Who names a piece of legislation, The One Big Beautiful Bill? I’ll give you one guess and no, it’s not little Jackie from the kindergarten. It is of course the Trump administration’s budget reconciliation bill that ostensibly focuses on reducing government spending while making tax cuts. Infamously, it is the Bill that is credited with starting the Trump-Musk public feud. Of more interest to foreign investors is Section 899 of this Bill which provides for significant extra taxes to be imposed on foreign investors and foreign companies, especially if they are from countries that the US see as unfairly taxing American businesses. Charles Stanley have provided a useful explainer and there was also an interesting discussion on the Many Happy Returns podcast (June 4th).

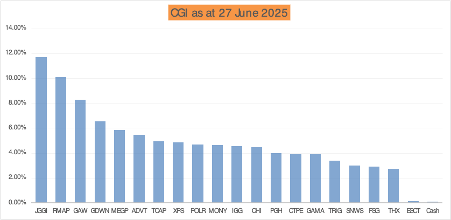

I believe it is another piece of the jigsaw that leads us to The Great Reset, whatever that might eventually look like. And it is this that sees me maintaining a 10% portfolio weighting in gold which of course, is a non-earning, non-yielding asset. Despite this and the various geopolitical tensions such as the Israel-Iran conflict, my portfolio has crept up to a positive return of +0.47% for the first six months of the year.

Performance versus Benchmarks

However, +0.47% YTD does not feel like a resounding victory. It is a significant underperformance against the FTSE All Share (TR) Index (+9.47% YTD) but slightly better than the Vanguard World ETF (VWRL)(-0.89% YTD). Pleasingly, The Compounding Machine which I launched at the start of the year is giving a decent account of itself with a total return of 7.58% and breathing down the neck of the FTSE All Share benchmark.

Dividends

A quieter dividend month with pay-outs from Gamma Communications (GAMA) and JP Morgan Global Growth & Income (JGGI) taking the total to 54% of my start of year expectations.

Main Contributors and Detractors

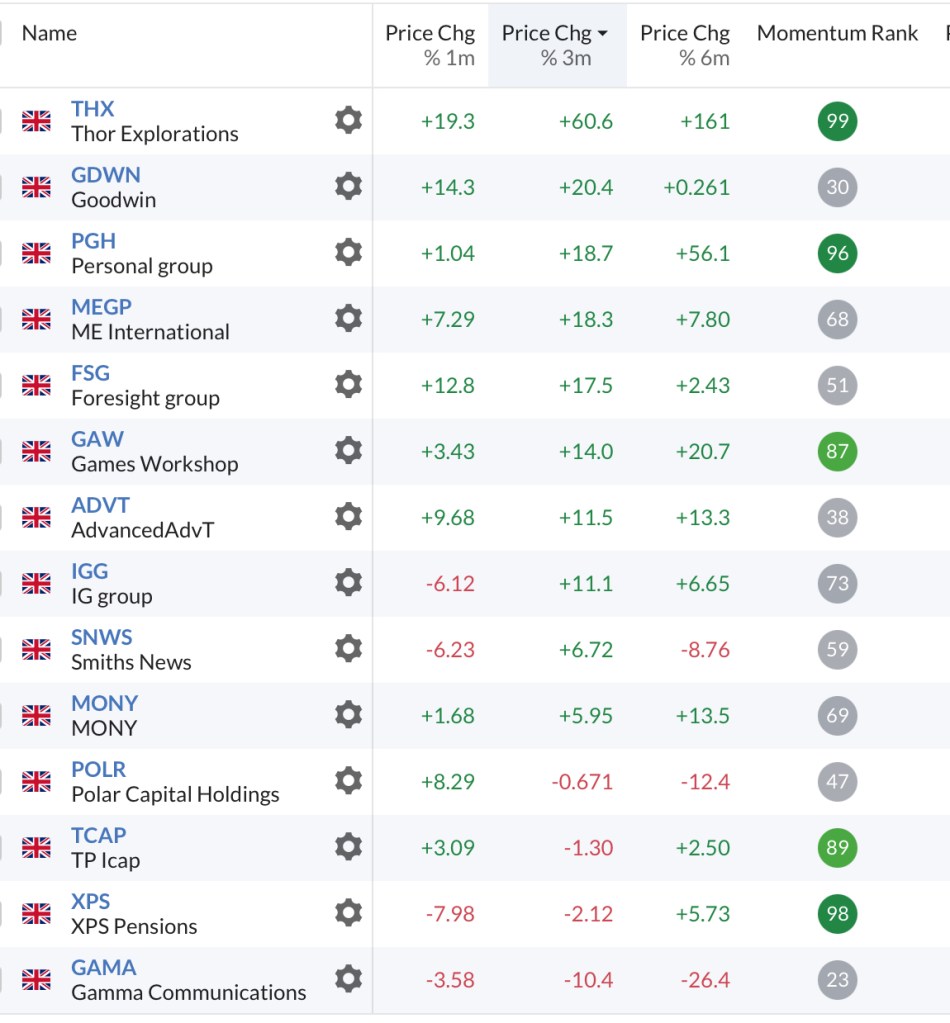

Unfortunately, the best performer this quarter is a company that I have only recently purchased (Thor Explorations (THX)). Nonetheless, Goodwin (GDWN) +20%, Personal Group (PGH) +18%, Me Group International (MEGP) +18% and Games Workshop (GAW) +14% have all put in a decent shift while the main detractor has been Gamma Communications (GAMA) -10%.

Company News (June)

Me Group International (MEGP) – Trading Update – A positive trading update for the first six months of their financial year with record profits expected, in line with consensus expectations. A particularly strong performance from Laundry operations supplementing slightly disappointing performance from the legacy Photobooths business which suffered from a technical issue (now resolved) with new printers. However, this was all somewhat superseded a couple of weeks later when the company effectively put up the For Sale sign, “in response to media speculation”. My own view is that this business would be attractive to private equity at around 270-300p per share (roughly 10x EV/EBITDA), although some commentators have suggested the CEO and majority shareholder might be making another bid to take this private – I don’t think this is likely but let’s see.

PayPoint (PAY) – Full Year Results – The headline numbers here seemed encouraging with approximately 10% increase in underlying EBITDA and underlying profit before tax. However, this included a lot of adjustments and frankly, more than I was comfortable with. I was also not comfortable with net debt increasing by 44%, especially when some of that is being used to buyback shares. I decided to exit this holding and of course, the share price has continued to go north since I did so but ultimately, I like to sleep soundly at night.

XPS Pensions (XPS) – Full Year Results – Excluding the gain on the disposal of National Pensions Trust (NPT) which was £32.5m, group revenue was up 18% and fully diluted EPS was up 36% reflecting a healthy dose of operational gearing. A near 3.5% dividend supports a share price that currently trades on a PE ratio of 17.4 at a PEG ratio of 1.1. The shares are probably close to fully priced at this level but I’m happy to stay aboard for the ride.

Foresight Group (FSG) – Full Year Results – Despite the headwinds being faced by asset managers, these results were encouraging with positive AuM and FuM movements of 9% and 14% respectively leading to revenue growth of 9% but short-term margin compression leading to EPS growth of only 6%. For good measure, FSG also passes all twelve checks on my QARP checklist. A 6.5% dividend yield seems like a good point to re-enter this former holding, although I am a little nervous when companies I own start referencing the share price, “our shareholders will benefit from the narrowing of what we believe to be an unjustified valuation gap.” Please, just focus on running the business and let the market take care of price discovery.

Portfolio Changes

Facilitated by exiting PayPoint (PAY) and top slicing some of my medium conviction financials I have expanded the portfolio this month by adding five new holdings; Foresight Group (FSG), Thor Explorations (THX), Smiths News (SNWS), Renewables Infrastructure Group (TRIG) and a starter position in the European Smaller Companies Trust (ESCT). If there is a theme to my new holdings it is that they all pay healthy dividends at their current valuation. While I try not to overreach for yield, my portfolio now has an attractive dividend yield of over 5% while EPS growth is forecast at a very healthy 26% (see portfolio metrics in the section below).

Portfolio Analysis

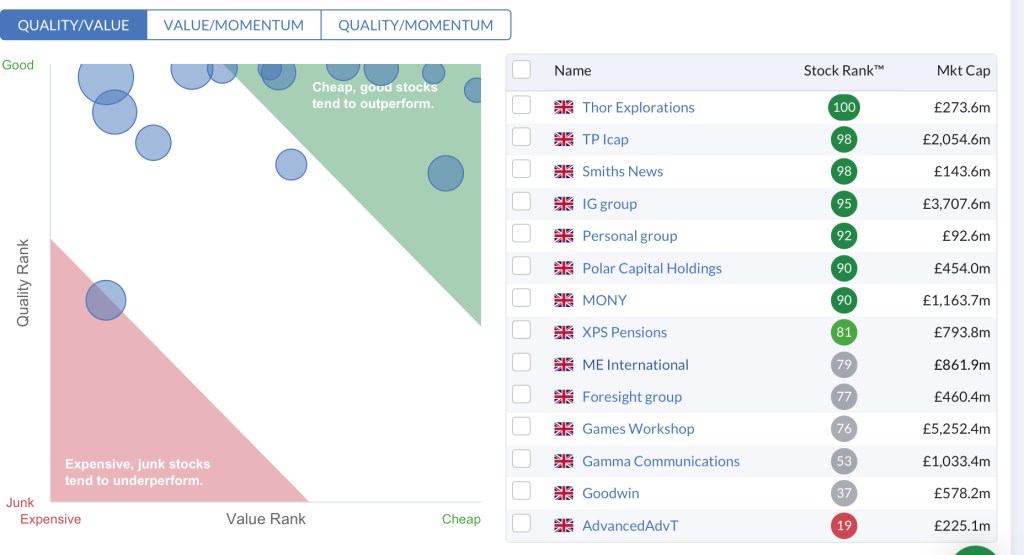

When I am going through a period of short-term underperformance, one of the things I like to do is look at the portfolio through several lenses as a sanity check that collectively, I own a good basket of shares. I always start with my QARP (quality at a reasonable price) checklist.

| QARP Checklist | Pass Rate | Average |

| ROCE % (5 Yr Avg) | 15% | 29.21% |

| ROE % (5 Yr Avg) | 15% | 23.10% |

| CROIC % (Last Year) | 15% | 23.31% |

| Gross Margin % (5 Yr Avg) | 20% | 55.61% |

| Operating Margin % (5 Yr Avg) | 10% | 19.51% |

| Net Gearing % (Latest) | 30% | -53.24% |

| P/OCF (TTM) | 20 | 10.37 |

| PEG (TTM) | 2 | 0.90 |

| EV/EBITDA (TTM) | 20 | 7.77 |

| Earnings Yield % (TTM) | 5% | 14.24% |

| Dividend Yield % (TTM) | 1% | 5.02% |

| EPS Growth % (1 Yr Forecast) | 5% | 26.19% |

| Checklist Passes n/12 | 9.67 |

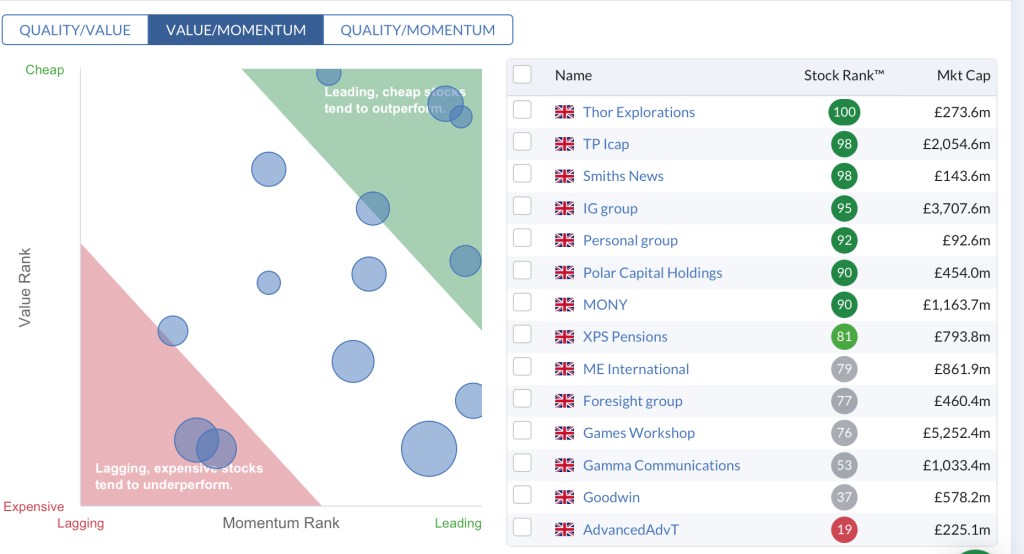

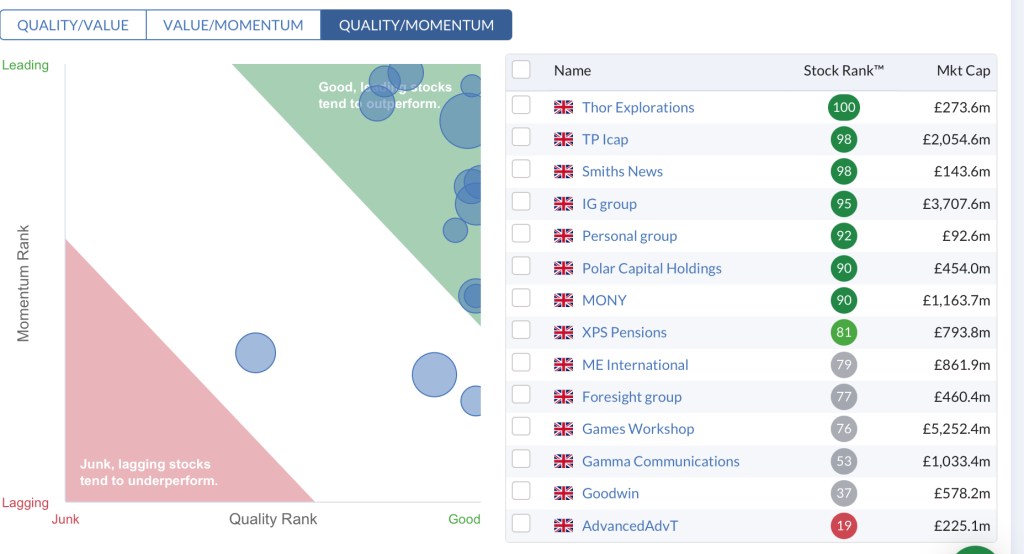

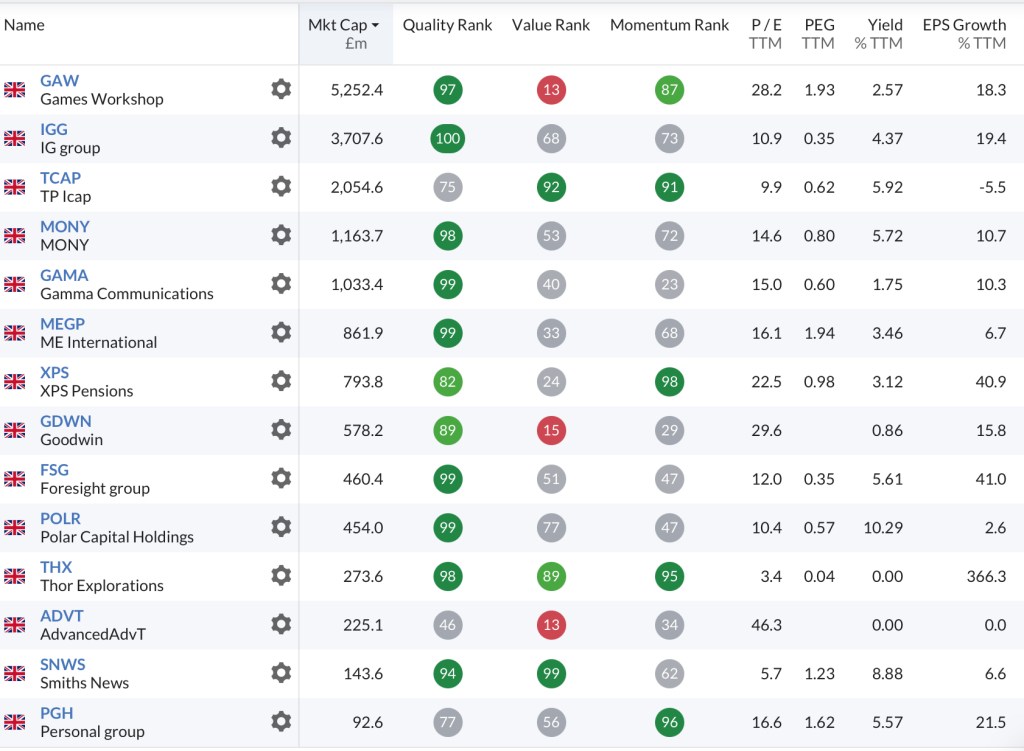

I also like to look at Stockopedia’s QVM (Quality, Value and Momentum) factor combos; QV, VM, QM and whether my holdings are broadly clustered in the right areas while also noting any significant outliers and the reasons for that.

My final sanity check is to look at those factors alongside some core metrics that I use to monitor the portfolio on a regular basis.

Overall, I’m very happy with the quality of the companies I own and how they complement each other in the portfolio mix.

Screen of the Month

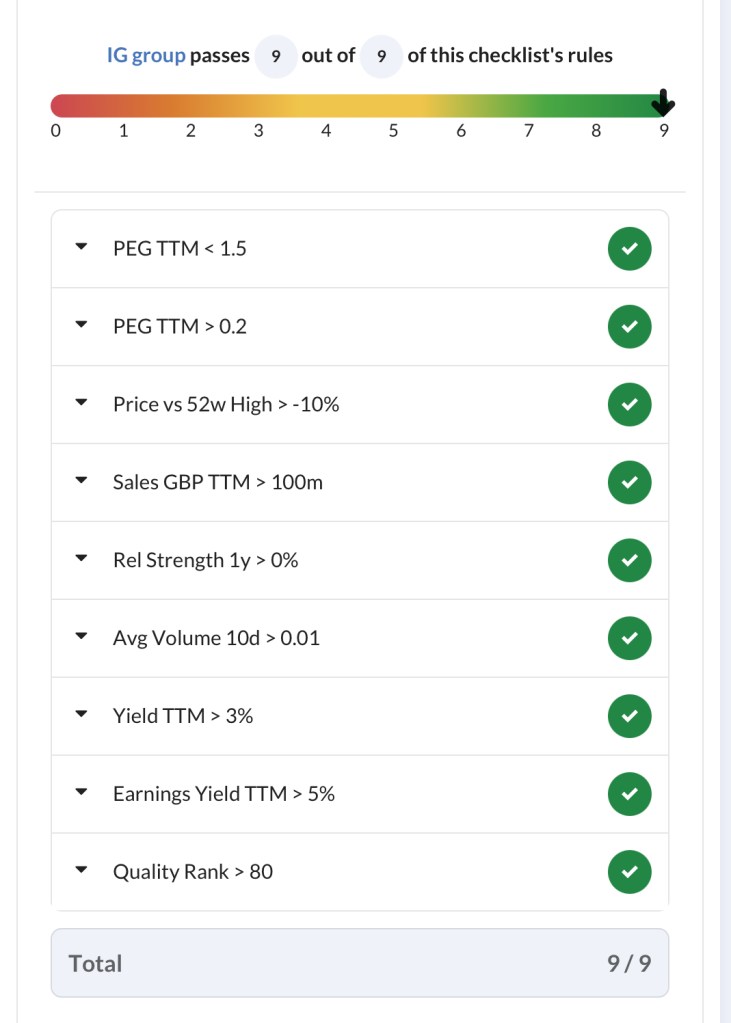

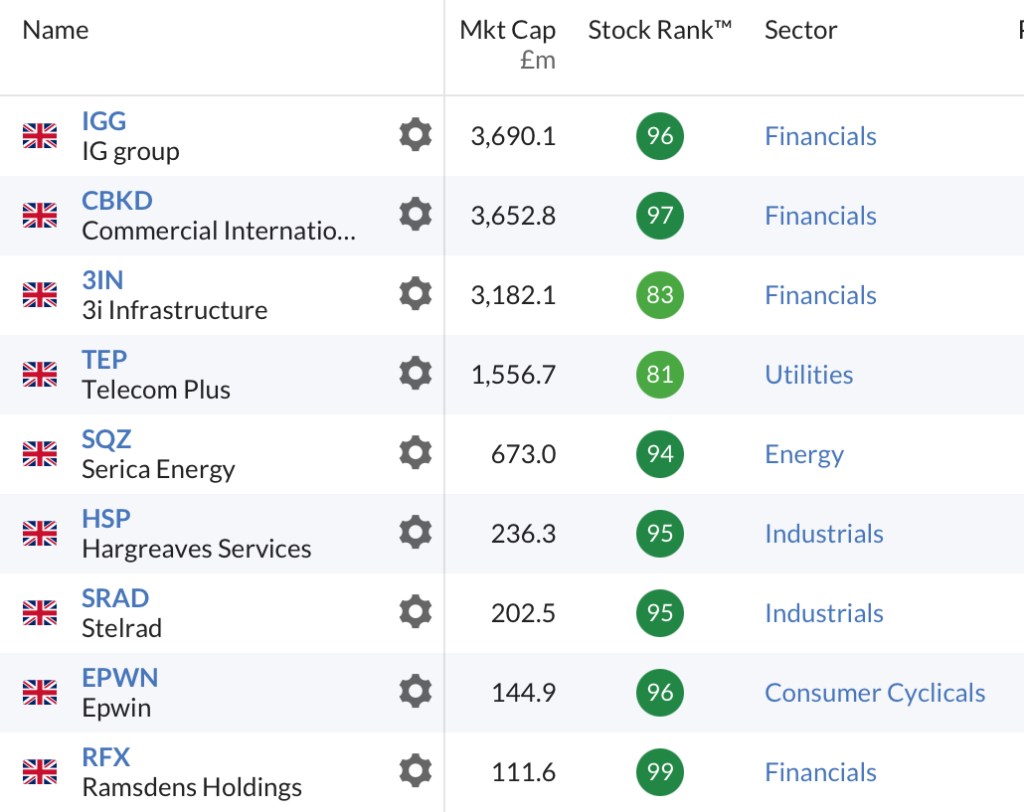

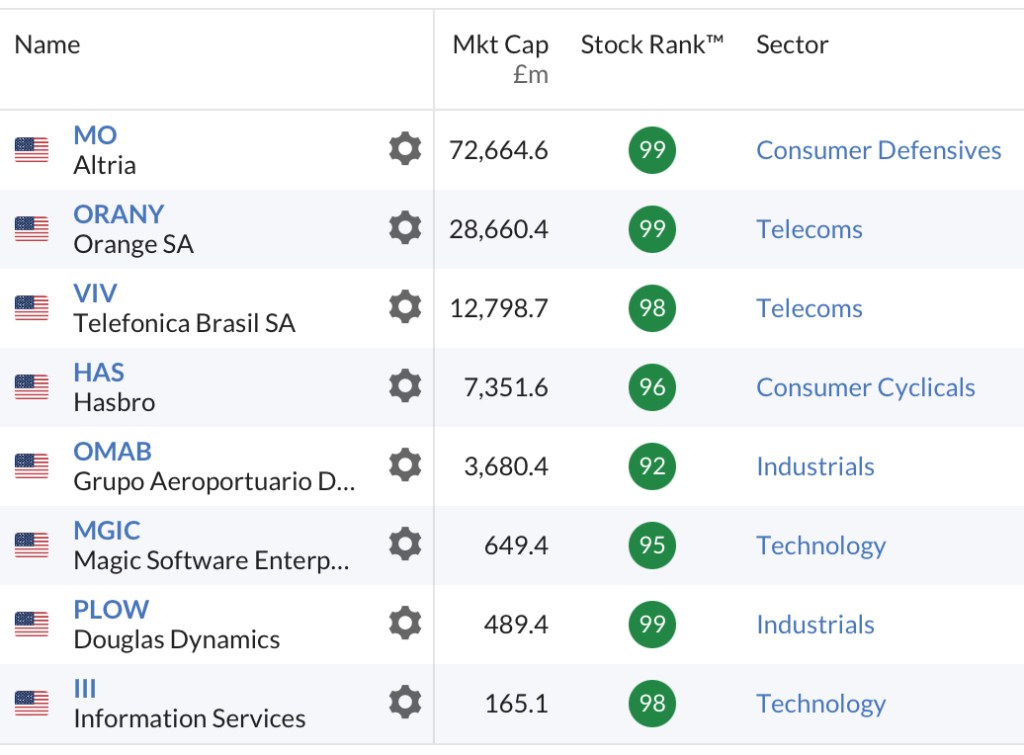

To celebrate ten years of the Compound Growth & Income (CGI) portfolio, I am sharing one of my screens each month throughout 2025. This month it is my Value Momentum screen.

There are currently 9 UK companies that pass this screen of which I own only one; IG Group (IGG).

And there are 8 US companies that currently pass this screen.

Closing Thoughts

If I am to outperform my benchmarks this year, especially the FTSE All Share (TR) index, then performance will need to be second half weighted. It is too early to say whether that is realistic. July will see a host of trading updates that will guide second half business performance while the Trump deadline for tariff/trade deals also comes up for renewal in July (TACO notwithstanding of course) alongside the voting through of that One Big Beautiful Bill. In combination, these will likely inform market performance in the short-term and potentially capital flows in the medium term.

Call me mad but for the first time in a long while, I am beginning to feel positive about UK equities as an asset class. And I am quietly confident that I own some very good ones within the small and medium subset of that asset class. Trust the process!

Until next time,

Happy investing

Simon

@BrilliantLeader on Twitter/X

Disclosure – At the time of writing, I own shares in the companies in the graphic below. If you are reading this article in the future, my latest quarterly holdings disclosure can be viewed here.