive section covering individual company analysis (supported by AI), regular screening updates (all my own analysis) and The Market Eye podcast (curated by me and presented by AI).

Subscriptions to both The Compounding Machine core content and the Deep Dive section of the site are free but please note, you will need to subscribe to each one separately for the respective content to be delivered direct to your inbox (this is because the Deep Dive section will have frequent content and I don’t want casual subscribers or those with limited time to become overwhelmed). There is also the option of accessing both sections without a subscription via the website.

Closing Thoughts

I missed this week’s budget because I was on a day trip with my grandson. During this trip he taught me about the eight planets of the solar system, their moons (he actually knows the names of lots of them), the possibility that Planet X might be hiding behind the Sun, other stars in the Milky Way galaxy, how black holes consume matter that pass the event horizon and whether white holes and worm holes might exist. Then he sang a song about the seven continents on earth (which he tells me is the planet we live on) and the five oceans. He is 3 years old!

On our next trip I am torn between teaching him about 3i/Atlas or Modern Monetary Theory (MMT) but I don’t want to give him nightmares.

Back to the UK’s budget. I thought Kemi Badenoch’s speech in response to the budget was excellent and if she can back this up with meaningful policies that support the rhetoric, I might just have rediscovered a political home. It will have been a long time coming.

As for December, it could be wild on the markets. It seems a racing certainty that the Federal Reserve and the Bank of England will both cut interest rates at their next meetings and there is increasing chatter that an almighty short squeeze is about to unfold in the silver market. Certainly, it has a massive cup and handle pattern which even I can see despite my usual chart blindness. And holding gold continues to feel like a necessary safe haven strategy.

And as Richard Crow pointed out on his substack this week, the fear and greed index is signalling almost the perfect contrarian indicator – it is just passing through extreme fear at 24, having been as low as 6 over the past couple of weeks.

I’ll be back with my annual review in early January. Until then,

Happy investing

Simon

Disclosure

At the time of writing, I own shares in the companies shown in the graphic below. If you are reading this article in the future, you can find my latest quarterly disclosure here

Many of the graphics on this site are shared with the courtesy of Stockopedia for whom I act as a Brand Ambassador.