May started well with an agreement between the US and China to suspend most of the reciprocal tariffs so that more in-depth negotiations could take place. At one point during the month President Trump increased tariffs on the EU to 50% because no progress was being made on trade negotiations (heck, you should try negotiating a Brexit deal buddy) only to suspend this increase until the 9th July following a “very nice” call with Ursula von der Leyen. More recently, a US federal court has ruled the tariffs unlawful because they need to be set by Congress rather than an executive order. An appeal to this ruling has been lodged.

Put the tariffs up

Put the tariffs down

Up down, up down

Shake them all around

But you know, it’s the art of the deal!

Meanwhile, my portfolio companies continue to perform well.

Company News

Personal Group (PGH) – AGM Trading Statement – In line with expectations which are for 17% EPS growth. At the time of writing the shares trade on a forward PE ratio of 13 giving a forward PEG ratio of 0.9 alongside a dividend yield of 6.4%.

Mony Group (MONY) – AGM Trading Statement – In line with expectations which are for 13% EPS growth. At the time of writing the shares trade on a forward PE ratio of 11 giving a forward PEG ratio of 1 alongside a dividend yield of 6.2%.

IG Group (IGG) – Full Year Trading Update – The company expects to meet or slightly exceed market consensus forecasts which are for 2.2% EPS growth. At the time of writing the shares trade on a forward PE ratio of 10 giving a forward PEG ratio of 4.9 alongside a dividend yield of 4.4%.

Gamma Communications (GAMA) – AGM Trading Update – In line with current market forecasts which are for 16% EPS growth. At the time of writing the shares trade on a forward PE ratio of 12 giving a forward PEG ratio of 0.9 alongside a dividend yield of 1.8%.

TP Icap (TCAP) – Q1 Trading Statement – The board remains comfortable with current market expectations which are for 12% EPS growth. At the time of writing the shares trade on a forward PE ratio of 8 giving a forward PEG ratio of 0.7 alongside a dividend yield of 6.5%.

Advanced Technology (ADVT) – Two Acquisitions – ADVT has agreed to acquire HFX Limited for £5.3m (£2m of which is deferred for two years) and Goss Technology Group Limited for £7.1m net of which £5m is in ADVT shares. It is good to see the cash pile being deployed, albeit on accretive acquisitions rather than a knockout deal. I’m sure Vin Murria and her team will continue to work their magic integrating these acquisitions and maximising the synergies.

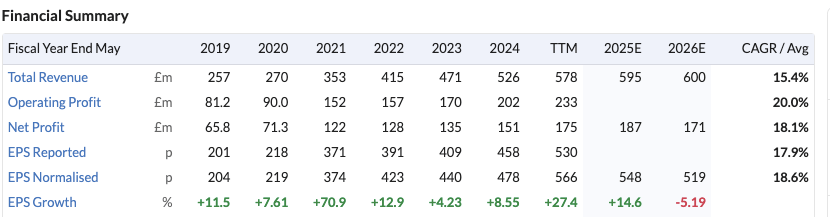

Games Workshop (GAW) – Full Year Trading Update – “For the 52 weeks ending 1 June 2025, we estimate the Group’s core revenue to be not less than £560 million (2023/24: £494.7 million) and licensing revenue of c.£50 million (2023/24: £31.0 million). Core operating profit is estimated at not less than £210 million (2023/24: £174.8 million) and licensing operating profit of c.£45 million (2023/24: £27.0 million). The Group’s profit before taxation (“PBT”) is estimated to be not less than £255 million (2023/24: £203.0 million).” Of course, there is no mention of consensus forecasts (because GAW do not give two hoots about such things) but my take is that they are ahead of expectations BUT…

“Licensing revenue in the period is at a record level and we are not expecting this to be repeated in 2025/26.” And thus, keeping a lid on those expectations going forward. Again, this is the GAW way and in the time that I have owned them (since 2017) they have always appeared to be an expensive, low growth company for anyone paying attention to the forecasts. However, a simple look at the financial history of the company will show that the reality is very different.

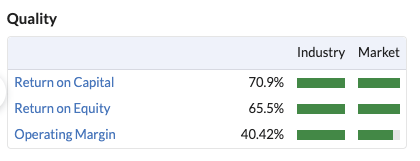

And their quality metrics are in a different league to most companies.

Games Workshop (GAW) is the longest held position in my portfolio and it remains the largest individual holding, even though casual observers often question the value, such as a PE ratio of 30. In a recent discussion on Stockopedia I said that GAW is the best company I have ever owned and the best company I am ever likely to own. I stand by that assertion.

Dividends

May was the largest dividend month of the year thanks to Games Workshop (GAW), Personal Group (PGH), Mony Group (MONY), Me Group (MEGP), TP Icap (TCAP) and two investment trusts that have both now been sold – Fidelity European (FEV) and HG Capital Trust (HGT). This brings the total dividend income for the year to 50% of my annual forecast which is bang on track given that August and December are historically slimmer months for dividend income.

Portfolio Changes

I exited Panthera Resources (PAT) in favour of a significant top up to Advanced Technology (ADVT). Despite announcing an arbitration claim of $1.58bn which was 50% higher than any other estimates I saw prior to the announcement, PAT shares were sold off and I decided to join the herd and bank a ~35% profit before it all disappeared. Against this, ADVT appears to be on a roll with two acquisitions this month along with a sizeable cash pile still left to deploy.

Monthly Momentum

The top contributor for the month was Personal Group (PGH) whereas the top detractor was Gamma Communications (GAMA).

Screen of the Month

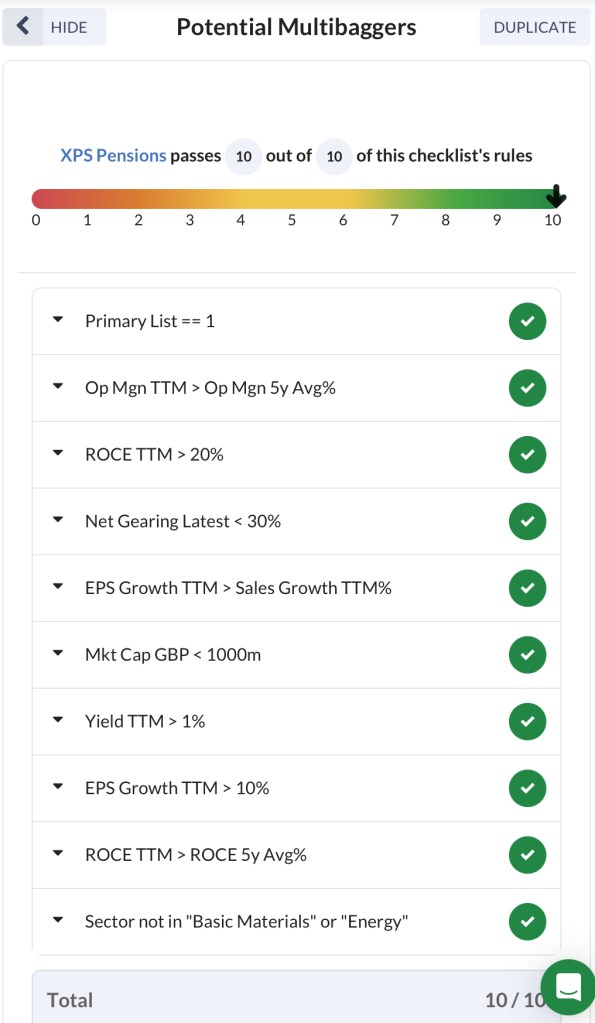

In celebration of the tenth anniversary of the Compound Growth & Income portfolio (CGI), I am publishing one of my stock screens each month throughout 2025. This month it is the turn of a screen I call Potential Multibaggers and was initially inspired by the work of Ed Croft at Stockopedia. Here is the screen.

There are currently 12 UK companies that pass this screen but only one of which I own – XPS Pensions (XPS).

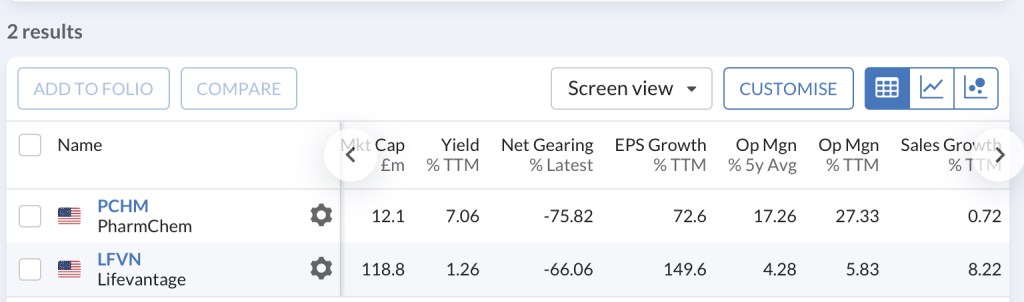

By contrast, there are only two US companies that currently pass the screen.

Closing Thoughts

Macro continues to be dominated by the US – Trump’s tariffs, tax cuts and the burgeoning fiscal deficit. There was an interesting quote from Treasury Secretary Scott Bessent in a recent article from ZeroHedge, “I think we’re in a long-term bull market in Gold. We’re seeing reserve accumulation by central banks. I follow it closely. It’s my biggest position.” Yes Scott, Gold also remains my largest position (via RMAP) until this drama you and President Trump are orchestrating plays out.

It is a tough business climate on both sides of the pond and I am heartened by the solid ongoing performances of my portfolio companies but also mindful that the next profit warning might be just around the corner.

Until next time,

Happy investing

Simon

Disclosure – At the time of writing, I own the companies shown in the graphic below. If you are reading this article in the future, my latest quarterly holdings disclosure can be viewed here