Following a buoyant January, I imagine many UK investors will have found markets challenging since then. A period that began with the solvency issue in some US regional banks and ended with the Bank of England having to raise their base rate to 5% in response to stubbornly high inflation numbers, notably ahead of those being reported in the US and Europe. It seems that UK focused investors will have to suffer some more before rates peak. Meanwhile, whether or not we see a technical recession, it is likely we will see some creative destruction in the economy which should provide opportunity for listed companies, so long as they are not first eaten themselves.

Meanwhile, UK investors waiting for the next bull market in UK equities, especially in mid and small caps, will be wondering if we are nearly there yet. For what it is worth, I suspect we are edging closer to peak interest rates but will likely lag the trend in the US and Europe.

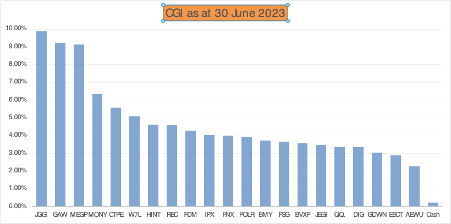

Performance versus Benchmarks H1 2023

Compound Growth & Income (CGI) +5.77% YTD

FTSE All Share Total Return +1.80% YTD

Vanguard World ETF (VWRL) +6.79% YTD

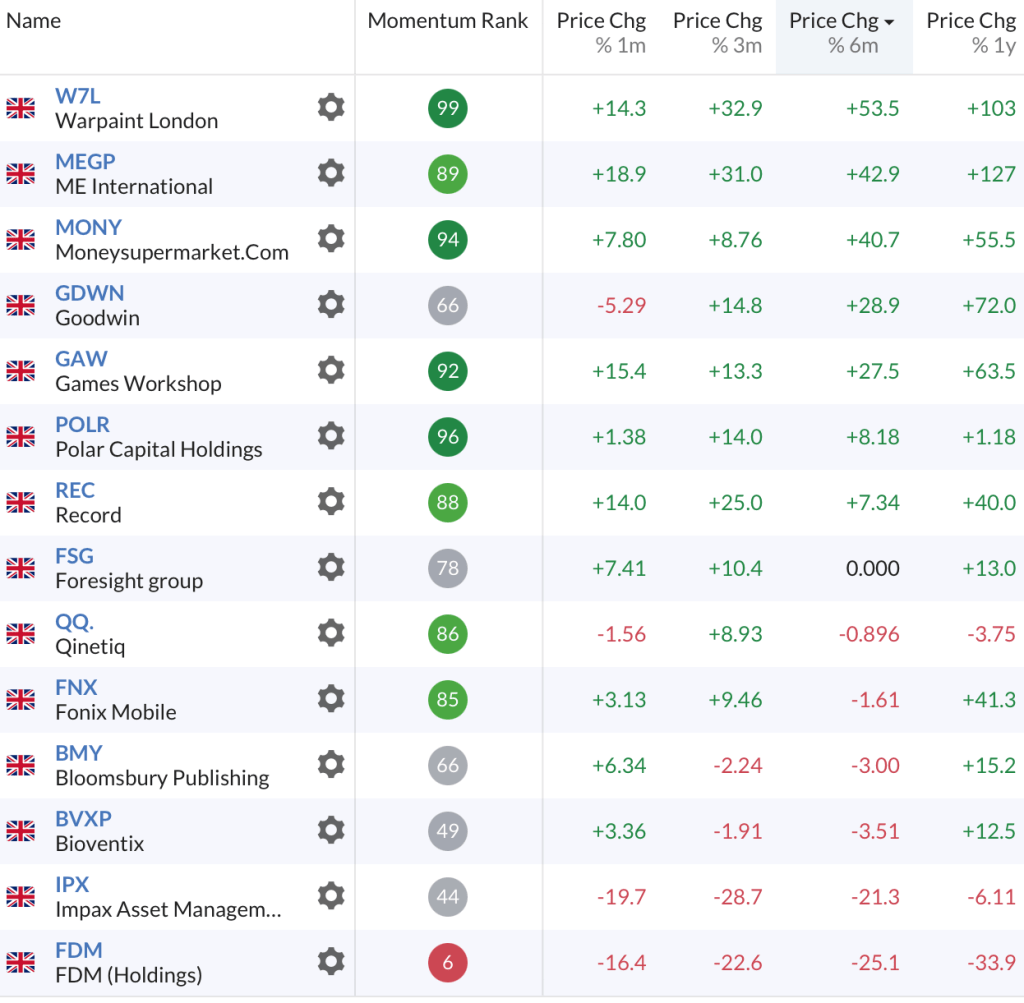

Main Contributors and Detractors

5 portfolio companies returned double digit gains during the half year; Warpaint (W7L), ME International (MEGP), Moneysupermarket.com (MONY), Goodwin (GDWN) and Games Workshop (GAW) counterweighed by 2 portfolio companies returning double digit losses; Impax (IPX) and FDM Holdings (FDM).

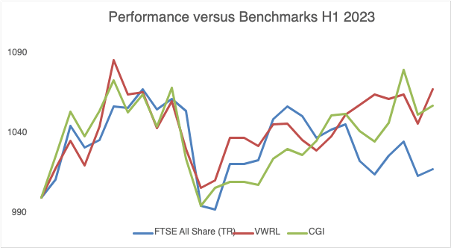

Current Asset Allocation

I have been quite brutal in weeding out lower conviction holdings with Spirent Communications (SPT), Gamma Communications (GAMA), Paypoint (PAY), Spectra Systems (SPSY), Wilmington (WIL), AG Barr (BAG) and Argentex (AGFX) all being shown the exit during the period. What is left is a more concentrated portfolio of higher conviction holdings underpinned by a subset of similarly high conviction investment trusts.

Investment Trusts – 7 holdings (31.94% weight)

Direct Equities – 14 holdings (67.85% weight)

Investment Trusts

JP Morgan Global Growth & Income (JGGI) 9.85%

CT Private Equity (CTPE) 5.56%

Henderson International Income (HINT) 4.62%

JP Morgan European Growth & Income (JEGI) 3.46%

Dunedin Income Growth (DIG) 3.33%

European Smaller Companies Trust (ESCT) 2.87%

AEW UK REIT (AEWU) 2.25%

If I could offer you an average 15% return on your portfolio annually while paying you a 4% dividend would you be interested? This is the long-term record of JP Morgan Global Growth & Income (JGGI) and while past performance is no guarantee of future success, I have made this investment trust my largest holding and am waiving my 10% portfolio limit for this holding only. It is supported by 4 other equity trusts (3 large cap and 1 small/mid cap) and 2 alternative asset trusts (private equity and UK commercial property).

Direct Equity Holdings

Games Workshop (GAW) 9.23%

ME International (MEGP) 9.14%

Moneysupermarket.com (MONY) 6.34%

Warpaint (W7L) 5.07%

Record (REC) 4.57%

FDM Holdings (FDM) 4.28%

Impax (IPX) 4.01%

Fonix Mobile (FNX) 3.99%

Polar Capital (POLR) 3.91%

Bloomsbury Publishing (BMY) 3.71%

Foresight Group (FSG) 3.66%

Bioventix (BVXP) 3.57%

QinetiQ (QQ.) 3.34%

Goodwin (GDWN) 3.03%

The elephant in the room for this motley bunch is that 4 of them are asset managers (16.15% weight) where fortunes are largely dependent on a rising stock market and fresh inflows (harder now that the age of TINA is over). That said, each of them operates in areas where I have limited exposure and therefore, I have been playing these themes via the asset managers rather than the assets themselves. I still think this will work out just fine over the longer-term (supported by healthy dividends) but I have been questioning the wisdom of having too much weight in this sector. The thinking shall continue.

Asset managers aside, I now have 10 individual equity holdings to manage directly, most of which I entered and/or added at very favourable prices during the autumn of 2022. I am now treading a fine line between letting my winners run (it is so tempting to snatch profits in these markets) and gradually rebalancing towards a 50-50 split between investment trusts and individual companies.

Portfolio Metrics

One of the most influential pieces I have read in recent times was Ed Croft’s article on Stockopedia, The Perfect Stock does not exist… stop searching for it where the suggestion is to synthesise the perfect stock across the whole portfolio. I have started monitoring this against my own QARP Checklist

| QARP Checklist | Pass Rate | Average |

| ROCE % (5 Yr Avg) | 15% | 41.57 |

| ROE % (5 Yr Avg) | 15% | 42.69 |

| CROIC % (Last Year) | 15% | 49.45 |

| Gross Margin % (5 Yr Avg) | 20% | 60.58 |

| Operating Margin % (5 Yr Avg) | 10% | 24.11 |

| Net Gearing % (Latest) | 30% | -41.05 |

| P/OCF (TTM) | 20 | 19.34 |

| PEG (TTM) | 2 | 1.52 |

| EV/EBITDA (TTM) | 20 | 12.53 |

| Earnings Yield % (TTM) | 5% | 7.26 |

| Dividend Yield % (TTM) | 1% | 3.81 |

| EPS Growth % (1 Yr Forecast) | 5% | 20.64 |

| Checklist Passes n/12 | 9.57 |

This and other metrics can be viewed on the Performance and Analysis page.

Brand Ambassador Role for Stockopedia

Perhaps one of the more exciting developments during the period is that I have agreed to act as a Brand Ambassador for Stockopedia. There are very few brands that I would ever consider ambassadoring (sic) for but hand on heart, Stockopedia has transformed my approach and success as an investor and I am happy to support the site.

Let me be clear, this is not an affiliate marketing arrangement. My role is to share different ways of using the site’s tools such as screening, portfolio analysis and stock analysis via social media and sometimes as long form content on this blog. I shall also be helping to make newcomers aware of the volume and quality of educational content available on the site, not least the recently completed series on the Strategy Map which I thought was absolutely fabulous.

One area where I have found Stockopedia’s global subscription very helpful has been enabling me to analyse funds’ top 10 holdings through the same lenses that I study and monitor my own portfolio. I shared this as a thread on Twitter. Over the months ahead I shall be looking at other aspects of investment trusts (I recently ran them through a Momentum lens, for example) and some of my favourite screens as applied to both the UK and overseas companies as well as sharing other educational content, as appropriate.

Closing Thoughts

Markets have been turgid during the first half of 2023 and we can but hope for a more buoyant second half but don’t hold your breath. The prospects for the UK economy are quite gloomy and likely to remain so until interest rates peak and by default fund flows into the UK generally and small and midcaps in particular are likely to be restrained. That said, we are starting to see good results/outlook being rewarded, so perhaps we are getting closer to the end of this bear market. Let us hope so.

I wish all my readers/followers every success for the second half of the year.

Cheers

Simon

@BrilliantLeader on Twitter, Stockopedia and the UK Stock Challenge

Disclosure – At the time of writing, I hold the companies in the graphic below or f you are reading this in the future, my latest portfolio disclosure can be viewed here.