Warren Buffett once famously said, “Only when the tide goes out do you discover who has been swimming naked”. He was of course referring to the risks associated with leverage and last week presented a timely reminder of this maxim via former holding Argentex (AGFX). On Tuesday 22 April the shares were suspended from trading (at 42.64p per share) with the following explanation, “Argentex has been exposed to significant volatility in foreign exchange rates… as a result (it) has experienced a rapid and significant impact on its near term liquidity position, driven by, inter alia, margin calls linked to its FX forward and options books.” On Friday 25April the company recommended a fire sale cash offer from IFX Payments at 2.49p per share. Ouch!

It is hellishly difficult for an investor to know which companies might have this level of leveraged exposure. Argentex was a profitable, dividend paying company with net cash on the balance sheet. And reference to risks in the annual report mainly reassured that any potential risks of this nature were being managed via internal controls.

Looking back at my records, I exited this holding at 118p in April 2023, At the time I was slightly disappointed as it had traded as high as 140p only a month earlier. But now, with the benefit of hindsight, I dodged a massive bullet. Never underestimate the role that luck plays in this stock market game we are engaged in!

Trump and Tariffs

Liberation Day turned out to be more spectacular than most commentators, myself included, had been expecting. The UK escaped lightly with only the basic 10% tariff whereas the EU were awarded a hefty 20% tariff. But this pales into insignificance when one considers the 100%+ tariffs that the US and China have now set for each other. This whole episode sparked some extreme volatility across stock, bond and currency markets which only settled down when President Trump announced that there would be a 90 day period of grace (excluding China) to allow for trade negotiations to take place.

Last month I wrote, “The bigger concern from my perspective is that I have absolutely no idea what President Trump’s endgame is nor how he plans to achieve it. And therefore, I have little idea on how I should be positioning my portfolio.” This remains the case although I have again increased my exposure to gold this month. Even if that turns out to be a losing trade in the short-term (and if it does, the rest of my portfolio should rise), it feels like the environment that has been created by this US administration needs a higher level of catastrophe insurance, not least as protection against the inflation risk created by these tariffs.

Company News

This month has been quiet in terms of company news flow.

Polar Capital (POLR) – Q4 AuM Update – Over the year the company saw AuM fall by 2% from £21.9bn to £21.4bn with net flows remaining flat and market movements accounting for the £0.5bn decrease. The company has a strong net cash position and currently yields over 12%. We shall have to wait for the full year results presentation to see if that dividend level is maintained but even so, this felt like a decent re-entry point for this former holding. Stockopedia currently rate it as a contrarian play which I think is fair.

XPS Pensions (XPS) – Post Close Trading Update – “The Group has continued to perform strongly with revenues growing 18% year on year.”…” With strong revenue growth and disciplined cost management, the Board is confident of achieving full year results in line with previously upgraded expectations.” We can argue about price and perhaps the shares are a tad expensive but I’m happy to continue holding this quality company that has strong trading momentum.

PayPoint (PAY) – Post Close Trading Update – “The Group anticipates that it will deliver a financial performance in line with expectations with underlying EBITDA of circa £90 million, underlying PBT in line with expectations”. With a near 6% yield and 10% earnings growth, Stockopedia currently rates PAY as a super stock. Who am I to argue?

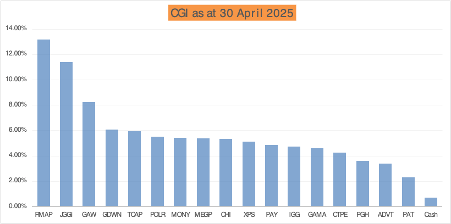

Current Portfolio

My aim is to be positioned to benefit from market upside while managing the downside risk. Therefore, it is perhaps surprising that my portfolio is more concentrated than at any time over the past 5+ years. I currently have 13 direct equity holdings (it is really 12 proper holdings plus a special situation punt) and just 4 investment trusts/ETFs.

Starting with the latter, my fund exposure totals around 35% weight and consists of major positions in gold (RMAP) and global equities (JGGI). These two holdings account for 25% of portfolio value between them and epitomise my point about balancing risk and reward. So far during this period of exaggerated volatility they are largely balancing each other out. Eventually, and perhaps not until Trump’s term in office has concluded, the gold holding will be sold and used to buy more equities. The other two fund holdings accounting for 10% of portfolio value are UK large cap equities (CHI) and private equity (CTPE) which offer a combined average yield close to 6%.

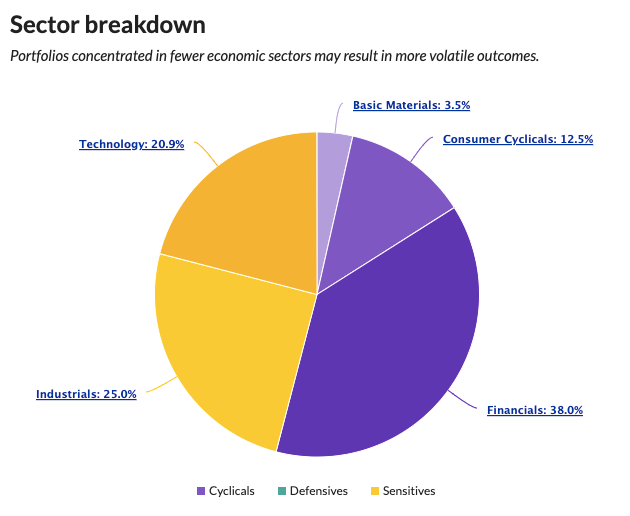

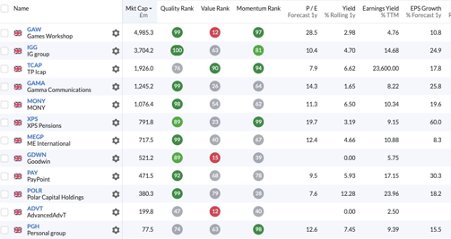

As for the direct equity holdings, I have used Stockopedia’s asset allocation tool to show the breakdown (below). I believe it is reasonably diversified, albeit very different from the overall market weightings. I also asked Grok (the Twitter/X AI tool) for a view and it suggested I was a Contrarian Value investor. My own view is that I am fundamentally a quality investor while also seeking a modest income stream.

Overall

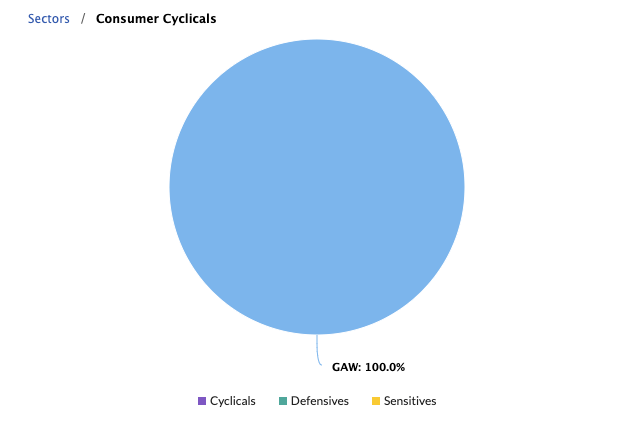

Consumer Cyclicals

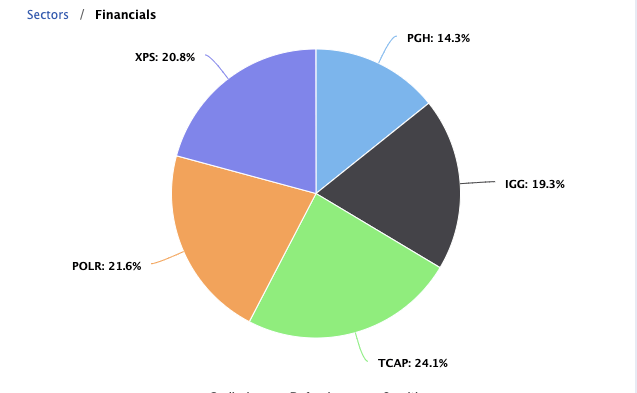

Financials

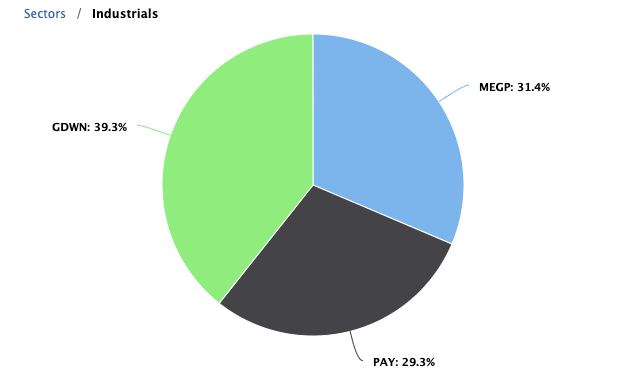

Industrials

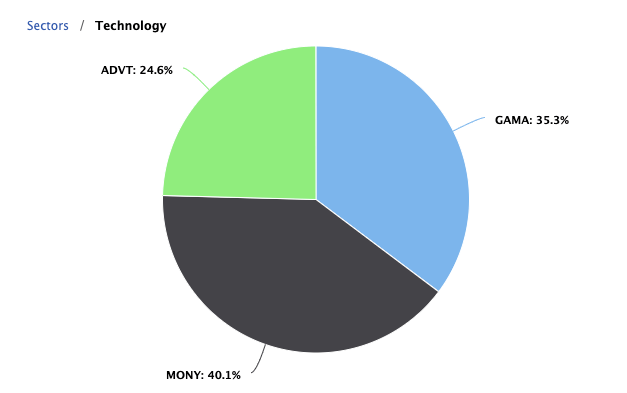

Technology

If I were to critique the mix of this portfolio, it would be to note that there is a lack of exposure to Consumer Defensives which is something that is under review. In terms of rankings and core metrics, I believe the quality tilt is apparent and there is also decent growth, income and momentum. If anything, the overall portfolio is not particularly cheap with the value rank being quite low by comparison.

Generally speaking, I am also trying to avoid companies that will be affected by US tariffs and that applies to my watchlist as well which is currently populated by mainly domestically focused companies.

Special Situation

Finally, there is a special situation punt. Notionally, Panthera Resources (PAT) is a gold exploration and development company but in reality it is doing very little exploring or developing. The entire investment thesis rests on an arbitration case with the Indian government which potentially carries an extremely large upside potential compared to its current market value of ~£45m. I managed to build my position at the beginning of April at around 10.5p which means I am currently sitting on a healthy gain of ~60%. The first milestone is in mid-May when we will learn how much PAT are claiming as part of the arbitration process which some commentators suggest could be as much as $1bn. Let’s see!

Screen of the Month

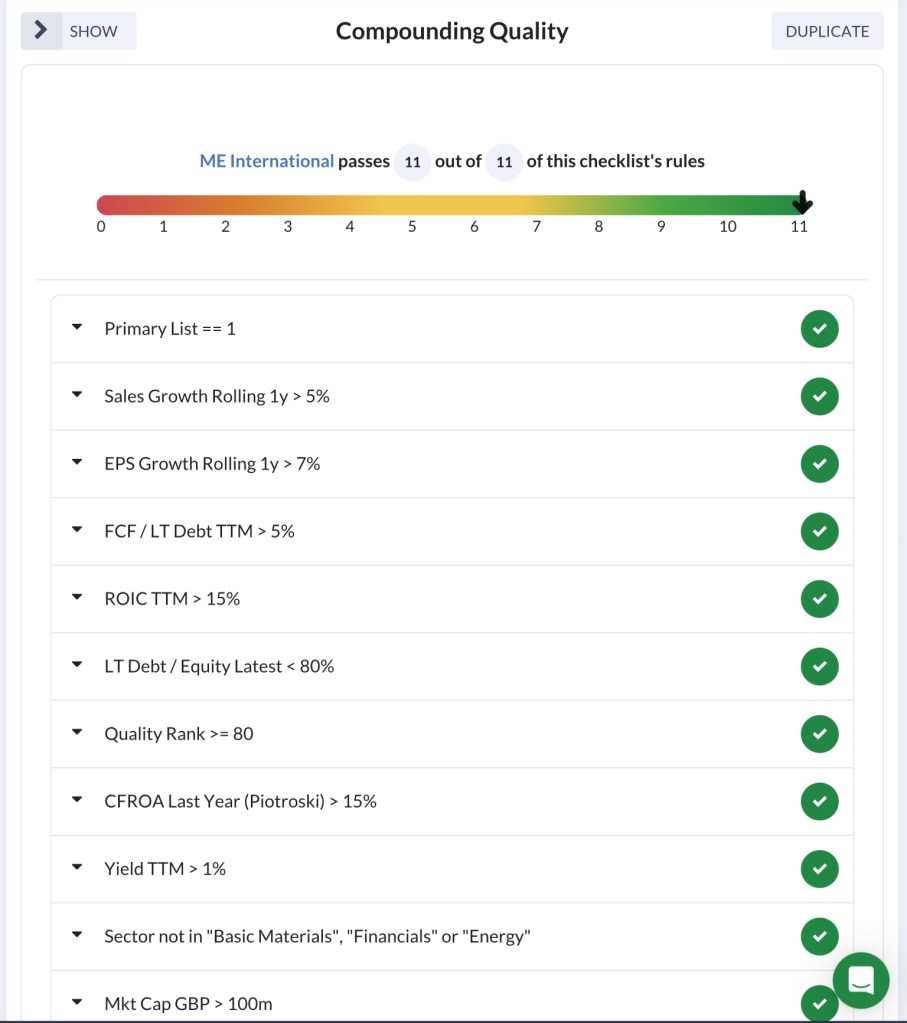

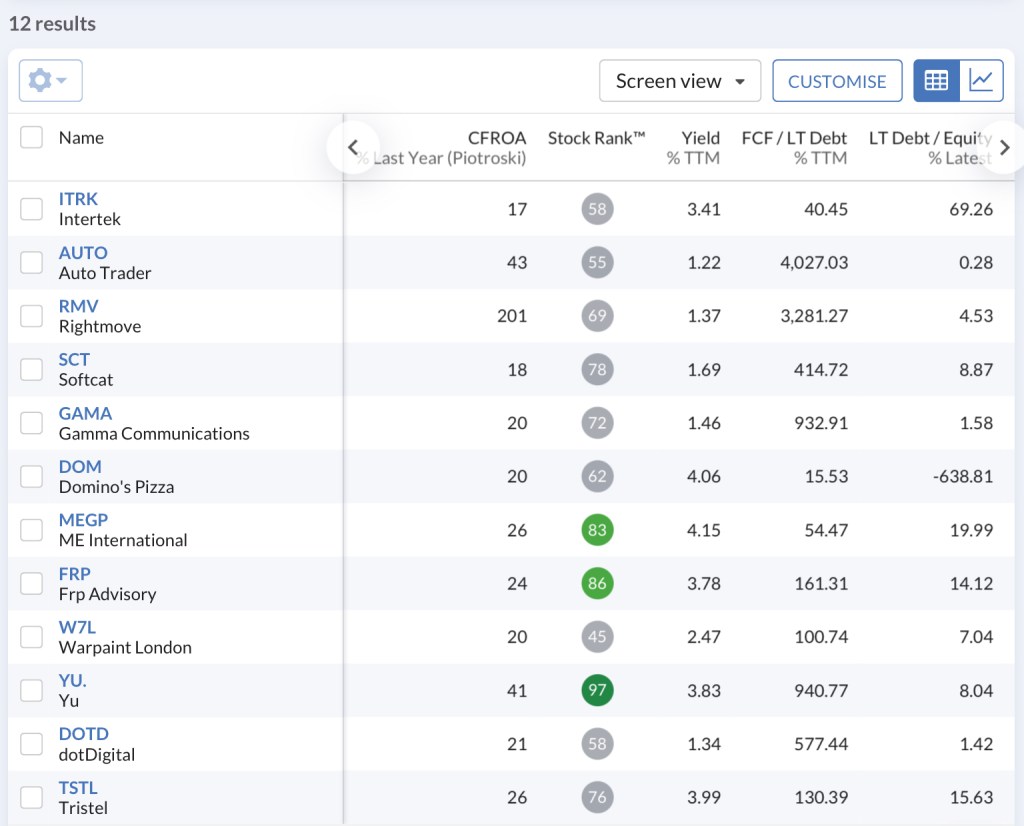

Regular readers will recall that in celebration of 10 years running my Compound Growth & Income (CGI) portfolio, I am sharing one of my screens each month. This month it is the turn of my Compounding Quality screen.

There are currently just 12 UK companies that pass this screen, 2 of which I own – ME International (MEGP) and Gamma Communications (GAMA).

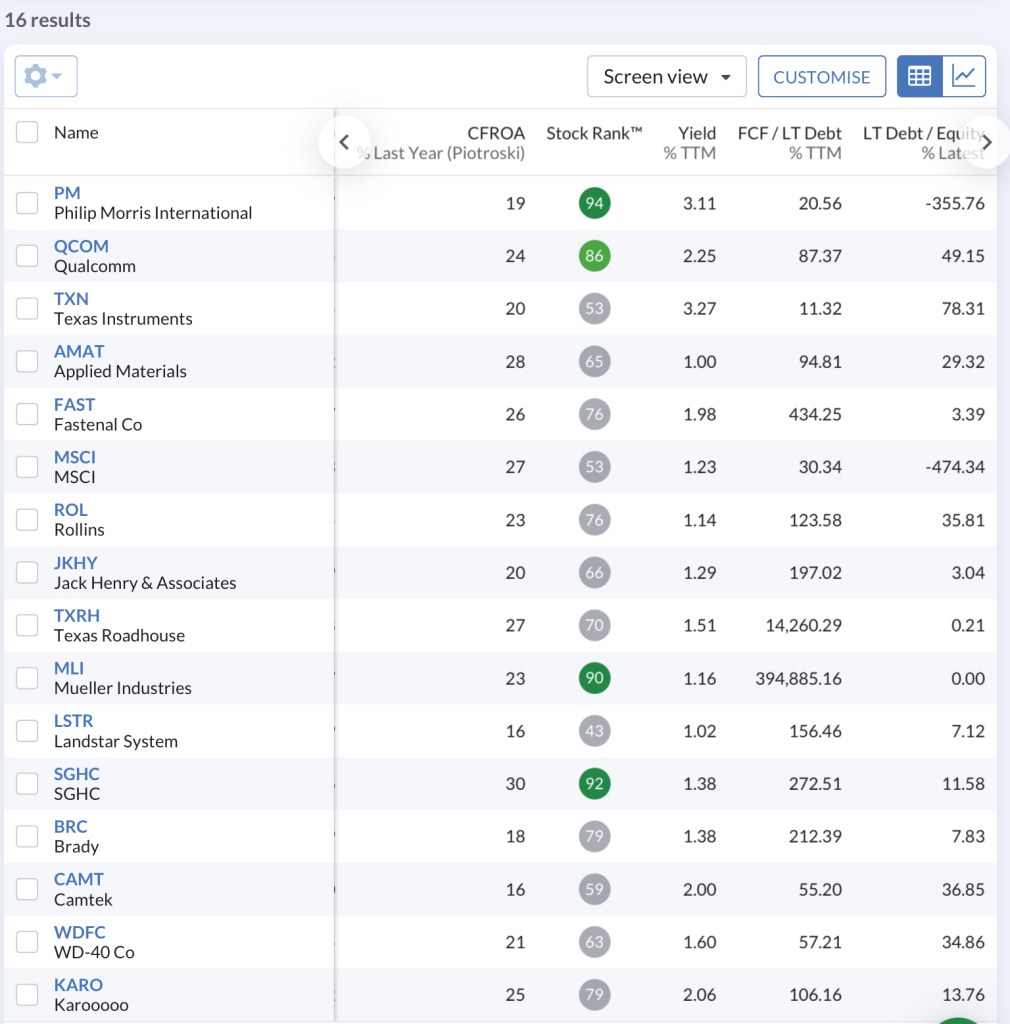

And there are currently 16 US companies that pass the screen.

Closing Thoughts

Given the turmoil President Trump has managed to create in his first 100 days, it feels like it is going to be a long three and a half years. To paraphrase Forrest Gump, a Trump presidency really is like a box of chocolates – you never know what you’re going to get.

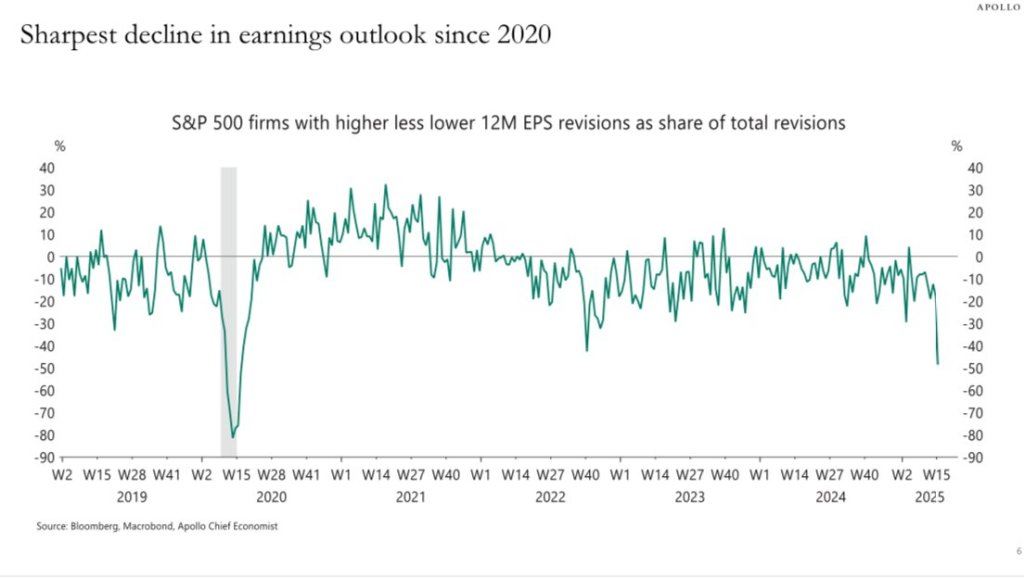

In the short-term it looks as though US Main Street will be bearing the brunt with recession looking likely and inflation risk on the horizon. There was a comment from Jamie Dimon, CEO of JP Morgan, speaking at a conference last week that suggested a mild recession was the best case scenario for the US. To what extent this crosses over into Wall Street is of course a different matter although earnings downgrades are starting to filter through.

On the plus side, it seems as though some funds might be flowing back into UK equities or at least, international investors are beginning to consider the UK as a viable place to invest once again. Perhaps the catalyst for a proper bull run will be an early trade deal with the US. At this point I should offer a word of warning. As of last night’s close, every portfolio holding is currently in profit. Historically, this means that a market fall is not too far away, so be careful out there folks!

Until next time,

Happy investing

Simon

Disclosure – At the time of writing I own shares in the companies shown in the graphic below or if you are reading this in the future, my latest quarterly disclosure can be found here. As ever, no financial advice is intended by anything that I write on this site.