My portfolio in September and October has been dominated by two things; Gold and Goodwin (I guess the clue is in the title). The former went parabolic after a summer of consolidation to reach an all-time high of $4,300 plus change before falling back to the $4,000 level where it looks to be consolidating again. The latter, having already provided an outstanding trading update in September went on to confirm confidence in doubling profits for the year ending April 2026 (the first time in 7 years of holding the shares I can ever recall them providing forward financial guidance) while also getting ahead of the UK’s November budget by announcing a special dividend of more than double the ordinary dividend for 2025.

Goodwin

At the time of writing, Goodwin (GDWN) is now my largest holding at around 15% of portfolio value, thankfully having declined the opportunity to follow my rules in September and top slice at the 10% level. The special dividend alone is equivalent to around 10% of the annual dividend forecast for the entire portfolio and while this might mean an ex-dividend dip, I shall continue to hang firmly onto my shares given that the product with the brightest prospects, Duvelco, is not due to begin generating commercial revenues until FY27. To paraphrase a well-worn advertising slogan, The Future is Bright, The Future is Goodwin!

Gold

As for gold, my investment thesis from the article I wrote in mid-September remains intact. Central banks continue to be net sellers of US treasuries and net buyers of gold. Add to this a dovish Fed, ongoing fiat money printing and a US debt that now exceeds $38 trillion (a mere trillion more than when I wrote my article), the GENIUS Act, stable coins, tariffs, geo-political uncertainty and the Trump factor and it is easy to see how gold could continue to go higher from here. A new Fed chair is due to be appointed in May next year and will likely be announced in December/January. There is also a rather significant anniversary coming up on July 4th next year which Judy Shelton believes might be the catalyst for a gold backed treasury bond – it will require an audit of Fort Knox though so let’s see what transpires.

Portfolio Changes

The one thing that has changed is that I used the spike in gold and silver to consolidate my precious metals holdings, exiting individual names in favour of a gold miners ETF (SPGP) and a junior miners investment trust (GPM). In round numbers, I now have 20% of my portfolio in precious metals; physical gold (two thirds) and silver (one third) and 35% in total when including the two gold mining funds.

Other News

With 50% of my portfolio now committed to Gold (including silver/miners) and Goodwin other holdings are currently taking a back seat, although I am plotting where to invest funds once I divest my precious metals holdings. To this end there have been positive updates in October from Advanced Technology (ADVT), Polar Capital Holdings (POLR), Foresight Group (FSG), IG Group (IGG) and XPS Pensions (XPS) following positive updates in September from Personal Group (PGH) and Games Workshop (GAW). There is also one standout constituent of my Watchlist which might find its way into my portfolio before year end.

Dividends

September and October have seen dividends incoming from Mony Group (MONY), XPS Pensions (XPS), Renewables Infrastructure Group (TRIG), Goodwin (GDWN), Games Workshop (GAW), Foresight Group (FSG), European Small Cap Trust (ESCT), JP Morgan Global Growth & Income (JGGI), IG Group (IGG) and Personal Group (PGH). The running total for dividends now sits at 95% of my annual forecast and with several dividends already booked for November and December along with a significant special dividend from Goodwin (GDWN), a comfortable outperformance is now a racing certainty.

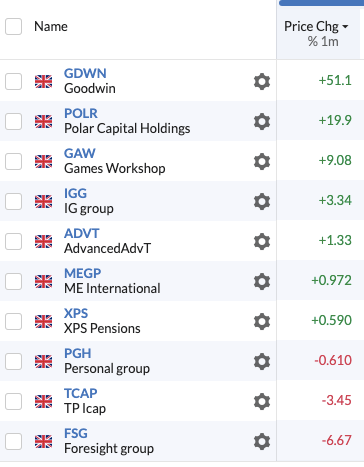

Monthly Momentum

It is a ‘no contest’ this month with Goodwin (GDWN) up over 50%.

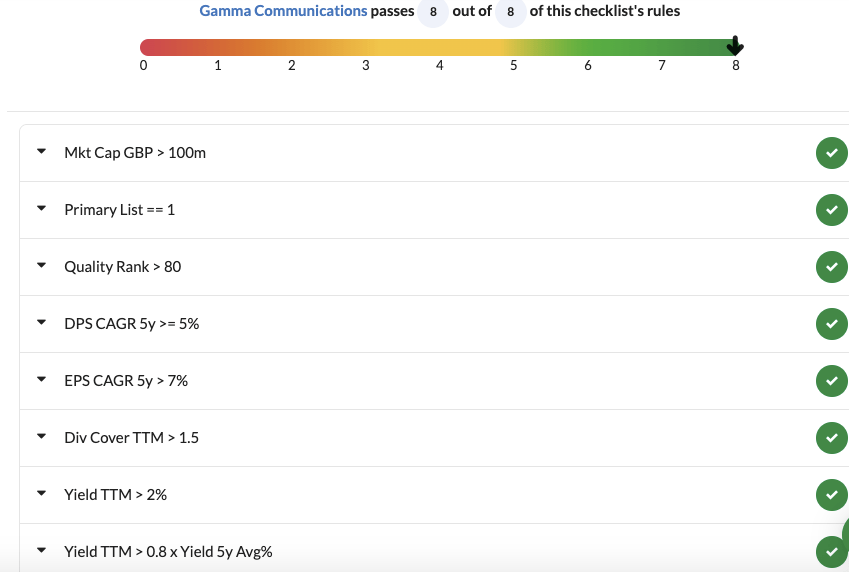

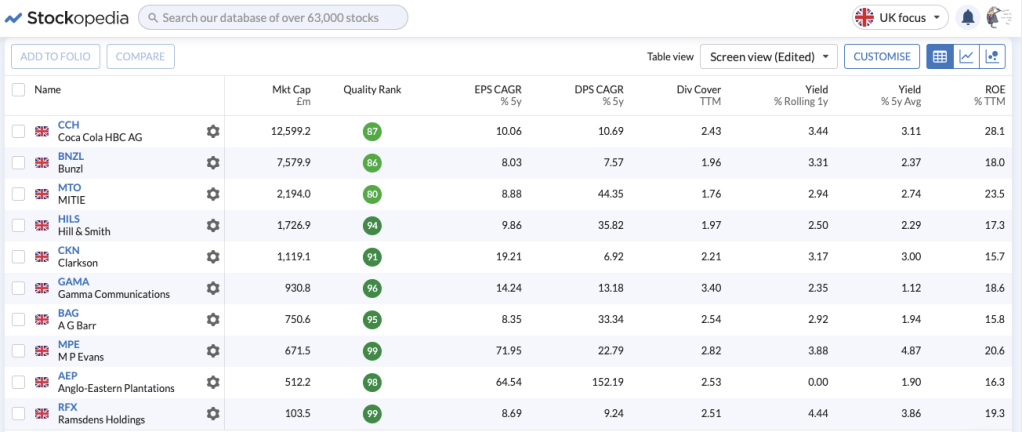

Screen of the Month

This month I am sharing my Dividend Growth Screen.

There are currently 10 UK companies passing this screen but none that I currently own.

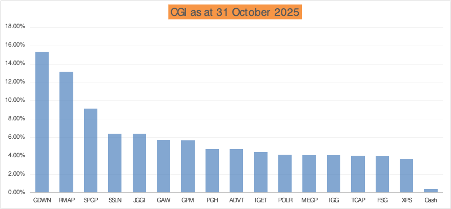

Portfolio Performance and Disclosure

As things stand my portfolio is tracking at +20% YTD. It would be great to maintain or better this level over the full year in order to celebrate the tenth anniversary of the Compound Growth & Income (CGI) portfolio in style. At the time of writing, the constituents of this portfolio and their respective weightings are shown in the graphic below.

Happy Halloween Folks!

Simon (@BrilliantLeader)