It has been an eventful month. First, there was the expected Labour landslide in the UK. Then, across the pond there was the attempted assassination of Donald Trump followed by Joe Biden withdrawing from this year’s Presidential race to be almost seamlessly and swiftly replaced by Vice President Kamala Harris. Moving away from politics we have signs of economic stress/slowdown across the board which hopefully means interest rate cuts will soon follow. And lest we forget how dependent on computers we have all become, there was the day when a security update brought down half of the world’s IT systems with the bi-product of letting some air out of the Magnificent 7 bubble.

Given this backdrop I was delighted that my motley collection of quality UK small/mid cap shares have driven my portfolio to a new, long awaited all time high during the month. Whoop! Whoop!

Company News

A busy month with over 50% of portfolio companies releasing meaningful news, so without further ado…

Goodwin (GDWN) – Having re-qualified for a full FTSE listing in June (they were previously excluded on liquidity grounds) there was an earlier than expected entry into the FTSE 250 at the beginning of July. For anyone looking to get up to speed on the company and why they are the largest individual holding in my portfolio I would highly recommend this excellent substack analysis from Alex Sweet.

Impax Asset Management (IPX) – Q3 AuM Update – IPX remains on the naughty step with further fund outflows and negative market movements during the third quarter reducing Assets under Management (AuM) from £39.6bn to £36.9bn. In all honesty, I should have sold IPX long before now but having first bought them in 2017 for around 170p per share (versus around 400p at the time of writing but well below their previous high of over 1500p), I am probably guilty of being a little attached. But we are where we are and there is hopefully more upside than downside from this point onwards and a near 7% dividend yield that is fully covered. There are worse “problem children” to have in a portfolio!

MONY (MONY) – Interim Results – Revenue up 5%, adjusted EPS up 6%, interim dividend up 3% and net debt reduced by 54%. Unfortunately, private investors do not have access to much research on this company but I believe the consensus was for around 14% growth this year which would mean the company are tracking below these expectations. Nonetheless, they are still growing and that growth should accelerate if energy switching ever returns to their offering. With a PE ratio of 12.5 and a dividend yield of 5.7% I am prepared to be patient unless a more compelling opportunity presents itself.

AdvT (ADVT) – Final Results – These results were for a change of year end to February 2024, as previously signposted, technically an 8 month period but in reality 7 months since ceasing to be a cash shell. They still have plenty of cash on the balance sheet (around £77m) and a near 10% holding in M&C Saatchi (SAA) following a previously failed takeover attempt. Revenue from continuing operations was £21m and EPS was 5p per share. The investment thesis here is a leap of faith that Executive Chairman Vin Murria and her loyal leadership team can repeat the success of previous ventures. These results merely provide a base line on which they will be building and the interim results to the end of August will be the next opportunity to assess progress. Investors will also be looking for earnings accretive acquisitions which could come at any time. There was a recent presentation by Vin Murria at a Mello online event that is now available on YouTube (from 1 hour, 21 mins)

Fonix Mobile (FNX) – Full Year Trading Update – Ahead of expectations with gross profit growing by 18.5%, adjusted EBITDA 18.1% and the promise of an increased dividend when full year results are published in September. Tantalisingly, there is the prospect of a new European territory being launched with broadcasting customers already lined up.

Me Group International (MEGP) – Interim Results – We already knew from the previous trading update that these interim results would be decent, albeit hampered by some FX headwinds. Revenue +8.6%, EPS +11.9% and interim dividend +16.2%. The laundry machines division was once again the standout performer but photobooths also continue to grow. And tucked away in the CEO’s comments we have this little nugget, “Additionally, the Group’s R&D team has devised new production techniques to reduce the cost of the next-generation photobooths by 28% (effective immediately) and the Revolution laundry machine by 13% (effective FY 2025)”. Accompanying these interim results was a company presentation on the Investor Meet Company platform where a recording is available.

Spectra Systems (SPSY) – Large Contract Win – A timely re-entry into SPSY at the beginning of the month saw me benefit from news of a $37.9m sensor manufacturing contract with an existing central bank customer. The bulk of the revenues from this contract will be recognised in FY25 and FY26 and will attract higher margins than previously anticipated. This has led to forecast upgrades and a nice bump in the share price. Alan Charlton recently pitched SPSY at the same Mello online event mentioned previously. This can be viewed from 2 hours, 33 mins

Bloomsbury Publishing (BMY) – AGM Trading Update – “Strong trading in line with recently upgraded expectations”. It is a shame that the detail behind these forecasts is not available to private investors, although the company does tell us, “The Board considers current consensus market expectation for the year ending 28 February 2025 to be revenue of £319.3m and profit before taxation and highlighted items of £37.6m”. This would actually represent a double digit decline in full year EPS which even without a Sarah J Maas release this FY looks conservative to me. However it is difficult to comment further without access to the detailed guidance which the company prefers to make available only to institutional investors. Ho hum!

Wilmington (WIL) – Full Year Trading Update – Organic revenue growth of 9% and profit before tax up 13%. I will unpick this a little further when full year results are published in September.

Games Workshop (GAW) – Full Year Results – If GAW trading updates are a model of brevity, then their annual report is a model of clarity. No adjustments. No obfuscation. Just informing shareholders exactly how it is. It helps of course if you are sharing record results with earnings per share of 458p up from 409p the prior year, even if that is a 53 week period rather than 52 weeks. Revenues up 11% or 14% in constant currency with gross margins and ROCE which would be the envy of just about any business on the planet. Is the company fairly valued with a PE ratio of ~21 and a yield a tad over 4%? I think so and it remains a top 5 holding in my portfolio. Market eyes though will be on the prospective licensing deal with Amazon Studios which might yet fail to be consummated due to creative differences. If so, the resulting dip might be one that I buy aggressively (this is not investment advice).

Dividends

Dividends were received this month from JP Morgan Global Growth & Income (JGGI), Warpaint London (W7L), Impax Asset Management (IPX) and CT Private Equity (CTPE) taking the total for the year so far to 63% of my annual forecast.

Portfolio Changes

The main change this month was to exit Oxford Metrics (OMG) as signposted last month and to re-purchase Spectra Systems (SPSY) which I should never have sold in the first place. Fortunately, this transaction took place at the beginning of the month enabling a ~20% gain following the contract news noted above.

I have also fiddled around a little with my investment trust holdings of which I now only own four. This subset of the portfolio remains a work-in-progress and I will refrain from further comment while that is the case.

Closing Thoughts

I am delighted with how my investing year is going so far (now over 20% YTD). I own a bunch of excellent companies, mostly purchased at very good prices and my attempt at doing very little is going better than in previous years. There is limited temptation among my watchlist (some good companies but not great prices) and nearly all portfolio companies are reporting solid progress.

My main goal for the remainder of the year is to continue to stick to my knitting and ignore the bigger picture noise unless it directly impacts my portfolio companies. And in the immediate future, I intend to continue enjoying this British heatwave while it lasts.

Until next time, happy investing

Simon @BrilliantLeader

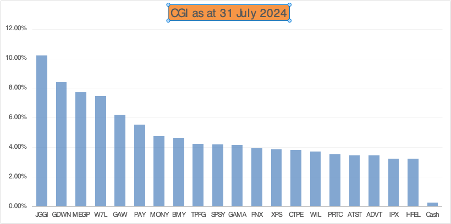

Disclosure – At the time of writing I own shares in the companies in the graphic below or if you are reading this in the future, my latest quarterly holdings/weightings disclosure can be viewed here

Nice work Simon. Good to see the pf getting some traction – 2024 has been kind to date, long may it continue. Well spotted on the MEGP news, that could have a material impact over coming yrs given the roll out programme.

LikeLike