As expected, a somewhat quieter month for meaningful news resulting in one portfolio company being sold. Before jumping into that, I’ve penned a few thoughts on share buybacks given an increasing number of companies going down this path.

Buybacks

Overall, I am not a fan so what follows comes with that starting bias. Firstly, a company buying back shares indicates to me that they have limited reinvestment opportunities for those funds. Secondly, as someone who is around 98% invested via tax efficient vehicles (ISAs and SIPPs), the argument that buybacks are more tax efficient than dividends does not interest me. However, dividends do interest me as they fund our living expenses without the need to sell any shares, so if a company cannot find any better reinvestment opportunities, I would much rather see an increased dividend pay-out than a share buyback.

Moving onto the mechanics of buybacks, a key question for me is, are they being cancelled or held in treasury? In the case of the latter, this usually indicates the shares will be used for staff incentives. I suppose this does mean that those incentives will not dilute existing shareholders but I much prefer to see shares being cancelled as this genuinely increases earnings per share (although I would be wary of that if director renumeration is linked to EPS targets). The next question I would ask is, are shares being purchased at a keen valuation? As things stand, the UK market is generally cheap and I am especially sympathetic to investment trusts or other asset plays that are trading at significant discounts to their asset value.

The final question I would ask is, are the company borrowing money to buyback shares? I am already uncomfortable with companies paying dividends when they have significant debt but to increase borrowing in order to buyback shares makes even less sense to me, especially in a higher interest rate environment, unless the company’s shares are genuinely mispriced by an order of magnitude.

News

Ultimate Products (ULTP) – the first news of February was a trading update from this homeware brands owner and distributor. A 4% decline in revenue was offset by margin improvements via productivity gains and reduced freight costs. Overall, I saw this update as neutral, albeit a little uninspiring. It was noteworthy to see debt reduce from 0.7x EBITDA to 0.4x EBITDA and therefore, I was disappointed to hear the company planned to increase debt to 1x EBITDA in order to embark on a share buyback programme.

Bloomsbury Publishing (BMY) – a nice Valentine’s Day surprise for shareholders with a trading update stating both revenue and profits (for the year ending February) would be significantly ahead of current market forecasts, although retail shareholders had to wait a further 24 hours to discover the exact numbers which were provided only to analysts on the day of the update (none of those covering BMY make their research available to retail shareholders). Furthermore, they have not (yet) guided an increase for the following financial year which means we now have the rather bizarre prospect of a ~30% decrease in earnings per share for FY+1. While I accept that much of this ‘significantly ahead’ comes from the standout success of the latest Sarah J. Maas launch, it is bonkers to suggest that at least some of this momentum will not continue into the next financial year. Nonetheless, the share price has responded positively and I remain happy with the company’s progress.

Wilmington (WIL) – interim results were in line with market expectations, albeit second half weighted. Like for like performance of continuing operations (there was both a disposal and an acquisition during the period) showing revenue up 7%, earnings per share up 12% and the interim dividend up by 11%. A decent enough performance but I will be happier once that second half weighting has played out.

Moneysupermarket (MONY) – full year results from this price comparison group with several moving parts. Overall these results were in line with expectations which translates as revenue +11%, adjusted eps +12%, net debt -49% and a return to dividend growth +3%. This was achieved with virtually no contribution from energy switching which remains a depressed market. The commentary seemed cautious on the outlook but that seems to translate into 25% eps growth according to the latest consensus. This seems a little ambitious to me absent energy switching but difficult to assess without seeing how the forecasts have been constructed (again, these are not available to retail shareholders).

Me Group (MEGP) – I thought full year results from this vending machine group were excellent and as expected which makes the share price sell-off since the year end trading update even more baffling and perhaps explains the 16% uplift on results day (which is quite a lot for a FTSE 250 company). In this instance, the company delivered revenue growth of 14% and diluted eps growth of 30% which is a record set of results. Current forecasts have them pencilled in for around 10% growth in the current year which look conservative given the reinvestment opportunities in both Photo Me and Wash Me, the two largest divisions.

JP Morgan Global Growth & Income (JGGI) – a successful and significant institutional placing and retail offer at a slight premium to NAV along with interim results confirming a ~10% share price return in the six months to 31 December 2023.

Dividends

Dividends received this month from Property Franchise Group (TPFG), Oxford Metrics (OMG) and Games Workshop (GAW).

Portfolio Changes

I have exited my holding in Ultimate Products (ULTP) in favour of a new position in XPS Pensions (XPS) which appears to have better growth prospects while offering a similar dividend. I have also taken a new position in Vin Murria’s technology vehicle AdvancedAdvT (ADVT). This was funded by top slicing CT Private Equity (CTPE) and Oxford Metrics (OMG) as they both have some crossover with ADVT in terms of my investment rationale/thesis (i.e. technology focus, cash for acquisitions and private market exposure).

Looking Ahead to March

I am expecting full year results from Gamma Communications (GAMA), interim results from Fonix Mobile (FNX) and AdvancedAdvT (ADVT) along with a trading update from Games Workshop (GAW).

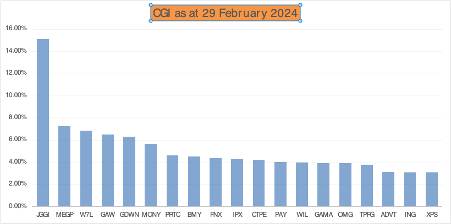

Disclosure – At the time of writing my portfolio now sits at 19 holdings in total with weightings as per the graphic below.