It has been a busy month of news flow for both my portfolio and at a macro level, including some worrying geopolitical developments in the Middle East. The portfolio news is summarised below. On the macro front, we are seeing some stubbornness in inflation, especially in the US which will likely delay interest rate cuts by the Federal Reserve. This puts the onus on the European Central Bank and the Bank of England to cut rates before their American counterparts which in turn feeds into a stronger dollar and all that entails. It remains a fine balancing act where the biggest takeaway from my perspective is that there are plenty of businesses on both sides of the pond that are doing just fine – soft landing anyone?

Corporate News

CT Private Equity (CTPE) – Full Year Results. A Net Asset Value (NAV) return of 2.8% in what has clearly been a tough period for private equity. Nonetheless this trust continues to provide diversified exposure to the sector and currently yields around 6%.

Impax Asset Management (IPX) – Quarterly Update. Assets under Management (AuM) of £39.6bn representing an increase of 1.3% during its second quarter. This is entirely due to positive market movements of £2.2bn versus negative outflows of £1.7bn which remains a slight concern.

Warpaint London (W7L) – Full Year Results. Confirming a year of outstanding performance – revenue +40%, PBT +136% and EPS +123% (reflecting a change of corporation tax from 19% to 25%), confirming a solid start to 2024 (Q1 revenues up 28% year-on-year) and expressing confidence in achieving the upgraded broker forecasts for the year.

Puretech Health (PRTC) – Full Year Results. Telling us little that we didn’t already know but confirming that cash at the end of March was $573m versus a market capitalisation on results day of £573m. There is also the prospect in May of $100m tender offer at 250p per share. The more significant news for PRTC this month was founded entity Seaport successfully raising $100m in a Series A funding round and CEO/Founder Daphne Zohar moving across to become CEO at Seaport – she must see significant value there. She is replaced as Puretech CEO by long standing senior executive Bharatt Chowrira who has the challenge of allocating PRTC’s significant capital resources while realising value for shareholders in the process.

XPS Pensions (XPS) – FY Trading Update. Full year revenues have grown 20% year-on-year. “Costs have been managed well and the Board expects operational gearing to have improved, and thus is confident of achieving full year results ahead of its own previously upgraded expectations.” Excellent!

Moneysupermarket.com (MONY) – Quarterly Trading Update. Overall revenue growth of 8% for the first quarter representing an in line performance. Insurance remains particularly strong with 21% year-on-year growth.

PayPoint (PAY) – FY Trading Update. A post close update lacking in any level of detail but seemingly delivering good news. EBITDA will be above £80m, net debt below £70m and Profit Before Tax will be in line with expectations which Stockopedia data has at £46.6m. Moreover, we are told a share buyback will be launched after full year results are published. Personally, I would prefer they cleared debt first but that seems to be a minority view.

Property Franchise Group (TPFG) – Full Year Results. On the surface these results appear to show a flat performance year-on-year. However, given the backdrop of a dire UK property sales market, that outcome should be seen in a positive light, underpinned by a very healthy property lettings market and a franchise business model that continues to provide confidence and predictability. Eyes this year will be on the successful merger/integration of TPFG and Belvoir. There was an excellent presentation by the CEO/CFO last week which is well worth a view for those interested in this name.

Dividends

Five dividends were received this month from Fonix Mobile (FNX), Wilmington (WIL), Goodwin (GDWN), JP Morgan Global Growth & Income (JGGI) and CT Private Equity (CTPE) taking dividend performance to 33% of my annual forecast.

Portfolio Changes

Minimal. A modest top slice of Warpaint London (W7L) at ~160% return to lock-in some profits. It remains a top 5 holding. These funds were used for small top ups to CT Private Equity (CTPE), PayPoint (PAY) and TP Icap (TCAP).

Closing Thoughts

My positions in PayPoint (PAY) and CT Private Equity (CTPE) have moved into profit this month meaning that all 20 portfolio holdings are currently showing a positive return. Be afraid, be very afraid! History suggests that whenever my portfolio gets to this point, a market fall follows soon after. Of course, this time could be different…

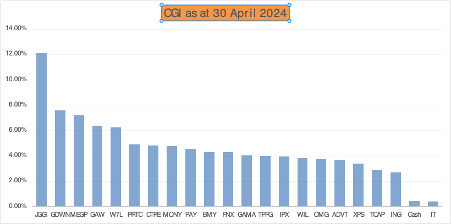

More seriously, I now have 7 companies on my shortlist – 4 investment trusts and 3 direct equities but as per my last update, there is nothing I currently wish to sell. Therefore, I have started nominal positions in the investment trusts which are collectively listed as “IT” in the graphic below. My intention is to build positions in these four trusts over the coming months, as funds become available.

In a UK market that continues to be dominated by takeovers, my holdings continue to be overlooked while delivering solid business performance. It is all gloriously boring really and long may it continue!

Happy investing

Simon @BrilliantLeader

Disclosure

At the time of writing, I hold the companies shown in the graphic below or if you are reading this in the future, my latest quarterly portfolio disclosure can be viewed here