It has been a funny old year. The bull was in fine fettle for the first six months of 2024 with my Compound Growth & Income portfolio (CGI) delivering a return of 16% by the halfway stage. The momentum was interrupted initially by the UK election but more significantly by budget fears/rumours and then the budget itself which only disappointed if you expected a socialist government to be anything other than, er, socialist. Latterly the world is also coming to terms with what Trump 2.0 is going to look like where separating bluster and bravado from reality over the next four years is likely to be a predictable challenge. I would suggest that little else is predictable at this stage and trying to do so is therefore futile from my perspective. Keep Calm and Carry On!

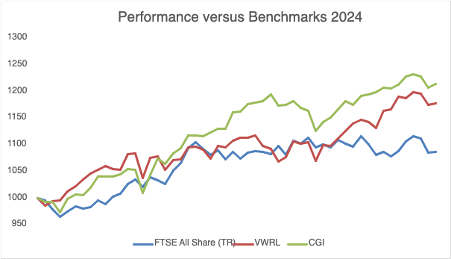

Performance versus Benchmarks

The CGI portfolio managed a total return in 2024 of 21.36% which was ahead of both benchmarks – the FTSE All Share (TR) Index and the more challenging Vanguard Developed World ETF (VWRL) – as per the chart below.

This takes my long-term batting average to 21.67% per annum or in CAGR terms 19.83% which is extremely satisfying and supportive of my decision to be a self-managed investor.

Dividends during the year were 8.5% ahead of forecast which was pleasing, especially given the level of portfolio churn during the year. And 2024 will go down as yet another year without a takeover in the portfolio. This comes during another year when The Great British Takeover has continued to dominate headlines. If I look to answer why my portfolio is unattractive to suitors the best answer I can come up with is that quality isn’t cheap.

Main Contributors and Detractors

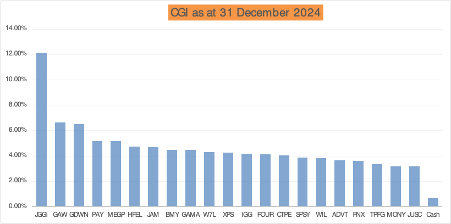

The positive contribution by current portfolio constituents was broad with most delivering a positive return during the year and only one, Mony Group (MONY), causing any significant pain (note – 3 of the 6 companies leaving the portfolio during the year also did so at a loss). The graphic below shows this quite well.

And a big shoutout to Games Workshop (GAW) which I have owned since 2017. Despite a modest return of “only” 30% and 9th place in my internal league table this year, it has now entered the FTSE 100. It is the first time that I have owned a share prior to FTSE 250 entry all the way through to the FTSE 100 and it transpires, I find this is a most satisfying feeling.

Meddling Quotient

A resounding victory for meddling this year. If I had done nothing the portfolio would have returned 12.81% versus the actual total return of 21.36% giving me an 8.55% improvement for my active management efforts. Carry on Meddling!

Portfolio Changes

Leaving the portfolio during 2024 were GlobalData (DATA), Impax Asset Management (IPX), Ingenta (ING), Oxford Metrics (OMG) and Ultimate Products (ULTP) to be replaced by Advanced Technology (ADVT), 4imprint (FOUR), Spectra Systems (SPSY), XPS Pensions (XPS) and IG Group (IGG). One share, Puretech Health (PRTC), was both bought and sold during the year and I have also added three investment trusts to the portfolio; JP Morgan American (JAM), JP Morgan US Smaller Companies (JUSC) and Henderson Far East Income (HFEL).

Portfolio Metrics and Characteristics

Here is how the 16 stock direct equity portfolio stacks up against my main QARP (Quality at a Reasonable Price) checklist:

| QARP Checklist | Pass Rate | Average |

| ROCE % (5 Yr Avg) | 15% | 32.70% |

| ROE % (5 Yr Avg) | 15% | 32.85% |

| CROIC % (Last Year) | 15% | 24.60% |

| Gross Margin % (5 Yr Avg) | 20% | 48.69% |

| Operating Margin % (5 Yr Avg) | 10% | 21.40% |

| Net Gearing % (Latest) | 30% | -36.64% |

| P/OCF (TTM) | 20 | 22.11 |

| PEG (TTM) | 2 | 2.24 |

| EV/EBITDA (TTM) | 20 | 14.86 |

| Earnings Yield % (TTM) | 5% | 7.33% |

| Dividend Yield % (TTM) | 1% | 3.13% |

| EPS Growth % (1 Yr Forecast) | 5% | 23.26% |

| Checklist Passes n/12 | 9.31 |

As ever, the key question I ask myself is this. If it were a single company would I want to own it? Less glibly, the portfolio has become more expensive with the average price-to-operating cashflow ratio now a fail and the EV/EBITDA and Earnings Yield averages also noticeably more expensive than a year ago. However, relative to the overall market the Quality/Value/Momentum (QVM) Stock Rankings have remained broadly stable at 91 (91), 33 (37) and 74 (79), respectively. The projected dividend yield of the portfolio is almost identical to twelve months ago at 3.68% (3.67%).

And here is how the portfolio currently looks in relation to those QVM factors and the other valuation criteria mentioned:

The Compounding Machine

A project that emerged during the year was to help some friends and family members build a portfolio of funds that would stand a good chance of beating a global equity benchmark. I’m pretty pleased with the result and have subsequently decided to run this as a public experiment over the next decade or so. I have called it The Compounding Machine, my version of which is a model portfolio of equity investment trusts.

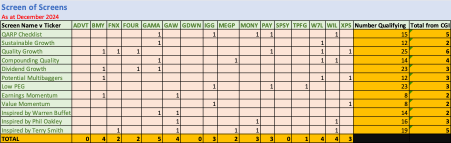

Screen of Screens

2025 will mark the tenth anniversary of my Compound Growth & Income (CGI) portfolio during which time I have managed to average around 20% annualised returns. To celebrate this milestone, I shall be sharing a little more of my process for avoiding the duds and finding the winners. Each month during the coming year I shall share one of my screens that I use to build and maintain the portfolio. As a teaser, here is how the current Screen of Screens shapes up against the CGI portfolio.

I look forward to sharing a new screen with you each month along with an explanation of how I use it and the companies currently qualifying for the screen. I hope readers will find this a useful addition to the monthly Share Watch articles over the coming year.

Final Thoughts

I usually find myself in an optimistic mood when entering a new investing year but this year, less so. I am extremely negative on UK government policies and consequently, I am negative on the prospects for the UK economy. And despite a small positive inflow to UK equity funds in November 2024 (my take is that this was a reaction to the budget uncertainty being removed but we shall see when the December and January numbers are published), I am negative on UK equity markets.

Over the pond I am positive on the US economy but cautious that the US stock market is in bubble territory. Trump 2.0 brings unpredictability and volatility. That said, I don’t believe Trump is a warmonger and perhaps we will see some positive change of direction in geopolitical events as the year unfolds.

All this presents a big dilemma as far as asset allocation is concerned. I have around 72% allocation to UK equities which feels too high but this portfolio is heavily exposed to the US economy. In addition, I have around 15% allocated to US equities via funds. There is also some exposure to Asia and Europe, although less than 10% in total.

As we enter the new year my overriding thought is whether I should be building up a war chest of cash in readiness for what may lie ahead. Ultimately, I think dividend stability is likely to keep me fully invested unless, heaven forbid, I should receive a takeover bid for one or more of my companies. Recent history would suggest there is more chance of bacon slices falling from the sky.

I wish all my readers, followers and casual observers a happy, healthy and prosperous new year.

Until next time,

Happy investing

Simon

Twitter/X @BrilliantLeader

Bluesky Social @BrilliantLeader99

Stockopedia @Brilliant Leader

Disclosure – At the time of writing I own shares in the companies shown in the graphic below. If you are reading this article in the future, my latest quarterly disclosure can be viewed here

Hi Simon

Just a quick note to thank you sincerely for your frank monthly articles which I thoroughly enjoy reading. If only I could be as disciplined, analytical & successful as you! This investing lark is much harder than it should be as there are so many distractions & emotions to overcome. I have learnt so much from your comments. I’d love to learn more about your ‘meddling’ process! (mine normally has the opposite effect!)

I’ll watch your new IT pf with particular interest as I’ve pondered a similar ‘ do nothing’ strategy for a while. I’m early retired (67) & still work PT, but personally I prefer a percentage of my holdings in bond & bond proxies, (currently 25%) which appears to be the conventional approach. The income might be more ‘secure’, but it’s hurt my pf over the last 3 years. Sleeping at night comes with a price tag it seems.

I concur with your comments about the UK, volatile outlook & the US. That said, none of us have a crystal ball & so I keep calm and carry on, but with a war chest at the ready.

Best wishes & happy New Year

Simon (aka Trader Jack)

LikeLike

Thank you for the feedback Simon, it makes the writing so much more worthwhile knowing that it is providing value for others. As for my meddling process, the outline of it lies in my process https://shareknowledge.blog/investment-process/ – however, if you are following my monthly Share Watch articles, please feel free to ask about specific decisions either in the comments here or on social media.

Best wishes

Simon

LikeLike