As the saying goes, you can put lipstick on a pig but at the end of the day, it is still a pig. And so it was that Rachel from accounts tried to dress up a massive tax and spend budget as investing for growth. What complete and utter tosh! Taxing citizens and businesses to the hilt and borrowing even more money in order to increase spending on public services is not how you invest for growth. Quite the contrary in fact. The way to invest for growth is to reduce the tax burden, reduce the size of government and reduce the cost of borrowing by actually borrowing less. Ms. Reeve’s first budget as Chancellor of the Exchequer was a tax and spend budget. Let’s not pretend it was anything else.

That said, the pre-budget messaging contained sufficient scaremongering that most of us were relieved that it was not as bad as it could have been. Capital Gains Tax (CGT) was “only” increased to 18% and 24% for basic and higher rate tax payers, respectively, when the pre-budget whispers suggested it could be a lot higher. Business Property Relief (BPR) on AIM shares will now only receive 50% relief from inheritance tax whereas the pre-budget rumours suggested it could have been removed completely. Defined contribution pensions only had inheritance tax exemption removed whereas pre-budget we were scared into thinking that higher rate tax relief might be curtailed or even the tax free lump sum significantly reduced. And the budget did not change either the contribution limits for ISAs or place any other restrictions such as a lifetime allowance which we had been primed to think was a possibility. Phew! We got off lightly didn’t we?

In fact, around half of the overall tax increase will come from increasing employers national insurance contributions from 13.8% to 15%. But of course, that doesn’t count as taxing working people or increasing corporation tax. Heaven forbid politicians would break an election promise! When combined with the increases to the minimum wage that were announced pre-budget the burden on employing people is becoming just that – a greater burden. How on earth are businesses expected to invest more, especially low margin businesses, when their costs have been increased? Those that can will put up prices. Those that can’t do that will try to become more efficient by employing less people, increasing automation, limiting pay rises, shifting jobs overseas and so on. Some might even go bust!

And while I’m having a political rant, this government has already all but surrendered our energy security and based its obvious indifference to farmers in this week’s budget food security might be next on the chopping block. It’s quite the start isn’t it and to think that once upon a time we were all worried about a Corbyn/McDonnell government.

Company News

Now that I’ve got that off my chest, let’s get back to the real business of making money from investing in predominantly UK businesses which the evidence suggests is still possible. Perhaps unsurprisingly, October has been a quiet month for company news.

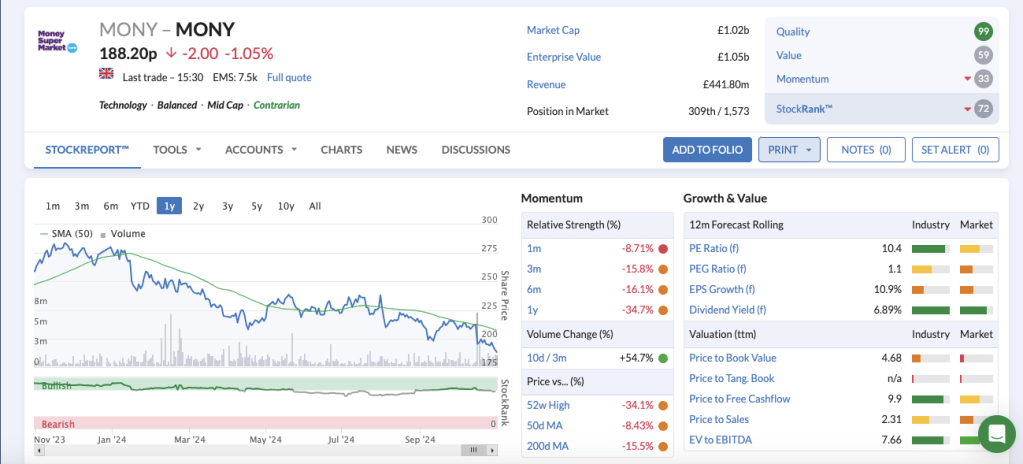

Mony Group (MONY) – Q3 Trading Update – A lack lustre report from this price comparison company (formerly known as MoneySupermarket) with overall revenue growth for the first 9 months of 2024 running at just 2%. The previous growth in insurance is slowing down and a lack of energy deals is unable to take up the slack. That said, the SuperSaveClub (their internal loyalty programme) now has over 750,000 members and can offer 11 product lines and the group remains on track to deliver in line with market expectations. The subsequent share price reaction makes MONY the current dog of my portfolio but to be honest if this is the worst share in my portfolio then I must be doing something right.

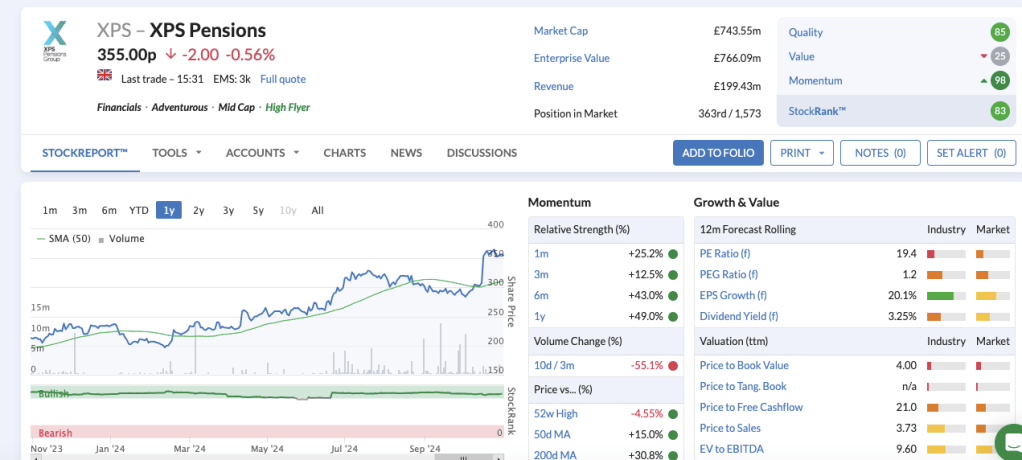

XPS Pensions (XPS) – 6 Monthly Trading Update – “The Group has continued to perform strongly with revenues from continuing operations (1) growing 23% year on year… The Board is pleased with the Group’s performance in the first half of the year and, notwithstanding an even tougher comparative period in H2 is confident of achieving full year results ahead of its previous expectations.” The subsequent share price reaction makes XPS one of the stars of my portfolio and for comparison, that’s what this looks like.

Bloomsbury Publishing (BMY) – Interim Results – “We have achieved our fifth consecutive double-digit growth in the first half with revenue growth of 32% to £179.8m, an increase of £43.1m, and profit1 growth of 50% to £26.6m, an increase of £8.9m… Following our strong performance in the first half of this year and good trading in September and October, we now expect trading for full year 2024/25 to be ahead of the current consensus2 expectation.” Jolly good, although it should be noted that the company are still guiding for a year-on-year decline in revenue and profits due to the lack of a new Sarah Jane Maas release during the current financial year. Believe that if you wish. Personally, I think the company are going gangbusters and are positioning for a full year beat. The like for like comparison at the interim stage looks like this:

Financial Highlights

| First Half Results | 2024/25 | 2023/24 | 2022/23 | ’25 vs ’24 | ’25 vs ’23 |

| Revenue | £179.8m | £136.7m | £122.9m | 32% | 46% |

| Organic revenue5 | £172.6m | £136.7m | £122.9m | 26% | 40% |

| Profit before taxation and highlighted items3 | £26.6m | £17.7m | £15.9m | 50% | 67% |

| Profit before taxation | £22.1m | £14.0m | £12.9m | 58% | 71% |

| Adjusted diluted earnings per share | 24.68p | 17.47p | 15.30p | 41% | 61% |

| Diluted earnings per share | 20.10p | 13.66p | 12.30p | 47% | 63% |

| Net cash | £9.7m | £39.1m | £41.5m | (75)% | (77)% |

| Interim dividend per share | 3.89p | 3.70p | 1.41p | 5% | 176% |

Dividends

Five dividends were received this month from Property Franchise Group (TPFG), Goodwin (GDWN), JP Morgan Global Growth & Income (JGGI), Gamma Communications (GAMA) and CT Private Equity (CTPE) taking year to date receipts to 91% of my full year forecast.

Portfolio Changes

Having exited several AIM shares during September due to concerns that the budget might lead to a mass exodus I began buying back Warpaint London (W7L), Property Franchise (TPFG) and Fonix (FNX) alongside a new holding in MS International (MSI) in the week leading up to the budget. Going into the budget itself I had half positions in all four companies and since the budget I have now turned all those into full positions.

Was it worth it? I think I’ve just about turned a profit on the round trip but it could have been a whole lot worse if IHT relief had been removed completely from AIM shares and in that respect, it certainly meant I slept soundly at night despite all the pre-budget noise.

As ever, I will measure my overall meddling quotient at the end of the year.

Closing Thoughts

I apologise for the political rant at the top of this article. Consider it a form of therapy on my part. I shall now return this blog to focusing purely on investment matters and most importantly trying to make money from the UK stock market. To that end, I don’t think the budget will have encouraged fund flows back into UK shares and I fear we are back to our previous state of waiting for a catalyst which frankly, might be a long time coming. That said, good companies are good companies and if the market doesn’t value them properly we have already seen that they will be taken over either by trade buyers or private equity. Ultimately, perhaps that is the catalyst!

Until next time, happy investing

Simon @BrilliantLeader

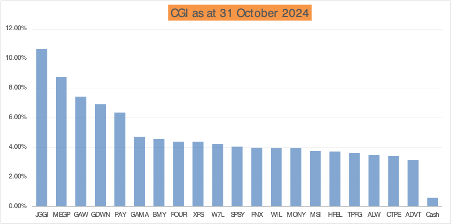

Disclosure – At the time of writing I own shares as per the graphic below. If you are reading this in the future, my latest quarterly disclosure can be viewed here

Great rant and could not agree more. A disaster of a budget.

LikeLike