Having filled an imaginary black hole with an increase to Employers’ National Insurance contributions, the addition of VAT on private school fees and the means testing of the winter fuel allowance, the Chancellor saw her remaining fiscal headroom all but wiped out with the watering down of the Welfare Bill to the point that it would possibly be a net cost rather than a saving. No wonder she was spotted crying at the subsequent Prime Minister’s Questions. The real question left unanswered though was, how will she balance the books?

Worry ye not fair maiden, Lord Kinnock is riding to the rescue. For younger readers, Neil Kinnock was once the leader of the Labour party who infamously tripped over and fell into the sea while attempting to convince journalists he could walk on water and subsequently fell foul of The Sun’s election eve headline of “Nightmare on Kinnock Street” before riding off on the European Gravy Train. Now, Lord Kinnock has suggested a Wealth Tax will solve the Chancellor’s problems, perhaps 2% annually on everyone worth more than £10m. Given that most people are not worth £10m, such a suggestion has not been met with much public outrage. However, once these things are established in principle it will be nigh on impossible to stop future Chancellors reducing the threshold to £5m or £1m. And even if that is not the case, how many wealthy people do you think will leave these shores rather than have their wealth eroded by such a punitive tax?

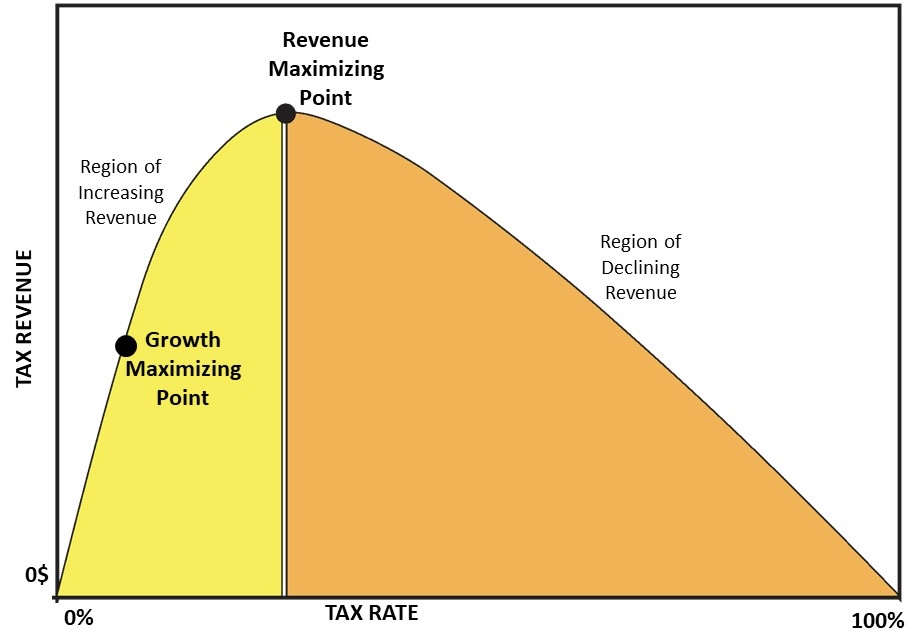

I have the Laffer Curve on repeat at the moment on my social media.

The principle is simple. If you tax people beyond what is considered fair and reasonable, the overall tax take reduces. In the case of the wealthy many will emigrate. In the case of companies there is less money to reinvest in the economy to create more jobs and therefore, more tax revenues. It stifles innovation and entrepreneurship while creating a benefit culture of entitlement.

As Lady Thatcher once famously said, “The trouble with socialism is that eventually you run out of other people’s money to spend.” It looks like we are about to see this play out for the first time since the 1970s and it is unlikely to be pretty!

Moving on, some portfolio companies also had some news during July…

Company News

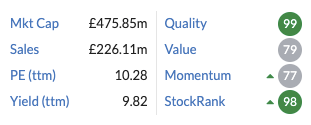

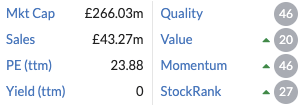

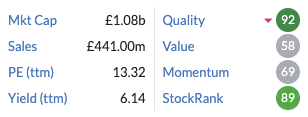

Polar Capital (POLR) – AuM Update – An 8% increase in AuM was entirely down to positive market movements offset by a modest net outflow. Stockpedia’s algorithms rate this a Super Stock and for good reason – high quality, reasonable valuation, high yield and strong fund performance.

Advanced Technology (ADVT) – Full Year Results – The growth is starting to show through now, driven by their acquisitive strategy with turnover doubling and EPS growth of 129%. There is also a significant cash pile for further earnings enhancing acquisitions and a legacy stake in M&C Saatchi (SAA). ADVT has risen to become a top 5 holding in my portfolio and despite this increase, it still feels like a very comfortable hold.

Thor Explorations (THX) – Q2 Operational Update – As you would expect from a gold miner at the moment, the numbers are rather good. Gold sales of 25,900oz during the quarter at an average sale price $3,187 generated revenue of $82.5m. Production guidance of 85,000oz to 95,000oz was maintained along with guidance for their All-In Sustaining Cost (AISC) remaining between $800 and $1,000 per ounce. I appreciate there is jurisdictional risk here (as is the case with many junior miners) but the shares do look rather cheap on a PE ratio of just over 3 and a prospective dividend yield of around 7%.

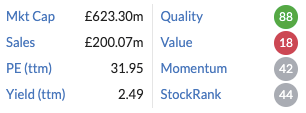

Mony Group (MONY) – Interim Results – Mediocre numbers with overall revenue up just 1% and EPS up 4%. As the company points out, car insurance provided a significant tailwind last year which has created challenging comparatives this year. The number of SuperSaveClub members is accelerating, passing the 1.5m member milestone and now generating 14% of group revenue. It is possible that this company has gone ex-growth and the 6% dividend yield will end up being a value trap. For now, I am sticking with them.

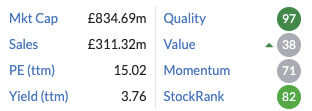

Me Group (MEGP) – Interim Results – Very solid numbers here with revenue up 2.3% and diluted EPS up 12.8%. Photobooths continue to be a low growth, cash cow with the laundry business providing the majority of the growth. As noted previously, the company has effectively put the For Sale sign up which is a shame because this is a very comfortable share to hold, offering Quality (ROCE of 30%+) and Growth at a reasonable price.

IG Group (IGG) – Full Year Results – Helped by favourable trading conditions (volatility), net trading revenue was up 12% and adjusted EPS was up 26%. The company also announced a small dividend increase and a new share buyback of up to £125m. Despite a healthy rise in share price post results, IGG still offers decent value, although growth can be less predictable than some companies due to variable market conditions. A comfortable hold nonetheless.

Personal Group (PGH) – H1 trading Update – Revenue was up 11% and greater than 90% is now from recurring revenue sources. Despite a share price rise of over 10% on the back of this news, the shares continue to look good value from my perspective.

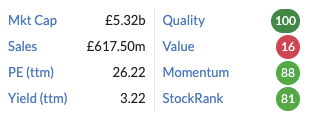

Games Workshop (GAW) – Final Results – Apart from being the cleanest set of accounts you are ever likely to see from a public company, GAW delivered a 17.5% revenue increase and a near 30% increase in EPS (no adjustments, no EBITDA). As for quality, pick your metric; ROCE 81%, gross margin 72%, operating margin 42% and no debt, with all surplus cash being returned to shareholders via dividends. The only downside in these results was a statement that US tariffs will have an estimated impact of around £12m per annum which of course, the company will try their best to mitigate. As I have said before, GAW is the best company I have ever owned and the best I am ever likely to own and it remains my largest individual holding.

Goodwin (GDWN) – Final Results – A revenue increase of 15% supported a profit increase of 47% and interestingly, now that the majority of capital investments have been made in prior periods, a change to the dividend policy from 38% of profits to 58% has led to an increase in the annual dividend of 111% which I believe is slightly ahead of inflation. Another significant piece of news in these results was that the impact of US tariffs has been negligible at just £100k of which the burden is being shared 50/50 with most customers. Goodwin don’t just dominate their niches but they are often seen as a critical supplier within complex supply chains. The other interesting snippet is worth repeating verbatim, “For Duvelco, whilst in its infancy, with customer trials already underway, the Board believes this strategic development for the Group will be the largest and most profitable division in years to come.” which implies the company continues to have a significant growth runway several years into the future. GDWN is my second largest individual holding.

Dividends

A sparse month for dividend receipts with only CT Private Equity (CTPE) paying out during the period.

Portfolio Changes

I have exited CT High Income (CHI) and Gamma Communications (GAMA) while taking new positions in Qualcomm (QCOM) (from my QARP Screen and offering AI and IoT exposure, among other things), Ark Innovation ETF (ARCK) and Invesco Global Equity Trust (IGET) along with continuing to build my holding in the European Small Cap Trust (ESCT).

The rationale behind these changes is subtle. I could have just held onto both CHI and GAMA as neither were strong sells in my mind. CHI had slightly underperformed some of its peers in the UK large cap space, although they do pay an enhanced dividend so that is probably par for the course. As for GAMA it had become a slightly uncomfortable holding with a share price that lacked momentum (still some selling from the IHT funds perhaps?) and a trading environment that suggested weakness in the UK market but growth coming through from the German acquisition. I might revisit this holding again once the dust has settled. The real driver for both of these sales is that I wanted to buy some shiny new things…

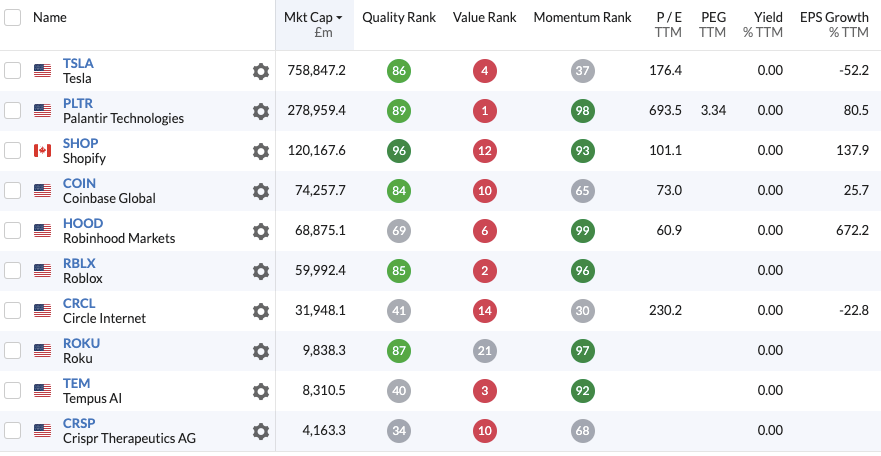

Ark Innovation ETF (ARCK) – I’m sure this will raise some eyebrows but I wanted some exposure to AI and other disruptive technologies such as blockchain and robotics. Perhaps we are in a speculative bubble but I have concluded that these things are coming more quickly than the mainstream is anticipating and they will potentially have a profound effect on society. It is a case of having to be in it to win it, albeit with some very speculative holdings with some frothy valuations. This is my summary view of their top 10 holdings.

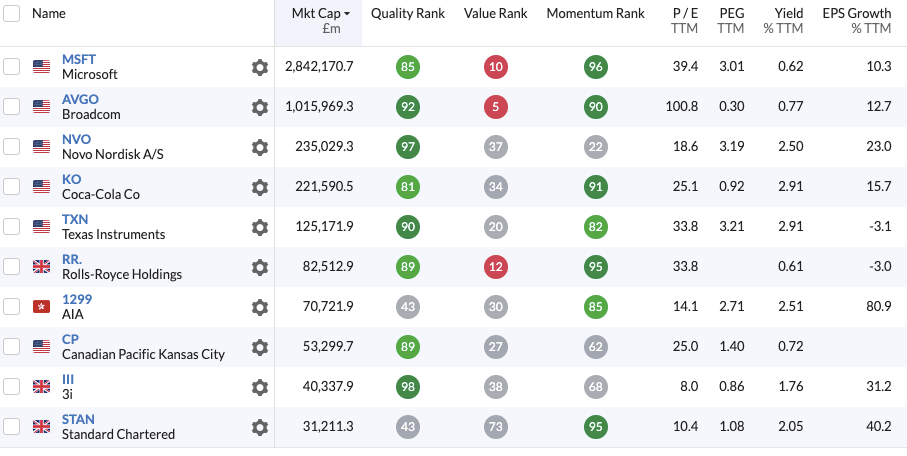

Invesco Global Equity Trust (IGET) – This is a more conservative global fund that has outperformed this year and one that I intend to hold for the long-term. Here is my summary view of their top 10 holdings.

European Small Companies Trust (ESCT) – Having seen off activist investor Saba, ESCT is now acquiring the European Assets Trust (EAT) and following this, will be paying a 5% p.a. dividend which is the icing on the cake from my perspective. Here’s my summary view of their top 10 holdings.

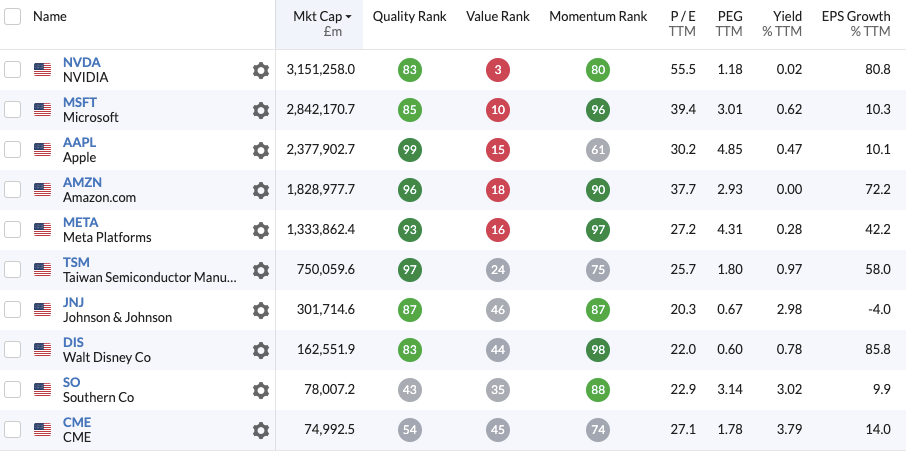

JP Morgan Global Growth & Income (JGGI) – I have retained my overweight position in JGGI and for completeness, here is my summary view of their top 10 holdings.

Monthly Momentum

A decent month with more contributors than detractors. Advanced Technology (ADVT) led the winners with Mony Group (MONY) being the worst performer.

Screen of the Month

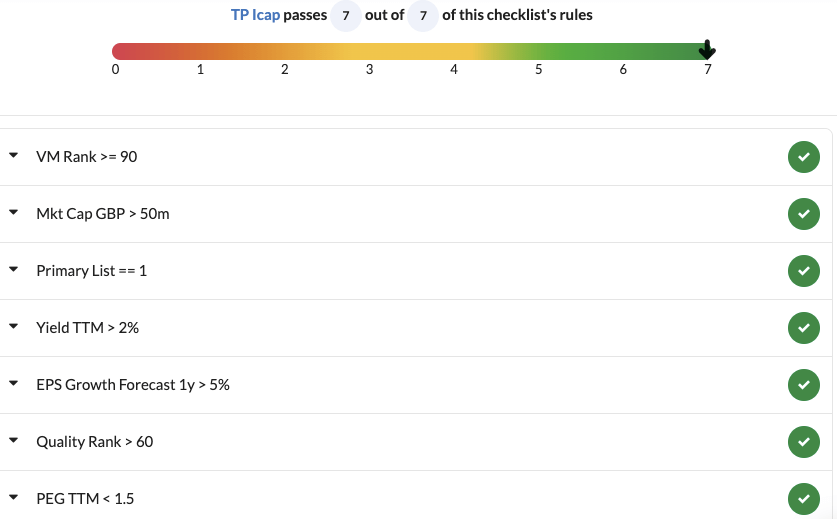

Following some feedback on last month’s Value Momentum screen, I created two new screens that simplified matters; a Top VM+ screen which I am sharing this month and a Top QM+ screen which I shall share next month. Here’s the simplified Top VM+ screen.

There are currently 7 UK companies that pass this screen and I only one that I own; TP Icap (TCAP).

By contrast, there are currently 49 US companies that pass this screen of which the top 10 by market capitalisation are shown in the graphic below.

Closing Thoughts

While I had a bit of a rant at the top of this article about the flaws of socialism we are currently experiencing in the UK, the real macro action is being driven by America. Tariff deals are starting to get done and they appear very favourable to the US, so this might just be a brand new revenue stream for the US government. There is something of a standoff with China and to a certain extent the other BRICS countries where something might still be brewing currency/trade wise but for now, the can has been kicked down the road for another 90 days.

Meanwhile, there appears to be a concerted effort by various members of the Trump administration to undermine Jerome Powell and therefore, the independence of the Federal Reserve. Whether Powell gets to serve his full term remains to be seen. At the heart of this of course is Trump’s desire to see interest rates lower and he clearly wants that to happen sooner rather than later. Too much too soon could see inflation take hold again and on that note, it seems a racing certainty to me that tariffs will also be inflationary for US consumers and businesses but what do I know? Just in case I am right I have a significant exposure to gold and gold miners which combined currently provide around 13-14% portfolio exposure to the precious metal.

One thing is for sure, there is never a dull moment with President Trump at the helm.

Until next time,

Happy investing

Simon

@BrilliantLeader

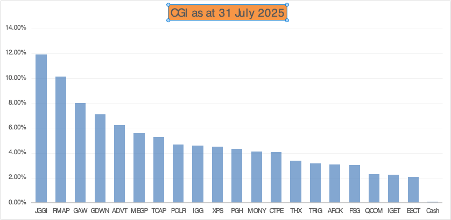

Disclosure – At the time of writing I own shares in companies that are shown in the graphic below. If you are reading this article in the future my latest quarterly holdings disclosure can be viewed here

Stockopedia – Many of the graphics in this article and across the site are copied and shared with the permission of Stockpoedia for which I act as a brand ambassador.