Despite the best efforts of our government and the Bank of England, corporate UK actually seems to be performing pretty well. I could probably spend a whole article unpicking that sentence but for now suffice to say that raising corporation tax from 19% to 25% is about as uncompetitive as it gets in my book and maintaining base rates at 5.25% is also beginning to look like a tighter noose than the economy needs. And yet, high quality UK companies continue to produce solid, sometimes stellar results despite these headwinds. Whisper it quietly but the UK stock market finally seems to be catching on to this, no doubt catalysed by the ongoing flow of takeovers from private equity buyers and overseas rivals.

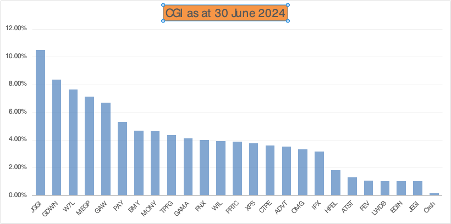

Performance versus Benchmarks

Perhaps my rose-tinted view has been influenced by a strong portfolio performance during the first half of the year. So far, my motley collection of quality UK companies has produced a return of 16.17% versus 7.42% for the FTSE All Share (TR) and 11.37% for a global tracker (VWRL). Based on my Twitter/X feed I am not alone in this encouraging outperformance but then again, that same echo chamber also implies we are on the brink of a landslide victory for Reform UK. I’m not sure what that says about me, my fellow investors or the platform we are all using but the sooner this general election is over and done with the better as far as I’m concerned.

Corporate News (June)

Eight portfolio companies delivered meaningful updates during the final month of the quarter.

Property Franchise Group (TPFG) – Acquisition and AGM Statement. An acquisition of The Guild of Property Professionals and Fine & Country for a total consideration of £20m (5.7x 2023 EBITDA) adds 1036 outlets to the TPFG portfolio including 65 international outlets. This was followed by a very bullish AGM Statement which confirmed lettings revenues were growing at similar rates to 2023 and the sales-agreed pipeline was 20% up on the previous 12 months.

Me Group (MEGP) – Half Year Trading Update. The financials for the 6 months ended 30th April were impacted somewhat by the weak Yen (MEGP are the largest photobooth operator in Japan) but nonetheless overall revenue was up 4.6% on the prior year and profit before tax was up 10.3%. I’ll comment further once the interims have been published in mid-July.

Oxford Metrics (OMG) – Interim Results. Revenue up 10.5% year-on-year but adjusted earnings per share down 10.5% year-on-year. I’ve read the narrative and watched the investor presentation and I am still not completely clear on the reasons for this decline in profitability beyond some “planned expenditures” in the first half. The saving grace for OMG is that they have a significant war chest for acquisitions (£54m of £131m market capitalisation) but with a relatively new CEO and a new CFO starting in July, they join Impax Asset Management (IPX) on the naughty step. Both are at risk of being replaced during my next reshuffle.

Games Workshop (GAW) – Year End Trading Update. I would be disappointed if a GAW trading update was any longer than the two sentences they provide. This said, we discover that group revenue will be at least £490m versus £445m for the prior year and that profit before tax will be at least £200m versus £171m previously. They continue to be an excellent company and a top 5 holding in my portfolio despite several top slices along the way.

XPS Pensions Group (XPS) – Final Results. Revenue up 21% year-on-year, fully diluted earnings per share up 24% and dividends up 19%. Moreover, the company entered the FTSE 250 index during June which bodes well for the year ahead.

Puretech Health (PRTC) – Result of Tender Offer. A tender offer for returning $100m to shareholders was massively oversubscribed (172m versus 33m available). It is concerning that so many shareholders want out, although I’m not one of them. The risk-reward here still looks excellent with around 70% of the market capitalisation in cash/cash equivalents post tender offer. Given that so many holders are looking for an exit at 250p, has this now put a fire sale price on the company? While that figure would still represent a win, it would be a disappointing outcome from my perspective given the unrealised value of assets held within the company. Que sera sera!

Warpaint London (W7L) – AGM Statement. An extremely bullish trading update without specifically upgrading guidance. Interim revenue is expected to come in around £46m versus £36.7m for the prior year. And results are expected to be second half weighted which when sales growth is so strong means further upgrades are likely to follow later in the year. This is all organic growth of course and a company that continues to be on a roll. Despite a top slice of my W7L holding during the second quarter, they are already back to being my second largest direct equity holding.

Wilmington (WIL) – Disposal of UK and French Healthcare Businesses. Two similarly valued disposals for a combined total of around £48.5m leaves the company as a “high margin, pure-play platform, focusing on Governance, Risk and Compliance (GRC) providing intelligence, data and training directly to customers… in regulated markets”. They also have a decent sized war chest to add other high quality GRC assets via acquisition. One to watch!

Dividends

Dividends from Property Franchise (TPFG) and Gamma Communications (GAMA) in June lifts the first half to 55% of my annual forecast.

Portfolio Changes (June)

I finally lost patience with my two lowest conviction holdings; TP ICAP (TCAP) and Ingenta (ING) in favour of building a small investment trust portfolio as a subset of my main portfolio. It is a subset that is still under consideration and nothing is written in stone but they are all now >1% positions and appear on my portfolio disclosure at the foot of this article. I will write further about these choices and how they fit with my portfolio thinking in future posts.

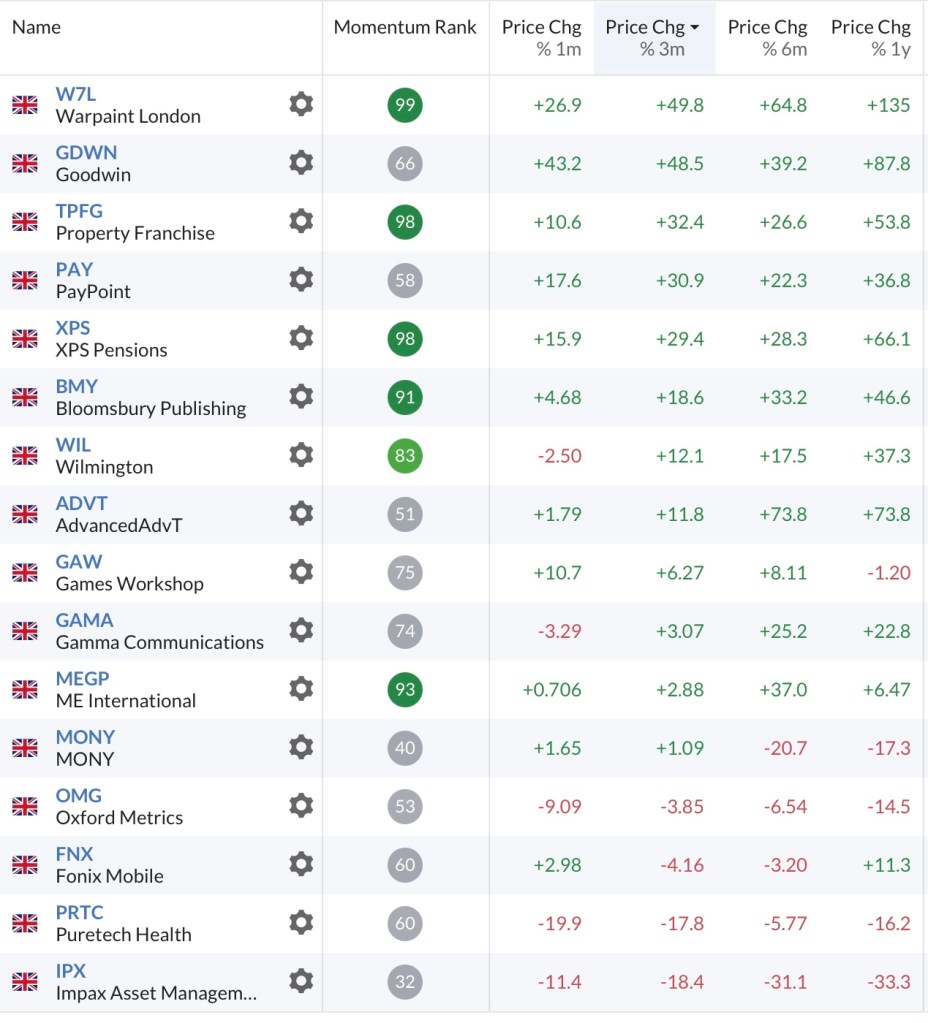

Main Contributors and Detractors

As one would expect from a rising tide, there have been more contributors than detractors this quarter with my two largest holdings Goodwin (GDWN) and Warpaint London (W7L) leading the charge. That said, Impax (IPX) and Puretech Health (PRTC) have both taken a bit of a drubbing at the other end of the spectrum.

Portfolio Metrics

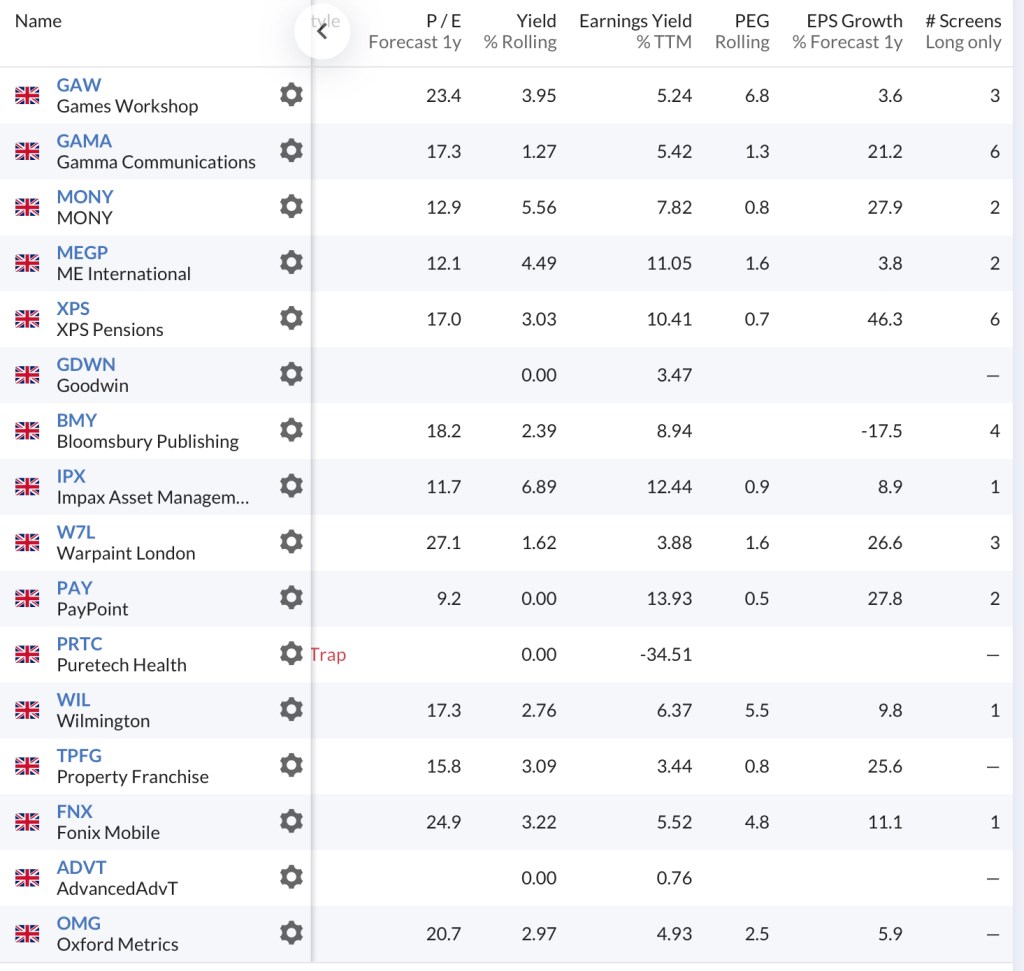

I have decided that the portfolio metrics on this page only really need updating annually. For this quarter’s portfolio analysis I am sharing the dashboard view I use to regularly monitor my direct equity holdings (in market cap order), courtesy of Stockopedia.

As ever, I am happy to chat about any of these holdings or other portfolio matters over on Twitter/X via @BrilliantLeader

Closing Thoughts

Politicians and their advisers would have been better off backing the UK stock market this year than betting on the date of the general election. Next, we’ll discover they have also backed England to win the Euros – now that would be ridiculous!

But one swallow does not a summer make. We have an incoming Labour government with a likely large majority, the uncertainty of European elections, most notably in France and of course, a US election in November. At a geopolitical and humanitarian level Russia/Ukraine and Israel/Palestine continue to cast large shadows and on a macro level, the US stock market, especially the AI fuelled Magnificent Seven, looks like a bubble waiting to burst – perhaps!?

Sometimes I wonder if we would actually be better off letting the machines take over but that is an essay I will probably never write. For now, I shall content myself with owning high quality, dividend paying companies and be thankful for good health and an amazing family.

Until next time…

Happy investing,

Simon @BrilliantLeader

Disclosure – At the time of writing I own the companies shown in the graphic below or if you are reading this in the future, my latest quarterly portfolio disclosure can be viewed here