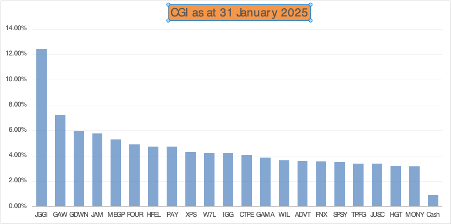

The start of 2025 has been like an episode of The Golden Shot – left a bit, right a bit, up a bit, down a bit, fire! Readers of a certain age will get the reference and if you are too young to remember, I envy your youth.

Company News

In what has seemed like a quiet start to the year, I find that, on reflection, just under half of my portfolio companies have reported news during the month.

Games Workshop (GAW) – Interim Results – A 20% increase in like for like (LfL) revenue and a 33% increase in LfL earnings per share. GAW continues to be a high quality company. GAW continues to be expensive to the casual observer. And GAW continues to be the largest direct equity holding in my portfolio.

Gamma Communications (GAMA) – Full Year Trading Update and Acquisition – An inline update for 2024 which equates to earnings per share growth of around 25%. On the same day as the trading update a significant acquisition of German company STARFACE was also announced which will absorb £125m of GAMA’s own cash and a further £40m from a new £130m revolving credit facility. The share price has dropped significantly since these announcements, although I’m not sure which of them the market disliked. I suspect the EV/EBITDA multiple being paid for STARFACE was more than GAMA’s shares were valued at and the market has adjusted accordingly.

IG Group (IGG) – Acquisition and Interim Results – News that IGG would be acquiring Freetrade for £160m funded from existing cash resources came a week prior to the interim results which saw revenue up 11%, adjusted earnings per share up 42% and an extension of £50m to the share buyback programme. The market has absorbed this news as overall neutral. Personally, I think the shares still represent good value on a PE ratio of less than 10, a dividend yield just shy of 5% and a PEG ratio of 0.9.

4imprint (FOUR) – Full Year Trading Update – In a challenging operating environment the company delivered a 3% increase in revenue and around 8.5% increase in profit before tax. As I was saying for much of last year, if the company can gain market share when the environment is tough, they are likely to reap the rewards as conditions improve. I suspect conditions will improve in 2025 as confidence returns to American businesses. The market has reacted positively to this news and this has moved FOUR to a top 10 holding in my portfolio.

Fonix (FNX) – Interim Trading Update – The company has performed in line with expectations which equates to around 6.5% growth. Moreover, the company has confirmed its launch in Portugal and also two new product innovations; PayFlex and DonationPortal (whatever happened to spaces between words?). There was also news of a special dividend returning surplus cash to shareholders. The market has responded positively to this announcement, having sold off previously.

PayPoint (PAY) – Q3 Trading Update – One of the more wordy trading updates hitting the newswire during January which can be interpreted as in line. The share price has responded positively having sold off previously. PAY has grown to a top 10 holding in my portfolio and still boasts strong value characteristics such as a PE ratio of less than 10, a dividend of over 5% and a PEG ratio of 0.8.

Property Franchise Group (TPFG) – Full Year Trading Update – In a year that has included two major acquisitions, the company has performed in line with market expectations which sees revenue increasing by 146%. The narrative for the year ahead is positive. The market reaction has been neutral.

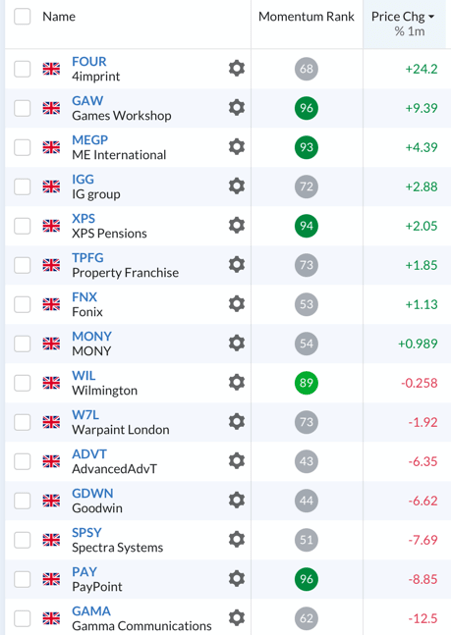

Monthly Momentum

My Direct Equity portfolio was a mixed bag with 4imprint (FOUR) and Games Workshop (GAW) leading the way.

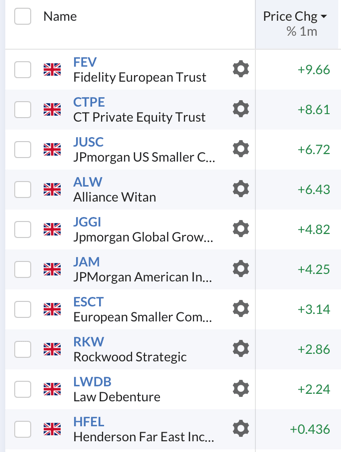

While there was a clean sweep of positivity from The Compounding Machine with Fidelity European (FEV) and CT Private Equity (CTPE) leading the way.

Dividends

Only two dividends have been paid during the month, JP Morgan Global Growth and Income (JGGI) and CT Private Equity (CTPE), totalling 4.21% of my annual forecast.

Portfolio Changes

I exited Bloomsbury Publishing (BMY) on news that they had renegotiated their distribution deal with Amazon having learnt a day prior that the deal had been terminated by the latter. In truth, it was a move I had been contemplating anyway as I had made a near 100% return over 4 years and felt the company was overly dependent on a couple of star authors rather than being a genuine compounder. It has been replaced in my portfolio by HG Capital Trust (HGT) which is a private equity vehicle that has an entire portfolio of technology compounders. I also topped up JP Morgan American (JAM) on the day the market had a wobble based on Chinese based DeepSeek AI.

Screen of the Month

To celebrate the ten year anniversary of the Compound Growth & Income portfolio (CGI) I am sharing one of my stock screens each month throughout 2025. These screens have been developed over time and continue to be a work-in-progress as I explore new ideas and eliminate those that are less fruitful. I am not a genius nor am I a market professional. Most of my screens have been developed originally by others and I have adapted them to suit my own needs, preferences and biases.

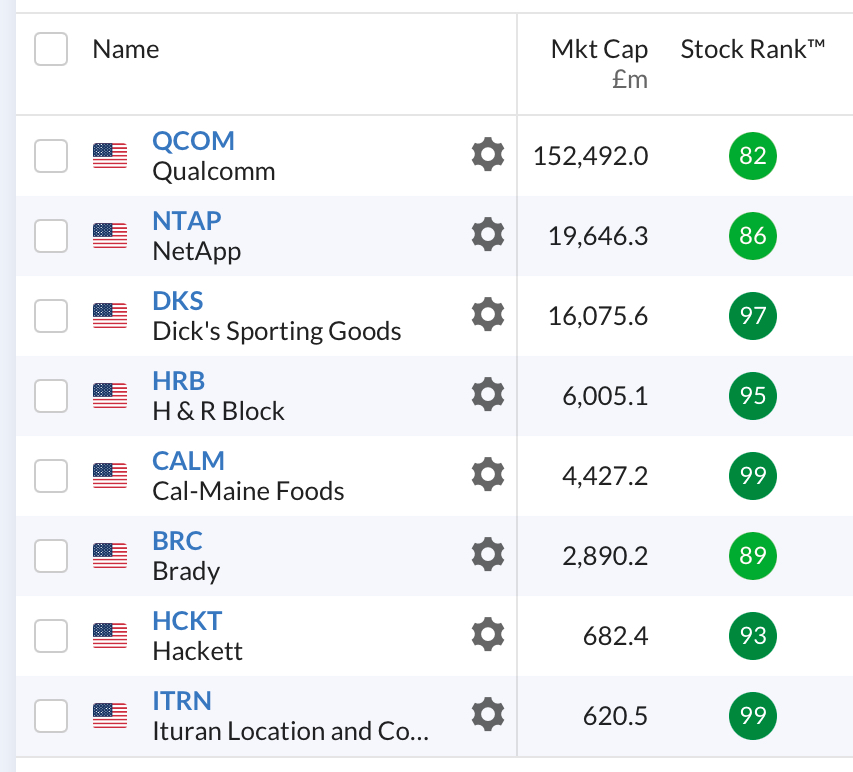

My plan is to share the screen, the UK companies that currently pass the screen, the companies from the screen I currently own and as an added bonus, the US companies that currently pass the screen. I shall begin with my QARP Screener (Quality at a Reasonable Price) which also doubles up as my investing checklist.

There are currently 15 UK listed companies that qualify for this screen of which I own 5 – IG Group (IGG), Gamma Communications (GAMA), Mony Group (MONY), PayPoint (PAY), Wilmington (WIL):

There are currently 8 US listed companies that qualify for this screen:

Closing Thoughts

Broadly, I remain negative on the UK economy and positive on the US economy. I continue to see the US market as overvalued and the UK market as undervalued. I have no clue what to make of exchange rates, although I note that the dollar has started the year strongly. I continue to have a foot in both the US and UK with a couple of fingers in Asia and Europe. More importantly, I continue to own high quality companies that are performing well.

The real truth is that I have spent more time planning for a double game week in the FPL than I have on the stock market in January. And of course, it is a lot of fun being an AFC Bournemouth season ticket holder at the moment – almost as much fun as being a Grandad!

Until next time

Happy investing

Simon

@BrilliantLeader on Twitter/X

@BrilliantLeader99 on Bluesky Social

@Brilliant Leader on Stockopedia

Disclosure – At the time of writing I own shares in the companies shown in the graphic below or if you are reading this in the future, my latest quarterly disclosure can be viewed here