My usual approach to budgets is to ignore the rumours until the facts are known and then decide if any action is required on my part. However, Rachel Reeves’ first budget as Chancellor feels like it could be different and not merely because it will be delivered around that time of year when we are celebrating witches and ghouls. The impact on the portfolios of private investors could be significant and wide ranging, especially given that there is a widely reported (and arguably fictitious) fiscal black hole that needs to be filled. Of course, speculation is rife as to what the Chancellor might target and a very useful long list has been published by Dan Neidle of Tax Policy Associates.

The problem as I see it with my usual “wait and see” approach is twofold. Firstly, there might be some changes that take effect from midnight on budget day such as changes to Capital Gains Tax (CGT) or Carried Interest. This said, there are other items where it makes sense to implement them from the new tax year such as changes to pensions tax relief and/or the pensions tax free lump sum or heaven forbid, any tinkering with ISA allowances/rules. However, there are some announcements that might be immediately market moving even if their implementation is not until April 2025 and in this category I would cite the removal of business property relief (BPR) for inheritance tax exemption on AIM shares because frankly, if this is removed, I can see a rush for the exit of London’s junior market. There is an estimated £6bn invested in this market from specialist IHT wealth management funds, not to mention investments held directly by individuals. Therefore, rightly or wrongly, I have decided to act pre-emptively and reduce my exposure to the AIM market.

Prior to making this decision I held six AIM listed shares, all of them in profit, some significantly so, and all held with a planned time horizon of forever (or until the investment thesis fails). So far, I have exited three of them; Warpaint London (W7L) at 236% profit, Fonix (FNX) at 55% profit and Property Franchise Group (TPFG) at 61% profit and I feel absolutely terrible about letting each of them go. Hopefully, I will get the chance to buy them back again at lower prices once the dust has settled.

Of the three AIM listed holdings remaining Gamma Communications (GAMA) have already signalled their intention to move to a main market listing where, all things being equal, they will enter the FTSE 250, so any outflows will hopefully be offset by corresponding inflows. For various reasons, my sense is that neither Spectra Systems (SPSY) nor Advanced AdvT (ADVT) are held extensively by AIM IHT funds and for now, I’m holding tight on both.

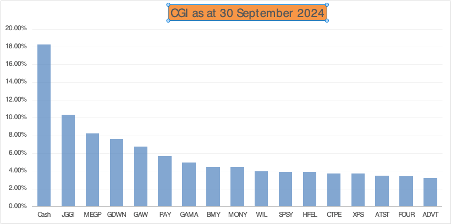

For someone who is usually fully invested, I now have dry powder of around 18% of my portfolio value. While I don’t feel great exiting quality assets, I do feel that a major downside risk is now under more control.

Now that I’ve got that off my chest, let’s move on to company news during September which coincidentally, includes all 3 AIM companies that I have exited during the month.

Company News

Property Franchise Group (TPFG) – Interim Results – This is the first set of results since the acquisition of Belvoir (March 2024) and GPEA Ltd. (May 2024). Both integrations appear to be going well and in combination are transformational for the group.

Gamma Communications (GAMA) – Interim Results – Revenue up 10%, Adjusted Profit before Tax (PBT) up 16% and Adjusted Earnings per Share (EPS) up 9%. I’m always wary of adjusted figures so let’s jump straight to cash where despite ongoing acquisitions and share buybacks net cash is up 17% to £142m. I’m delighted that GAMA have chosen to move to the main market where I think they will become a popular member of the FTSE 250 index.

Wilmington (WIL) – Final Results – Revenue up 14%, Adjust EPS up 41%. Following the sale of both the UK and European Healthcare businesses, WIL is now positioned as a higher margin platform business with net cash of £67m at the period end.

Warpaint London (W7L) – Interim Results – Revenue up 25% and Basic EPS up 67% demonstrating significant operational gearing. With several years of growth baked into their strategy this is a high quality business that will be top of my list to buy back into if the opportunity arises.

Games Workshop (GAW) – Trading Update – “Games Workshop Group PLC announces that trading for the three months to 1 September 2024 has been in line with the Board’s expectations.” Unlike some, I’m fine with the brevity of this trading update, after all, it is what we’ve come to expect from GAW. However, reference to the board’s expectations is meaningless because nobody knows what they are. As a FTSE 250 company and potentially a FTSE 100 company of the future, I think the time has come for them to begin referencing consensus forecasts in their updates.

Fonix (FNX) – Final Results – Double digit growth on every meaningful metric emphasising what a high quality company Fonix is. I’ve owned them since shortly after their IPO and it was a wrench to let them go from the portfolio. Hopefully, there will be an opportunity to buy them back again once the dust has settled.

Goodwin (GDWN) – Trading Update – Goodwin have only been issuing trading updates for a couple of quarters and it seems to me that they focus primarily on what has changed since the last set of results. Of particular note is the performance of Goodwin Steel Castings (GSC) which has helped improve the group’s order book by £30m+ supplying hull components to the US Navy who have also awarded GCS $14.5m of grant funding. That seems like a pretty strong endorsement to me.

Spectra Systems (SPSY) – Interim Results – To the casual observer these results will appear quite strange with revenue up 96% but adjusted EPS only up 4%. Both figures are primarily due to acquiring Cantor in December 2023 which is a much lower margin business. However, the strategic reasons for buying Cantor remain intact and this should become apparent as 2025 unfolds, not least with regard to the $38m sensors manufacturing contract that the company announced in July. The narrative from these results suggests that more significant contract wins could follow especially in relation to their polymer substrate.

JP Morgan Global Growth & Income (JGGI) – Final Results – I don’t usually provide much commentary on these pages regarding my investment trust holdings but as JGGI is my largest holding I am making an exception. Briefly, their 12 month NAV return was 28% versus 20% for their benchmark (MSCI AC World Index) and on a 5 year basis 110% versus 67%. This year’s performance has led to a 23% increase in their dividend. Put simply, it is a very high quality trust with a style agnostic process that has been shown to outperform over multiple timeframes.

Dividends

Six dividend payments were received during September; Mony Group (MONY), Games Workshop (GAW), 4imprint (FOUR), XPS Pensions (XPS), Alliance Trust (ATST) and PayPoint (PAY) taking the portfolio to 82% of my annual forecast.

Portfolio Changes

Aside from the three AIM holdings mentioned above, I also exited Puretech Healthcare (PRTC) during September (on a stop loss) as I just don’t see what will reverse the negative share price trend anytime soon. It is also a reminder for me to stick to my circle of competence.

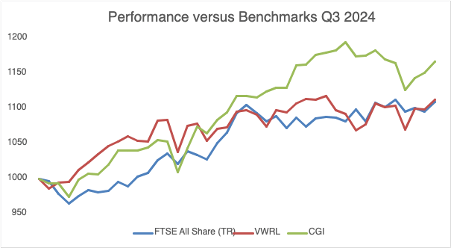

Q3 Performance versus Benchmarks

Smashing it!

Q3 Main Contributors and Detractors

Gamma Communications (GAMA) and Me Group (MEGP) leading the way with 4imprint (FOUR) and Goodwin (GDWN) holding things back.

Closing Thoughts

Have I overreacted by significantly reducing my exposure to AIM holdings? Perhaps. Will I live to regret it? Perhaps. Am I sleeping more soundly at night? Definitely.

Until next time, happy investing

Simon @BrilliantLeader

Disclosure – At the time of writing I own shares in the companies shown in the graphic below or if you are reading this in the future, my latest quarterly disclosure can be seen here