Trump 2.0

I am not American and therefore, will not express a political view on the result of the American election. However, it is likely to have a meaningful effect on markets over the next four years. That said, I have no clear idea what the effect will be. For sure, I can see increased volatility with markets reacting to, among other things, his social media posts. But the rest is more complex – tax cuts, protectionism, trade wars, clashes with the Fed over inflation and interest rates, less immigration to fill lower paid jobs – take your pick!

Net-net, I seem to recall he likes a rising stock market and despite the US market appearing overheated, I have increased my exposure to the US stock market and to the US economy. I’ve also begun adding some gold to my portfolio, although for now, only a modest allocation.

Company News

It has seemed like a quiet month for company news yet looking back, there are seven items worthy of note, a whopping third of my portfolio.

4imprint (FOUR) – Trading Update – An inline update, reporting continued challenging conditions in their North American market. New customer orders were down 9% on a like-for-like( LfL) basis but orders from existing customers were up 6% LfL and overall revenue was 4% up on the prior year. Other reasons to be cheerful are a 32% gross margin, double digit operating margin and a cash balance of $137m. Crucially, FOUR provides direct exposure to the US economy and will be a likely beneficiary as and when this environment improves.

Advanced Technology (ADVT) – Interim Results – At the operating level, progress has been excellent with pro forma revenue up 16% and adjusted EBITDA up 53.7% (excluding Celaton which was acquired on 1st July 2024). The war chest remains very large with £83m cash and a stake in M&C Saatchi worth £25m versus a current market capitalisation of £186m. My own investment thesis here relies on Vin Murria and her team deploying that cash to good effect on acquisitions while continuing to improve performance at the operating level in readiness for an eventual sale. So far, so good.

Fonix (FNX) – AGM Statement – “Fonix has had a positive start to the financial year, in line with expectations, across both the UK and Ireland. At the same time, the Company is progressing well with its plans to roll out interactive services with a number of broadcasters in Portugal in early 2025.” I can offer little explanation as to why the share price has fallen in response to this update and continue to believe that FNX is a really good company with an excellent management team and a decent international expansion opportunity.

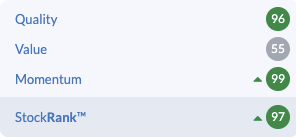

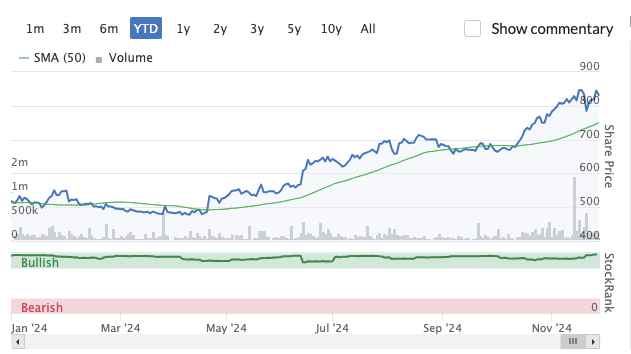

PayPoint (PAY) – Interim Results – Net revenue up 6%, diluted earnings per share up 35% and underlying EBITDA up 20% to £37.5m. While I usually don’t like to focus on EBITDA it does serve a purpose when there is a lot of acquisition activity which in the case of PAY has been necessary to take it out of value trap territory and into growth mode. If the company achieve their stated aim of £100m underlying EBITDA by the end of FY26 this strategy will have been justified. And the company continues to pay out more than 1% per quarter in dividends despite remaining a Super Stock (according to the Stockopedia Stock Ranks) with an excellent YTD chart (see below). Perhaps it is not surprising that PAY has risen to be a top 5 holding in my portfolio.

XPS Pensions (XPS) – Interim Results – Revenue up 23%, earnings per share up 53% and interim dividend up 23%. “The Board is pleased with the Group’s performance in the first half of the year and, notwithstanding an even tougher comparative period in the second half of the year, is confident of achieving overall full year results in line with its recently upgraded expectations.” What’s not to like? XPS is a new holding for me this year and has already risen to be a top 10 position.

Games Workshop (GAW) – Trading Update – “The Group is pleased to announce that trading since the last update on 18 September 2024 is ahead of expectations. The Board’s estimate of the results for the six months to 1 December 2024, at actual rates, is core revenue of not less than £260 million (2023/24: £235.6 million) and licensing revenue of not less than £30 million (2023/24: £13.0 million). The Group’s profit before tax (“PBT”) is estimated to be not less than £120 million (2023/24: £96.1 million).” The subsequent share price action means that GAW are now a near certainty to enter the FTSE 100 index as part of the December reshuffle. It has been quite the journey as I first owned GAW before they entered the FTSE 250 index. Despite several top slices along the way, they remain my largest individual holding.

CT Private Equity (CTPE) – Q3 Results – NAV return for the three month period was minus 1% although the quarterly dividend is maintained and the shares continue to trade at a wide discount, along with most listed private equity companies. CTPE has been a slightly disappointing investment for me so far but I remain of the view that it is useful to have some exposure to this sector and CTPE offers a diversified way to obtain that exposure and while waiting for the sector’s fortunes to improve, it pays 6%+ in dividends.

Dividends

Six incoming dividends this month from Warpaint London (W7L), Games Workshop (GAW), Me Group (MEGP), Bloomsbury Publishing (BMY), Henderson Far East Income (HFEL) and Fonix (FNX). This takes total dividends for the year to date to 103% of the start of year forecast which is very pleasing with a further two dividends due in December.

Portfolio Changes

I have exited Alliance Witan (ALW) in favour of JP Morgan American (JAM) which offers more focused exposure to the US markets. I have also exited MS International (MSI) due to their dependence on defence spending (which may or may not continue to expand) in favour of a new position in an old favourite IG Group (IGG). And as stated at the top of this article, I have also initiated a small position in gold via RMAP in order to provide some catastrophe insurance. My plan is to increase this position, or not, depending on how events unfold over the next couple of years. In particular, I have my eye on what Trump does about the role of Fed Chair which I believe comes up for renewal in May 2026.

Closing Thoughts

Despite being bearish on the UK economy (I will spare you a repeat of last month’s rant about the budget) I continue to have around 75% of my portfolio invested in UK listed companies. But the economy is not the market and a large chunk of revenues from my portfolio come from overseas, most notably the US but also with some exposure to Europe and Asia. That said, I remain mindful of overall flows into UK equities which continue to be in the wrong direction.

Suffice to say, the jury is out on whether to stick or twist on my UK listed holdings in favour of moving more funds into overseas focused investment trusts (I have neither the time nor the inclination to invest directly in overseas equities).

Until next time,

Happy investing

Simon @BrilliantLeader

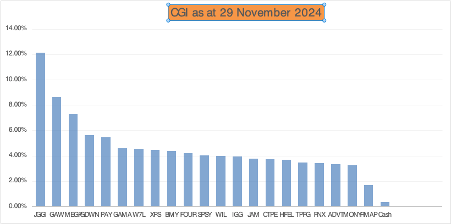

Disclosure – At the time of writing, my portfolio holdings are as per the graphic below or if you are reading this article in the future, my latest quarterly disclosure can be viewed here