For reasons I shall not trouble you with, I am time poor at the moment and therefore, this is an abbreviated version of Share Watch for February.

Company News

News this month came from Warpaint (W7L) which I have now exited (see Portfolio Changes below), XPS Pensions (XPS), Wilmington (WIL), MONY Group (MONY), Advanced Technology (ADVT) and Me Group (MEGP). It was mostly positive although the share price movements would suggest otherwise. W7L lost its momentum due to only delivering an inline update. WIL had a lot of adjustments where one has to take a view. And MEGP followed decent (but not stellar) results with news of a secondary placing by their second largest shareholder.

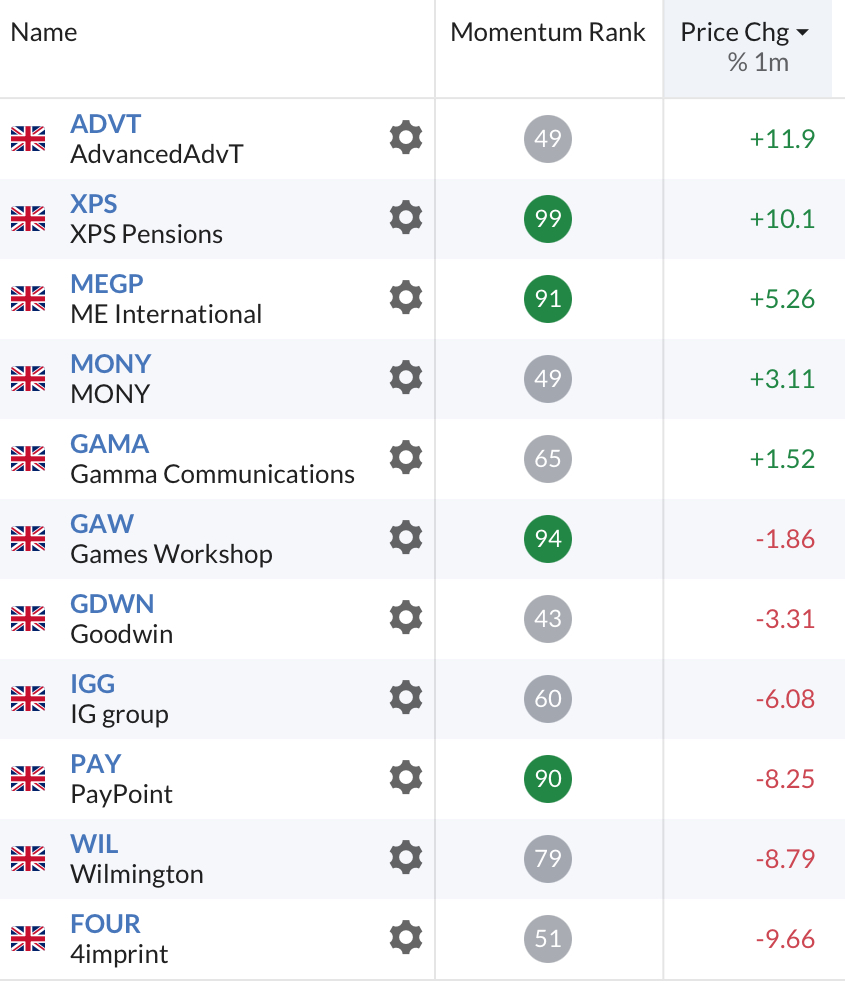

Monthly Momentum

My direct equity portfolio and the Compounding Machine were both net negative for the month, although not a disaster as both had a couple of bright spots with Advanced Technology (ADVT) and XPS Pensions (XPS) leading the way.

Dividends

February saw dividends received from XPS Pensions (XPS), Fonix (FNX), Henderson Far East Income (HFEL) and a double bubble from Games Workshop (GAW) taking year-to-date cashflow up to 13.61% of my annual forecast.

Portfolio Changes

As I wrote earlier today on Stockopedia I believe that for the time being at least, the AIM is something of a broken market. Liquidity is dire and for the most part, it appears to be a backwater pub frequented mainly by retail investors. I’m sure there will continue to be the odd flurry of excitement as takeover offers appear but it is not the friend of a quality oriented compound investor and so, reluctantly, I have taken most of my money off the table, exiting Warpaint (W7L), Fonix (FNX), Property Franchise Group (TPFG) and Spectra Systems (SPSY) during the month. This largely funded my gold hedge via RMAP although I have also taken new positions in two further investment trusts; Fidelity Europe (FEV) and European Smaller Companies (ESCT) both of which feature in my Compound Machine.

Screen of the Month

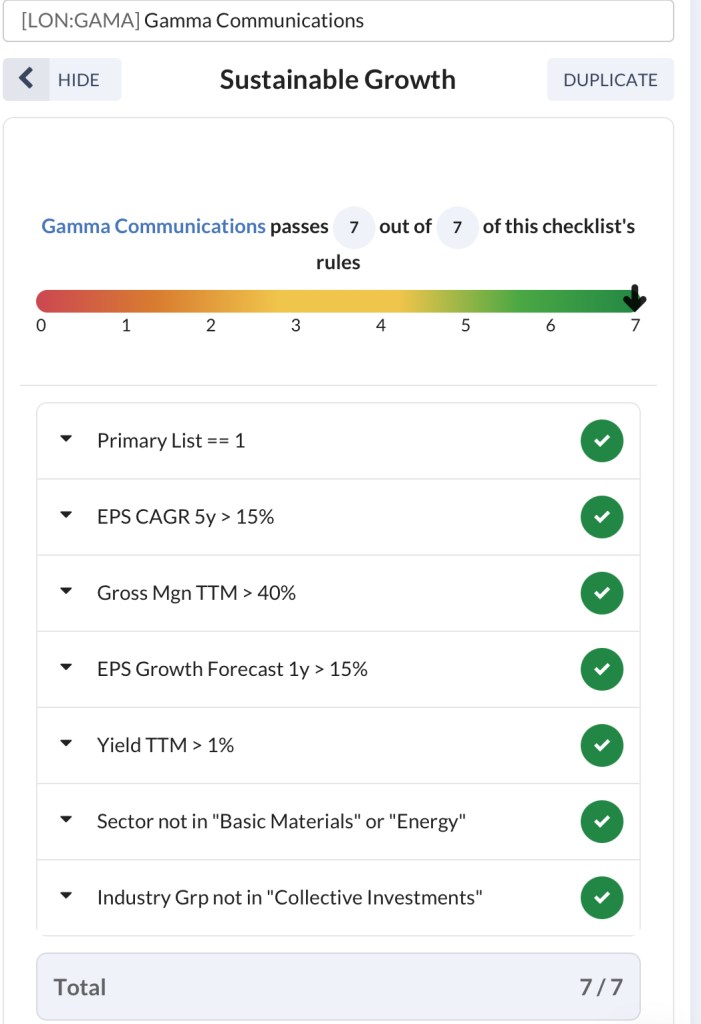

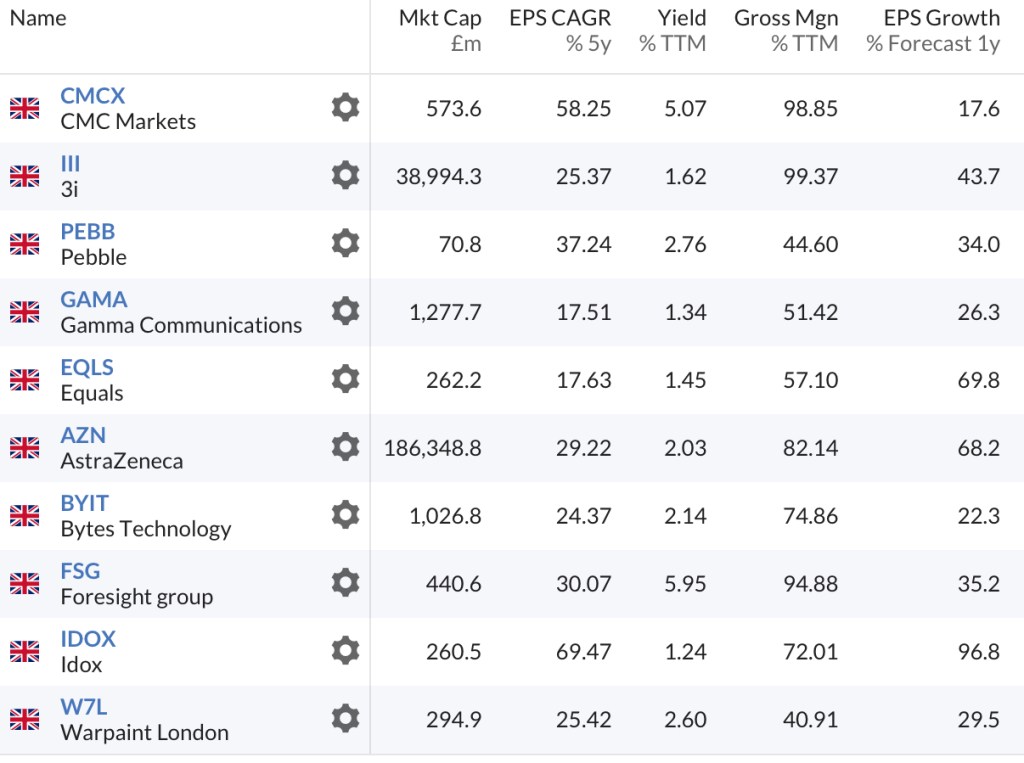

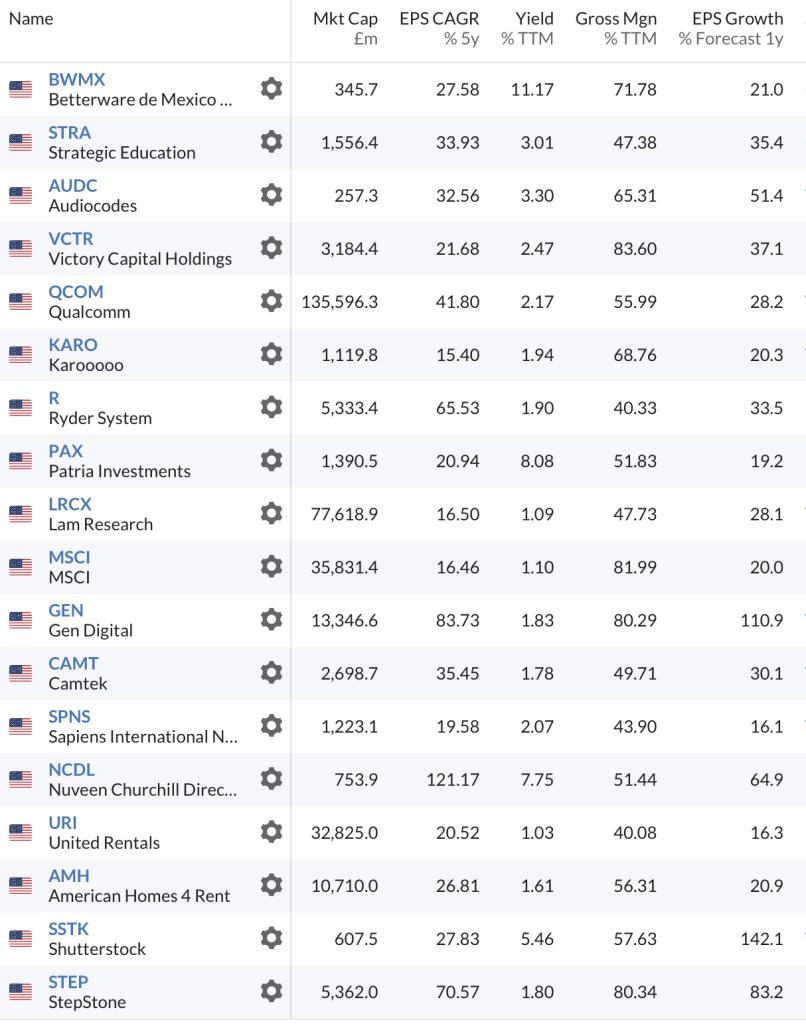

To celebrate the ten year anniversary of the Compound Growth & Income portfolio (CGI) I am sharing one of my stock screens each month throughout 2025. These screens have been developed over time and continue to be a work-in-progress as I explore new ideas and eliminate those that are less fruitful. I am not a genius nor am I a market professional. Most of my screens have been developed originally by others and I have adapted them to suit my own needs, preferences and biases.

This month it is the turn of my Sustainable Growth screen. There are currently 10 UK companies that pass the screen but only one that I own; Gamma Communications (GAMA). There are currently 18 US companies that pass the screen.

Closing Thoughts

I have slipped into negative territory year-to-date during the month and it is anything but a comfortable investing environment at the moment. The geopolitical landscape is full of uncertainty (and that is putting it mildly) and the Trump presidency is proving unpredictable (also putting it mildly) which leads to both practical and psychological challenges for investors and in that respect, I am no exception.

Until next time,

Happy investing

Simon

Disclosure

I now have just 11 direct equity investments complemented by 8 investment trust holdings and 1 exchange traded commodity in the form of gold (RMAP). These are shown in the graphic below or if you are reading this in the future, my latest holdings disclosure can be viewed here.