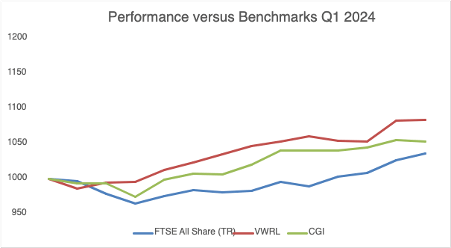

Performance versus Benchmarks

Carrying on from the 2023 outcome, portfolio performance for the first quarter remains sandwiched between my two benchmarks, delivering a 5.30% return versus 3.57% for the FTSE All Share (TR) and 8.41% for the Vanguard World ETF (VWRL).

Main Contributors and Detractors for Q1

Some impressive quarterly gains from Me Group (MEGP) +33% and Gamma Communications (GAMA) +21%. There were also some decent initial gains from three new purchases during the quarter; AdvancedAdvT (ADVT) +20%, Puretech Health (PRTC) +15% and TP Icap (TCAP) +15%. At the other end of the spectrum the biggest detractors were Moneysupermarket.com (MONY) -21% and Impax Asset Management (IPX) -15%. In particular, the sell-off in MONY is baffling to me, leaving the shares on a forecast PE ratio of 12 and a dividend yield approaching 6% which is too cheap, in my opinion.

Looking at my portfolio wholistically 18/20 positions are currently in profit. The two that are currently showing a loss on the purchase price are PayPoint (PAY) and CT Private Equity (CTPE) which are both down around 8%, although somewhat less than that if one includes the dividends received since purchase.

Macro Overview

Things are broadly unchanged since my 2023 annual review. The market is still expecting interest rates to begin reducing during 2023 while central banks remain cautious over the lag effects of inflation. So far, the effects of higher interest rates do not seem to be taking us into a deep recession but maybe another quarter of data is needed before we begin shouting that from the rooftops.

The second half of 2024 will see elections on both sides of the Atlantic and while I don’t like to be political on this site, it does seem as though the choices for both electorates are restricted to Bob Hope and No Hope – I know it is an old joke that might see younger readers having to Google the name of the aforementioned comedian but it really does seem a rather stark choice all round. As for markets, they seem to be shrugging that off for now with both the S&P 500 and FTSE 100 ending the quarter on all-time highs.

News

TP Icap (TCAP) – I bought into this holding the day prior to full year results and so far that decision has worked out well. While these results were mixed (revenue and dividends up, EBIT, Profit Before Tax and Earnings Per Share down), the main driver behind my own investment thesis is the possible spin-off of Parameta Solutions which could potentially be valued on a par with the current value of the whole business. Let’s see!

Fonix Mobile (FNX) – well received interim results from this SMS payment provider which saw double digit increases in all key metrics. With the prospect of further international expansion on the horizon, it is a company with plenty of tailwinds and a management team that has barely put a foot wrong since coming to market at the end of 2020.

Goodwin (GDWN) – an in line quarterly trading update which initially went down like the proverbial lead balloon for some reason (probably a lack of orders for their Easat Radar Systems). The market can be fickle but I am happy to hold tight for the prospect of multi-year growth. So too it seems are the Goodwin family who this week added around £500k to their concert party holding.

Puretech Health (PRTC) – I don’t like to describe an investment thesis as a no-brainer because things can and do go wrong but PRTC is surely as close as one can get. Following the completion of the sale of Karuna Therapeutics to Bristol Myers Squibb for $14bn, PRTC have received gross proceeds of $293m ($18.5m invested and a total return of $1.1bn) which along with their existing cash resources means that cash is now pretty close to the entire market capitalisation of the company. This means that investors get the rest (and in this case the rest amounts to some pretty significant assets) effectively for free. The company have already announced a $100m tender offer at 250p and I anticipate a special dividend announcement once that process is complete.

Games Workshop (GAW) – an in line third quarter trading update and a further dividend declaration of 105p. To say any more would be saying more than the company’s actual update which was delivered with their usual brevity.

Gamma Communications (GAMA) – decent full year results which were in line with consensus forecasts as per their January update. The dividend increase of 14% (from a low base) is welcome but I would have preferred more of their strong cash generation to be directed towards an enhanced dividend rather than (or in addition to) the £35m share buyback programme (some of which will be used to satisfy share based compensation and some of which will be cancelled). As Paul Scott mentioned on his daily SCVR (Small Cap Value Report on Stockopedia for those not familiar), GAMA look ripe for a private equity takeover bid. I concur.

AdvancedAdvT (ADVT) – solid Interim results from this relatively new addition to the portfolio which are running ahead of expectations since acquiring their core platform businesses from Capita in July 2023. If one were to strip out cash and the ~10% investment in M&C Saatchi (SAA), ADVT are currently trading on a PE ratio of around 12. In the fullness of time, I believe this will prove to be excellent value.

Dividends

Dividends received this month from PayPoint (PAY) and Impax Asset Management (IPX). This means that dividends for the first quarter of 2024 are running at around 23.5% of my full year target, so there is a little bit of ground to be made up as we head into the second quarter.

Portfolio Changes

As noted above, I added a new holding in March, TP Icap (TCAP) which was funded by dividend income and a small top slice of JP Morgan Global Growth and Income (JGGI) – which incidentally, has returned an impressive 10% during the first quarter. As I noted on Twitter at the time, I’m undecided if TCAP will be a long-term holding but will hold for both the final dividend and details of the Parameta Solutions spin-off before reassessing.

Closing Thoughts

I had a very pleasant lunch last week with a dear old friend and former investment club colleague (investment clubs eh, remember them?!) which made me think that perhaps I should have a little more exposure to investment funds. The problem is I am very happy with my existing holdings and there is literally nothing that I currently wish to sell. Nonetheless, I have begun compiling a small watchlist of additional investment trusts that I might consider buying should an existing holding disappoint or heaven forbid, should I actually ever again receive a takeover bid for one of my portfolio holdings.

Disclosure

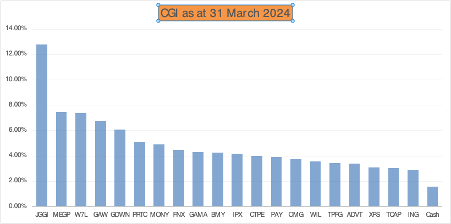

I now have 20 holdings overall (2 Investment Trusts and 18 Direct Equity holdings) which is my self-imposed maximum. The current holdings and weightings are shown in the graphic below or if you are reading this in the future my latest holdings disclosure can be viewed here