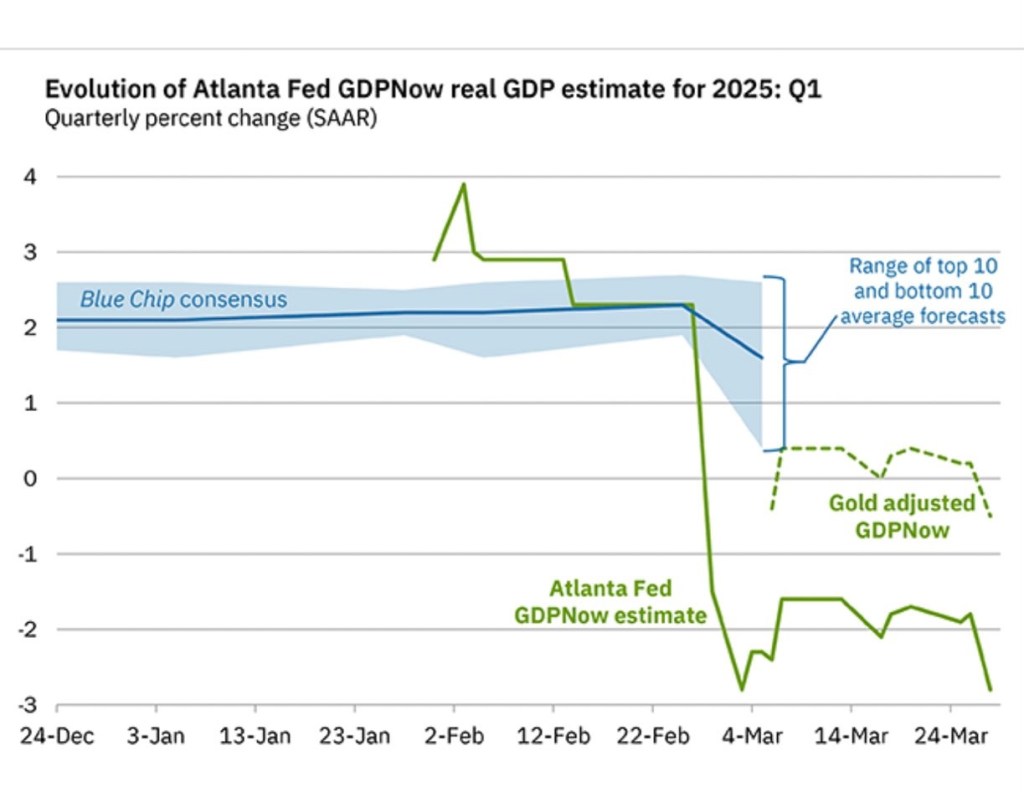

In my annual review I wrote that “Trump 2.0 brings unpredictability and volatility.” While that might be true, things are unfolding in ways many people, myself included, had not imagined. From a distance, I thought the whole basis of his election campaign was to Make America Great Again (MAGA). Early indications are that the opposite might be happening, as the chart below from the Atlanta Fed GDPNow suggests:

To quote David Kelly of JP Morgan Asset Management, “The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine”.

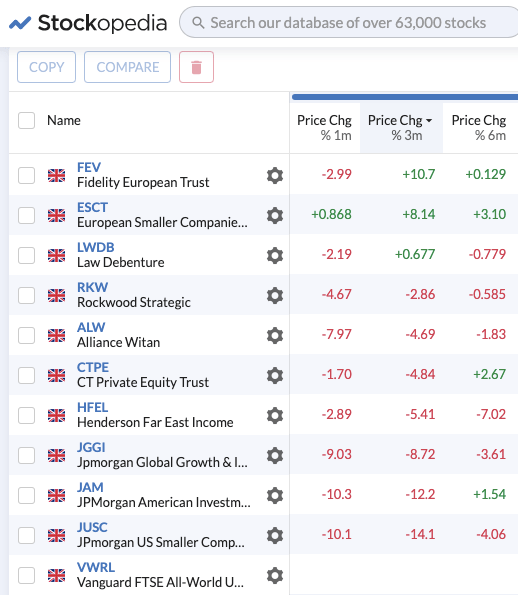

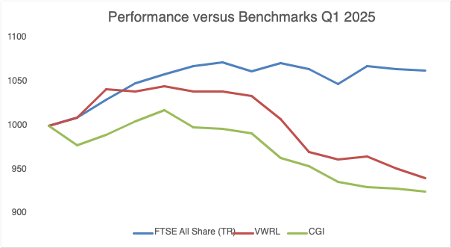

Given this, it is perhaps not so surprising that the worst performers in the Compounding Machine during the quarter were the American focused trusts both of which have been temporarily sold in my actual portfolio until President Trump is able to make America great again from an economic and investing perspective. By contrast, Europe has been doing quite well, at least for the time being. Overall, the Compounding Machine portfolio was down 5.92% over the quarter which is exactly in line with its benchmark (VWRL).

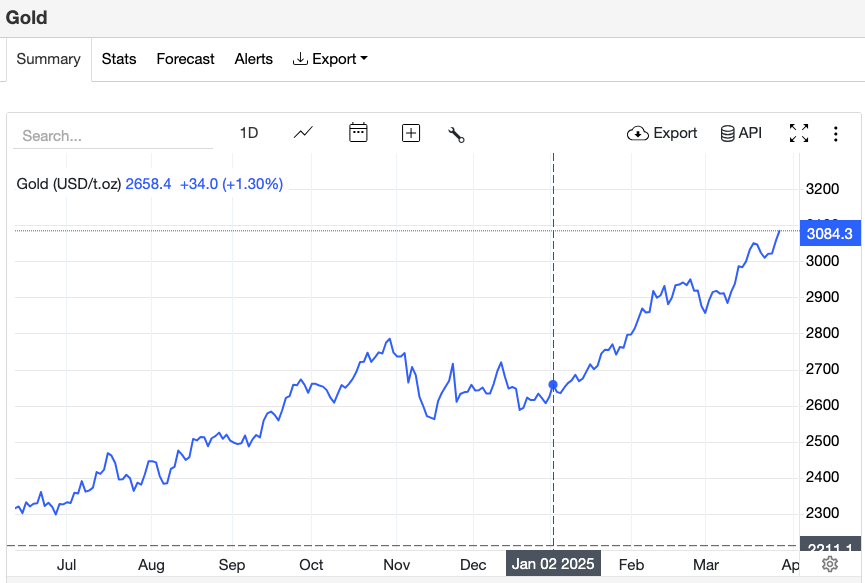

Whereas Gold has been absolutely knocking it out of the park, although I’m not sure that is such a good thing.

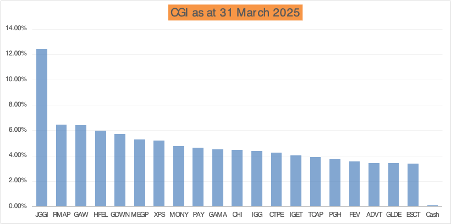

Against this backdrop, my own CGI portfolio has not fared particularly well during the first quarter, down 7.48% YTD and behind both the FTSE All Share index and my global benchmark (VWRL). This might be a case of shutting the stable door after the horse has bolted but my reaction has been to reduce exposure to the US while increasing exposure to Europe, UK large caps and Gold.

Company News

A theme that I have noticed during the quarter is that a lot of companies have been delivering good results for 2024 but subsequently forecasts are being downgraded for 2025/26. From my purview this seems to be among both UK and US companies. I imagine this is caution on behalf of both companies and the analyst community on, among other things, the impact of America’s tariffs and trade policies. It might go some way towards explaining the weak first quarter we have just experienced but whether this means the bad news is now fully priced in remains to be seen.

Specific news from portfolio companies in March came from:

Games Workshop (GAW) – An ahead of expectations trading update.

TP Icap (TCAP) – Record profits and news that the company plans to list a minority stake in Parameta Solutions in the US.

4Imprint (FOUR) – A strong 2024 but reduced guidance for 2025 (now sold from my portfolio).

IG Group (IGG) – Total revenue up 12% in Q3.

Goodwin (GDWN) – A Q3 trading update confirming the order book has reached a record £300m.

Gamma Communications (GAMA) – Full year revenue up 11% and diluted earnings per share up 13%. An in line outlook for 2025.

It is also worth noting that 5 of the 11 individual holdings in my portfolio currently have share buybacks in progress. These are Mony Group (MONY), Gamma Communications (GAMA), IG Group (IGG), PayPoint (PAY) and TP Icap (TCAP). Generally, I am not a fan of share buybacks and would much prefer to receive an enhanced dividend if the companies cannot find a more productive way of reinvesting the cash within the business.

Dividends

As expected, Q1 is the lowest returning quarter and only 17% of my annual forecast has been achieved to date.

Screen of the Month

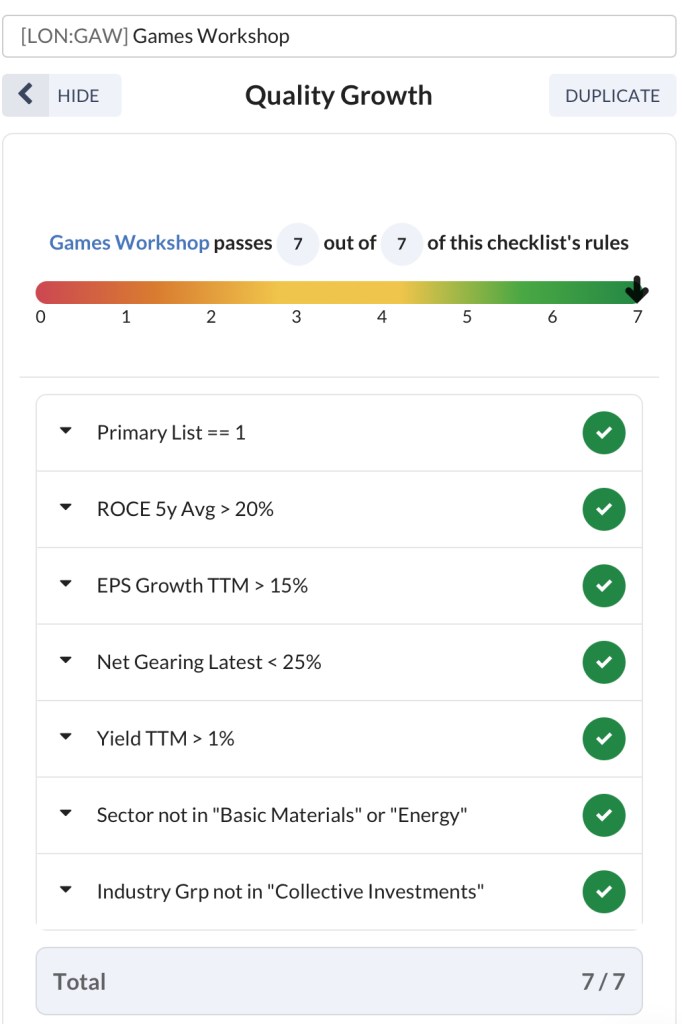

To celebrate the ten year anniversary of the Compound Growth & Income portfolio (CGI) I am sharing one of my stock screens each month throughout 2025. These screens have been developed over time and continue to be a work-in-progress as I explore new ideas and eliminate those that are less fruitful. I am not a genius nor am I a market professional. Most of my screens have been developed originally by others and I have adapted them to suit my own needs, preferences and biases.

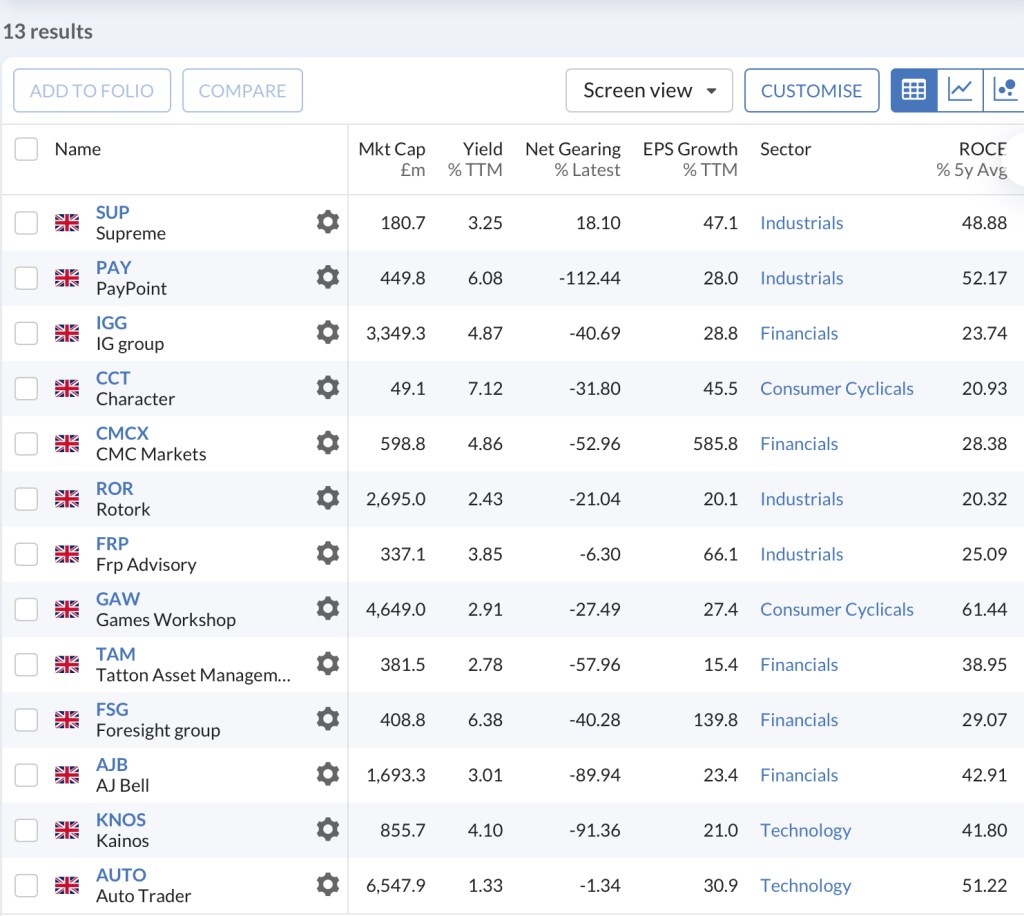

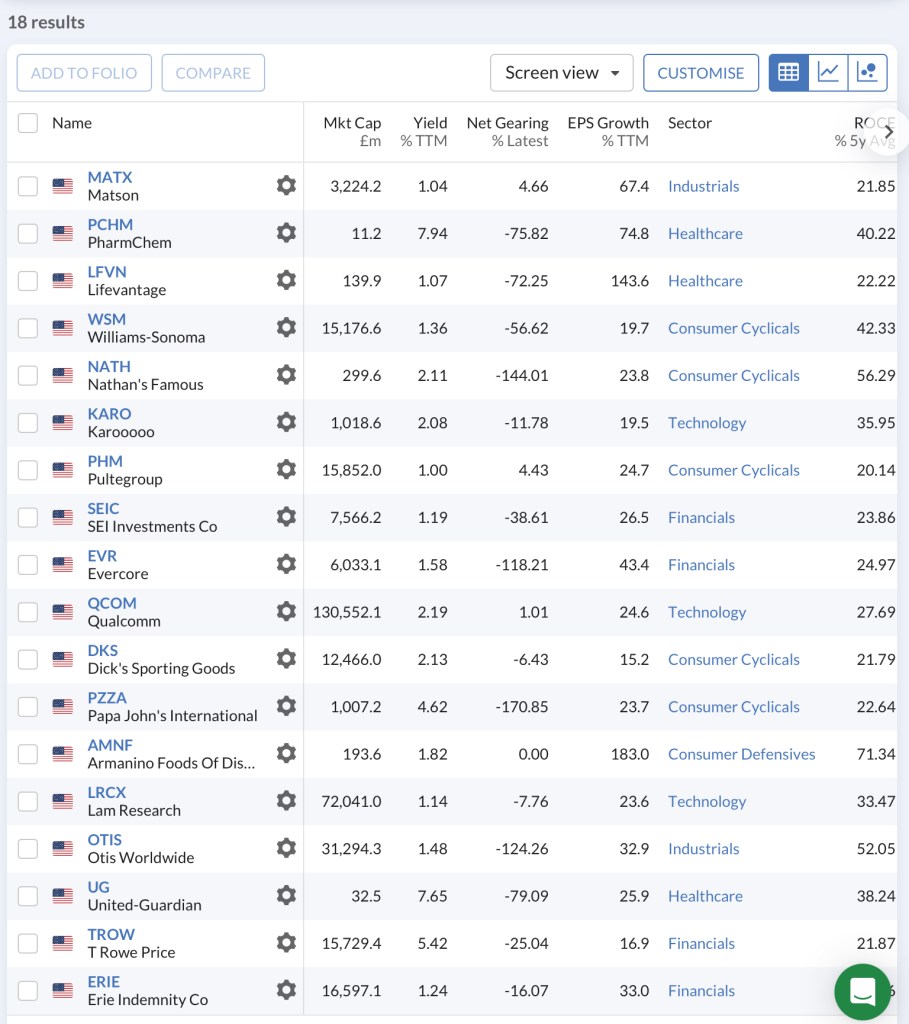

This month it is the turn of my Quality Growth screen. There are currently 13 UK companies that pass this screen, 3 of which I own; PayPoint (PAY), IG Group (IGG) and Games Workshop (GAW). And there are currently 18 US companies that pass this screen.

Closing Thoughts

From an investment perspective, it has been a pretty poor quarter. This is not the first time and it won’t be the last. The bigger concern from my perspective is that I have absolutely no idea what President Trump’s endgame is nor how he plans to achieve it. And therefore, I have little idea on how I should be positioning my portfolio.

Should I own more gold?

When should I move back into US shares?

Should I load up on European Defence stocks?

Should I just keep calm and carry on?

Perhaps some answers will become clearer as the second quarter unfolds, starting with the so called Liberation Day on 2 April when the first tranche of US tariffs are due to be implemented. But somehow, I suspect we will end up with more questions than answers. On the bright side, there are only another 3 years and 3 quarters of this to go. But wait, what’s that you say, he’s going for a third term – surely not!

Until next time,

Happy investing

Simon

Disclosure – At the time of writing, I own shares in the companies shown in the graphic below. If you are reading this article in the future, my latest quarterly holdings disclosure can be viewed here.