It seems as though this year’s summer malaise could prove to be the calm before the storm, on both a UK and global level. In the UK we are faced with what might prove to be a sovereign debt crisis with 30 year gilts over 5.6% and a punitive fiscal budget pending this autumn. The global landscape continues to be orchestrated by the US with the possibility of a BRICS uprising murmuring in the background. Perhaps the most significant monetary development is Trump’s growing influence over the Fed where a September rate cut now seems a racing certainty, the main question being by how much?

At the time of writing, gold has just breached $3,400 while physical gold (RMAP) combined with my solitary junior gold miner (THX) sees my portfolio exposure to the precious metal at around 16%. I also have my eye on a small exposure to Bitcoin (BTC) when Exchange Traded Notes (ETNs) become available to UK retail investors on 8th October, although I fear the FCA have acted 6-12 months later than they should have done in this regard, if indeed they should ever have acted in the first place.

Company News

A quiet month…

TP Icap (TCAP) – Interim Results – Group revenue up 9%, adjusted EBIT up 10%, a new £30m buyback launched and most significantly to this shareholder, “Turning to Parameta Solutions, as previously announced, our focus is on a listing in the United States with the Group maintaining a majority stake. The Board is keeping under review appropriate timing for any potential listing and will update shareholders in due course. Were the listing to proceed, the Group would expect to return most of the proceeds to shareholders.” It is far from being my highest conviction holding but nonetheless, the value and income on offer make it a relatively comfortable hold.

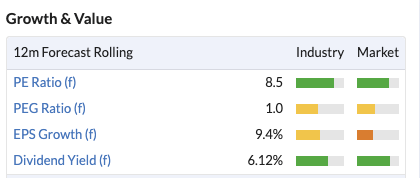

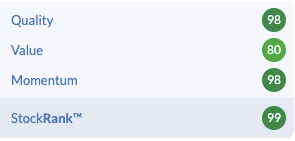

Thor Explorations (THX) – Interim Results – Revenue up 67.8% to $146m, EBITDA up 70.5% and net profit up 115% leaving a net cash position at period end of $52.8m, supporting a basic yield of around 5% and an ongoing exploration programme (where the news flow continues to look promising). Unsurprisingly, Stockopedia rates THX as a Super Stock with an overall Stock Rank of 99.

CT Private Equity (CTPE) – Interim Results – NAV for the period down 2.5% (mainly due to currency movements) with the share price up 0.1%. The shares continue to trade at around a 30% discount and currently yield 5.9%. So far, this has been a disappointing investment with nearly all my returns coming from the dividends. I continue to hold.

Dividends

A busier August than usual for dividends with payments received from CT High Income (CHI), Polar Capital (POLR), Invesco Global Equity (IGET), Thor Explorations (THX) and Games Workshop taking the overall receipts to 69% of my annual forecast.

Portfolio Changes

With the US market looking extremely toppy, I exited QCOM and ARCK along with the underperforming Renewables Infrastructure Group (TRIG) while topping up Thor Explorations (THX), Foresight Group (FSG), Invesco Global Equity (IGET) and the European Smaller Companies Trust (ESCT). Cash is currently a full position at 3.75% weighting.

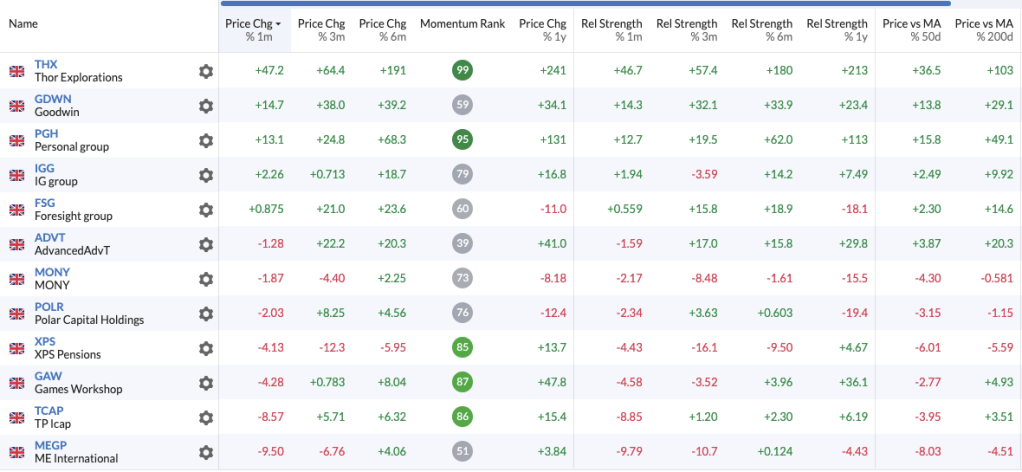

Monthly Momentum

Leading the pack this month is Thor Explorations (THX) with the main laggards being Me Group International (MEGP) and TP Icap (TCAP).

Screen of the Month

To celebrate the ten year anniversary of my Compound Growth & Income (CGI) portfolio, I am sharing one of my screens each month. As signposted previously, this month is the Top QM+ screen which has the following criteria.

There are currently 19 UK companies that qualify for this screen of which I own 2; XPS Pensions (XPS) and Mony Group (MONY).

And there are also 19 US companies that currently qualify for this screen.

Closing Thoughts

Aided by light news flow, I have spent most of August away from the markets. My own summer malaise has been a combination of a very pleasant fortnight walking in the Alps and swimming in Lake Annecy and a more than healthy amount of time building my Fantasy Premier League (FPL) team. For those interested, this season I am writing a journal of the trials and tribulations of an FPL manager under the aptly named AFC Blunder.

September is likely to be a more active month for both company news flow and macro events, not least the Fed’s decision on interest rates where many eyes will be focused.

Until next time,

Happy investing

Simon

@BrilliantLeader

Disclosure

At the time of writing I own shares in the companies shown in the graphic below. If you are reading this article in the future, my latest quarterly holdings disclosure can be viewed here.

Stockopedia – Many of the graphics in this article and across the site are copied and shared with the permission of Stockpoedia for which I act as a brand ambassador.