Shortly after I wrote my Boy Who Cried Wolf article back in February, I had lunch with a friend who asked me if I was sufficiently confident in my thesis to continue investing in gold at all time highs. At the time, gold was threatening to breach $3,000 and the truth is that I was 50:50 on whether the dramatic move in gold was likely to be sustained or if it was another false dawn.

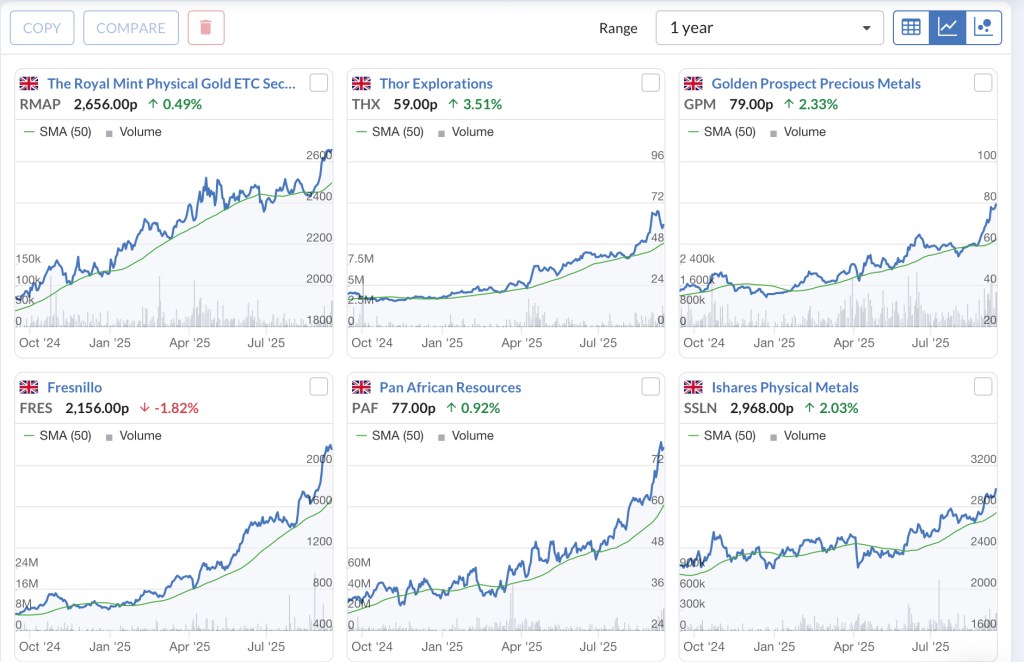

Fast forward seven months and a further 20% has been added to the gold price, gold miners have been on a tear and silver is starting to catch up. Spoiler alert, I have been buying more of all three. A glance at the 1 year chart for the metals and miners that I own tells the story of the price action.

What is driving this price action?

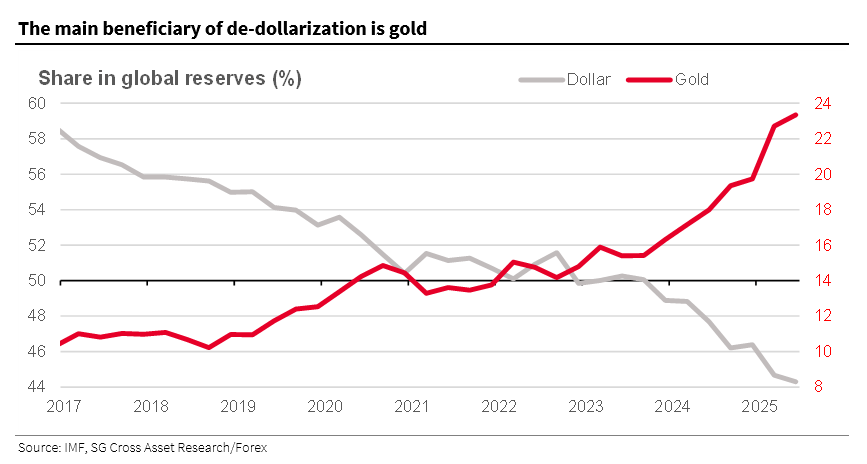

The biggest buyers of gold have been central banks and it seems to be part of a de-dollarization process. When Russia invaded Ukraine and the US confiscated Russia’s dollars, gold began to overtake the US Dollar as a share of global reserves. The gap has been widening ever since and it has accelerated quite dramatically during 2025 as the chart below shows.

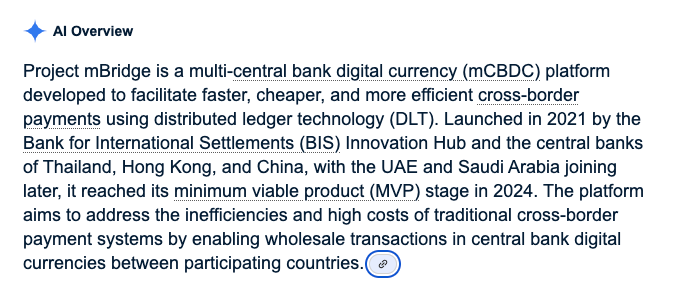

So, it seems that central banks, led by the BRICS countries and most notably China, have been converting their US Dollar Treasuries into Gold. These BRICS countries, along with other non-BRICS countries across Asia and the Middle East have launched their own settlement system that bypasses the US led SWIFT. It is called mBridge. It is blockchain-based and real-time payments are supported using Central Bank Digital Currencies (CBDCs).

It is also worth noting that China doesn’t just buy gold on the open market via exchanges but also directly from miners, both foreign and domestic.

What about the United States?

The GENIUS Act (Guaranteeing Essential National Infrastructure in US-Stablecoins) recently approved by Congress and signed into law by President Trump, is the United States’ first comprehensive legislation on stablecoins.

From Reuters, Crypto company Tether, the creator of the world’s largest stablecoin, plans to launch a U.S.-based stablecoin designed for U.S. residents called USAT… The new law requires stablecoins to be backed by liquid assets – such as U.S. dollars and short-term Treasury bills – and for issuers to disclose publicly the composition of their reserves monthly…U.S. Treasury Secretary Scott Bessent had encouraged lawmakers to pass legislation to create federal rules for stablecoins, arguing that it could lead to a surge in demand for U.S. government debt.

Ah, so there we have it, stablecoins can be used to buy short-term Treasuries, presumably to offset the reduced demand from foreign central banks.

The U.S. has an awful lot of debt, currently running at around $37 trillion. One school of thought is that the U.S. has 8,133 metric tons of gold valued on their balance sheet at just $42.22 per Troy ounce. If this were to be revalued, perhaps via very long dated, gold-backed Treasury Bonds at the prevailing price, the debt could be reduced or even wiped out, depending on the price of gold. The question then becomes at what price would the U.S. revalue their gold and what can they do to increase the price of gold?

Let’s start with what the U.S. can do to increase the price of gold.

Does this sound familiar?

As to what price the U.S. would be prepared to revalue the gold on its balance sheet; at around $150,000 per ounce, the $37 trillion debt could be entirely wiped out. Now, I am not suggesting they will drive it to this level (although never say never) but nonetheless, it is not hard to see that the U.S. Administration would be happy to see gold significantly higher than the current $3,600 per ounce level.

Can you see what is happening yet?

All that glitters is not just gold, it is a new global monetary system or more likely, two competing systems, West and East. And I am in little doubt that they will both need to be underpinned by gold in one way or another. But don’t take my word for it, Stephen Miran (Chair of the Council of Economic Advisers to the U.S. Government and the latest member of the FOMC after replacing Adriana Kugler) published A User’s Guide to Restructuring the Global Trading System in November 2024. The playbook has been hiding in plain sight.

As for silver, apart from the historic connection to gold as a supporting precious metal (e.g. poor man’s gold), it is also an industrial metal and the U.S. have declared it to be a critical mineral, designating it as a Strategic Metal.

I am having lunch with my friend again next week and when he asks me if I am still sufficiently confident in my thesis to buy more gold at current all-time highs, I shall tell him that I am over 90% confident that gold, silver and gold/silver miners are going higher and that I am buying all three in order to try and protect my portfolio BUT that the price for these going higher is likely to be value destruction elsewhere in the economy (e.g. debt, currencies etc.).

To paraphrase Sherlock Holmes, “If you eliminate the impossible, whatever is left, however improbable, is the truth”. Be careful out there folks!

Disclosure – At the time of writing, I own shares in gold (via RMAP), silver (via SSLN) and gold/silver miners via Golden Prospect Precious Metals (GPM), Fresnillo (FRES), Pan African Resources (PAF) and Thor Explorations (THX). Collectively, these holdings currently account for around 28% of my portfolio’s value.

Disclaimer – No advice is offered or intended by this article. It is simply me sharing my research, opinions and personal strategy in order to educate and entertain.

Thank you Simon, you’ve excelled yourself with this article. As a long term sceptic on gold, I’ve been buying miners, (SRB, GJGB) and gold ETF (SGLP) over the last 10 months, tentatively thinking they’re on a long term bull run. This note has helped to strengthen my conviction – just hope we’re not got down the rabbit hole of conspiracy theories!. Chris

LikeLike

Thanks for the feedback Chris. Personally, I dislike investing in commodities, including gold and silver. Give me a steady compounder with a solid dividend any day. However, I don’t think this time round it’s a conspiracy theory which is why I have taken steps to try and protect my portfolio. Good luck with your own decision tree. Cheers, Simon

LikeLike