In truth I have spent more time during August focused on my Fantasy Premier League team than I have my investment portfolio. As I recall there was a bit of a selloff earlier in the month from which my portfolio has only partially recovered. I’m struggling to remember what caused this particular selloff (I’m pretty sure it started in America and we in the UK caught the obligatory cold) but it seemed to run parallel to a period of UK civil unrest which thankfully has been nipped in the bud. And then there was the annual central bankers gathering at Jackson Hole during which Jerome Powell all but confirmed the Fed will begin reducing rates in September, the only question being whether it is by a quarter or a half percentage point.

What have I missed?

Company News

Six portfolio companies published meaningful news during the month.

PayPoint (PAY) – First Quarter Trading Update – As ever with PAY there is a lot to unpick in their business updates. The short version is net revenue grew by 9.5% year-on-year and the company remains on track to achieve £100m EBITDA by the end of FY26. They also made a strategic investment in Yodel which is a Collect+ partner and took a majority stake in obconnect (59.3%) which will be immediately earnings enhancing. With both the share buyback and significant dividend payments continuing, this is a management team who are happy to work the balance sheet in pursuit of growth. So far, so good.

4imprint (FOUR) – Interim Results – In challenging market conditions FOUR produced 5% revenue growth, an increase of 11% in profit before tax and expect the full year performance to be similar. A company that can grow margins and market share when trading conditions are soft is likely to benefit when those conditions improve.

Property Franchise Group (TPFG) – Trading Update – With the acquisition of Belvoir and the Guild of Property Professionals and Fine & Country completing during the first half of the year, it is fair that management describe the period as transformational. This franchised estate agent now owns 18 brands which incorporates sales, lettings and financial services. They are also likely to benefit from reducing interest rates. Oh yes, trading is at least in line with market expectations.

Goodwin (GDWN) – Full Year Results – Pre-tax profit increased by 27% on modest revenue growth. This excludes the interest rate swap which sees them locked into a borrowing rate of less than 1% on £30m of debt (£43m of debt in total). There are many moving parts with GDWN and with the share price doubling in the past year, the valuation perhaps looks a little stretched – on the surface at least. The real investment thesis here is the number of growth opportunities that might yet come to fruition, thanks to their previous capital investments. As ever, the proof of the pudding will be in the eating.

Puretech Health (PRTC) – Interim Results – I see PRTC as an asset play rather than a trading company per se. In that respect the company had year end cash of $500m and following an oversubscribed $100m tender offer they expect year end net cash to be around $330m. Clearly they have value in their drug pipeline both via the founded entities and their internal development targets. The issue I am grappling with is, what will unlock that value?

CT Private Equity (CTPE) – Interim Results – A six monthly NAV return of 0.8% is not why one invests in private equity. However, there were some significant realisations (£52m) during the period (at a 35% premium to prior valuations) with more to follow in the second half. Net debt is down from £99m at the end of Q1 to £91m at the halfway stage and the 6.5% dividend yield is maintained. With interest rates now likely to be on a downward trajectory and market activity seemingly on the move, I am hoping this marks the low point for the share price and that NAV returns over the remainder of the year and beyond will be more encouraging.

Dividends

Some chunky dividends during the month from PayPoint (PAY), Bloomsbury Publishing (BMY) and Henderson Far East Income (HFEL) taking dividend receipts to 70% of my annual forecast.

Portfolio Changes

I made one change early on in the month which was to exit Impax Asset Management (IPX) to take a new position in 4imprint (FOUR) which I have been tracking for a while now. I think IPX will probably recover in due course but it was time for me to move on.

Closing Thoughts

How are we all feeling about the new Labour government? While I don’t like to be political on this site, the early signs are somewhat worrying. Putting aside the civil unrest, there is the invention of a £20bn fiscal black hole, generous settlement of long running industrial disputes, withdrawal of the winter fuel allowance for any pensioners not on benefits and the cancellation of all new oil and gas licenses in the North Sea. And all this comes before we get their first budget where we already know that VAT will be levied on private schools and that somehow, more tax money needs to be raised without breaking their manifesto promise not to raise taxes. I’m sure the rumours and lobbying will begin in earnest now that the summer is over – oh joy!

That aside, news flow and trading volumes should be picking up, interest rates should be on the way down and the US election campaign will be running at full throttle for the next couple of months. Twitter/X might or might not become even more unbearable but the good news is there is a sparkly new hideout for UK investors that is emerging called Blue Sky Social. You can find me there using the handle @brilliantleader99.bsky.social

Until next time,

Happy investing

Simon @BrilliantLeader

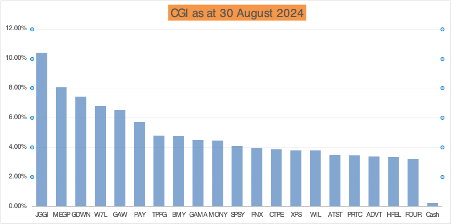

Disclosure – At the time of writing I own shares in the companies shown in the graphic below. If you are reading this article in the future my latest quarterly holdings disclosure can be found here