It seems that hardly a week has passed this year without another UK company falling under the hammer, such has been the value on offer in UK listed companies. There have been a mixture of private equity bids and trade buyers (especially overseas buyers), mostly at a healthy premium to the prevailing share price, although often well below previous share price highs (I guess it depends which side of the trade you are on), along with a fair bit of consolidation in Investment Trusts. Given this backdrop, I am both surprised and delighted not to have received any takeover bids within my portfolio this year. Surprised because I own some really good companies that are trading on historically low valuations. Delighted because it means I don’t have the headache of trying to find replacements for these names. This said, several portfolio companies have made some excellent acquisitions this year at what seem to be very good prices. This is a key advantage to owning cash rich companies in the current climate and has also led to several companies embarking on significant share buybacks during the year.

The UK has been on sale this year and hungry buyers have been taking advantage – myself included!

In macro land, the Goldilocks scenario of taming inflation without crashing the economy remains a possibility but still far from a certainty. It is the lag effects that are so difficult to predict. The markets are looking for the point at which interest rates begin to fall while central bankers continue with the higher-for-longer mantra. While this game of chicken plays out, I am simply trying to focus on owning the best companies I can within my own circle of competence, ones which I believe will be resilient despite current macro headwinds and moreover, ones that will be positioned to thrive over the next few years.

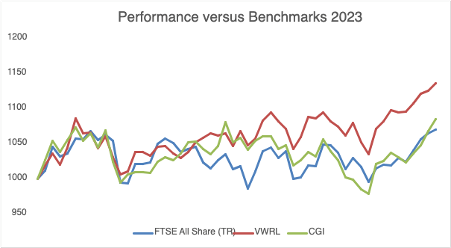

Performance versus Benchmarks

I finish the year with a positive return of 8.5%, sandwiched between my two benchmarks; FTSE All Share TR +7% and Vanguard World ETF (VWRL) +13.5%. I should probably be satisfied with that outcome but in truth I am a little disappointed not to have achieved an absolute return above 10% and to see my CAGR since portfolio inception (8 years) drop below 20% to 19.64%.

Main Contributors and Detractors

Star performer this year was Warpaint London (W7L) +110%, ably assisted by Goodwin (GDWN) +74%, Property Franchise Group (TPFG) +54% and Moneysupermarket.com (MONY) +45%.

On the other side of the ledger the only detractor I currently hold that had a negative return is Impax Asset Management (IPX) -25%, although I also sold FDM Holdings (FDM) and Polar Capital (POLR) for double digit losses during the year.

Meddling Quotient

I started the year with 26 holdings and now have just 18. In the process of this consolidation exercise I have taken something of a long route with a portfolio churn that has been far from ideal. With this in mind, I was fully expecting my meddling quotient (the difference between the actual outcome compared to doing nothing at all) to be in negative territory. Therefore, I was pleasantly surprised to see that my Meddling Quotient was actually +3.19% (a do-nothing portfolio would have delivered 5.31% compared to the actual return of 8.5%).

Regardless of this positive outcome, I plan to meddle a lot less in 2024.

Portfolio Under the Microscope

I have spent much of this year (and last year) trying to get to grips with Investment Trusts and I have concluded that it is a time-consuming minefield. Undoubtedly, there is money to be made by buying trusts that sit on (or close to) historically wide discounts. But equally, there is money to be made from UK small and midcaps which sit on (or close to) historically low valuations. Unlike some, I am more comfortable investing in individual companies than I am Investment Trusts and ETFs, given the time I currently have available. Therefore, I have decided to simplify my asset allocation, focusing on just two trusts that provide exposure to key parts of the market that I cannot effectively cover myself. These are:

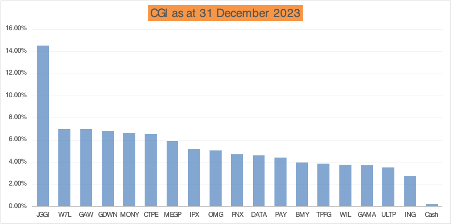

JP Morgan Global Growth & Income (JGGI) – This is a trust that has consistently traded at a premium throughout 2023, boasting an excellent short, mid and long-term track record in different market conditions via a concentrated portfolio (50-60 holdings) of large cap global equities while paying a progressive (enhanced) dividend equivalent to 4% of year end NAV. This ticks all of my boxes and the trust is my largest overall holding at ~15% weighting.

CT Private Equity (CTPE) – I believe there are significant growth opportunities in private markets and CTPE provides a relatively conservative, diversified way to gain exposure to this space. The portfolio is a roughly equal split between fund investments and direct co-investments, an approach which has led to consistent long-term returns. Like many private equity trusts, they currently trade on a large discount while boasting a progressive dividend yield of over 5%.

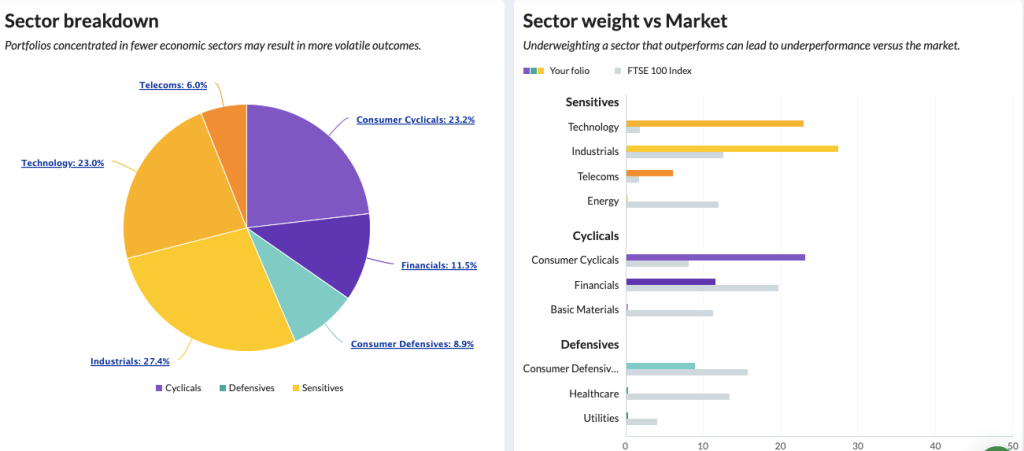

The remainder of the portfolio (~80%) consists of 16 individual small and midcap stocks that I plan to hold for the long-term (while my investment thesis remains valid or unless a more compelling proposition comes along). While these are all UK listed shares many of them generate the majority of their earnings overseas, offsetting what might initially seem like excessive home bias, although I accept that fund flows into UK equities are a significant factor. Beyond my own due diligence, idiosyncratic risk is managed via diversification, albeit significantly different allocation from the UK market overall.

All holdings are profitable, have strong balance sheets, exhibit solid quality metrics and pay a dividend (see here for my current portfolio holdings/weight). The key to unlocking future gains though is growth and I believe all holdings have a decent growth runway but as ever, that assessment will be one that requires ongoing verification as the future unfolds. After all, markets and businesses are dynamic and it is important to try and keep on top of that.

Coupled with this, I was also influenced during the fourth quarter by the excellent Stockopedia series on multibaggers which challenged me to critique portfolio holdings through an additional lens. My biggest takeaway is that I should focus on doing nothing more often. It has also given me some ideas about how to spot potential multibaggers a little earlier in their growth phase.

Last year I introduced my QARP (quality at a reasonable price) checklist and the table below shows the updated averages for the portfolio as a whole.

| QARP Checklist | Pass Rate | Average |

| ROCE % (5 Yr Avg) | 15% | 33.70 |

| ROE % (5 Yr Avg) | 15% | 33.88 |

| CROIC % (Last Year) | 15% | 64.49 |

| Gross Margin % (5 Yr Avg) | 20% | 45.57 |

| Operating Margin % (5 Yr Avg) | 10% | 17.25 |

| Net Gearing % (Latest) | 30% | -5.61 |

| P/OCF (TTM) | 20 | 16.58 |

| PEG (TTM) | 2 | 1.37 |

| EV/EBITDA (TTM) | 20 | 11.68 |

| Earnings Yield % (TTM) | 5% | 8.06 |

| Dividend Yield % (TTM) | 1% | 3.21 |

| EPS Growth % (1 Yr Forecast) | 5% | 26.07 |

| Checklist Passes n/12 | 9.50 |

As per last year, the question remains the same. Would you be interested in owning a single stock that exhibited these characteristics? It certainly makes me confident that at a portfolio level, I am in the right ballpark.

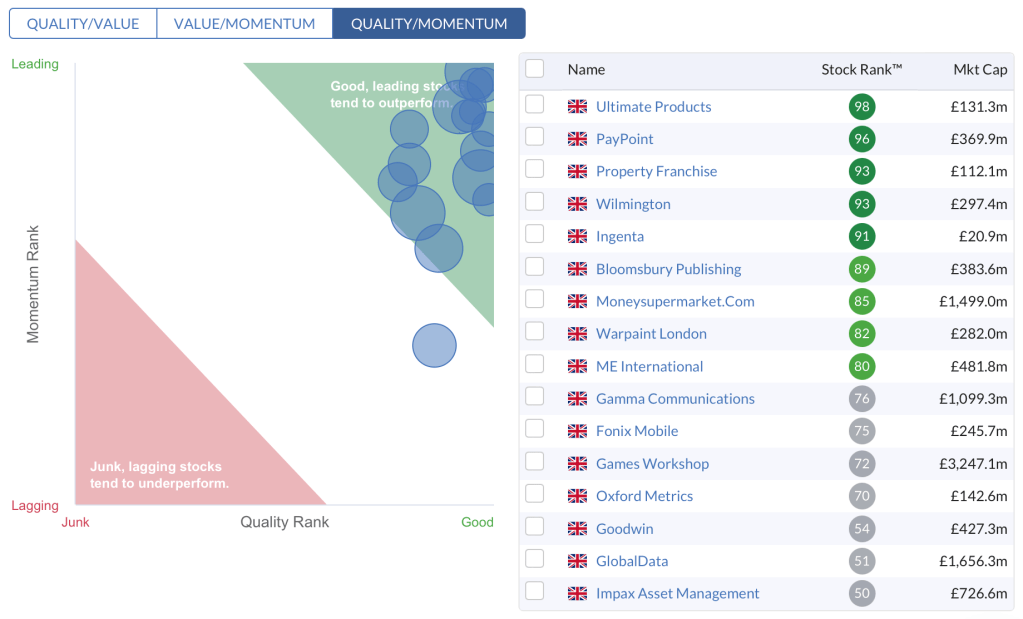

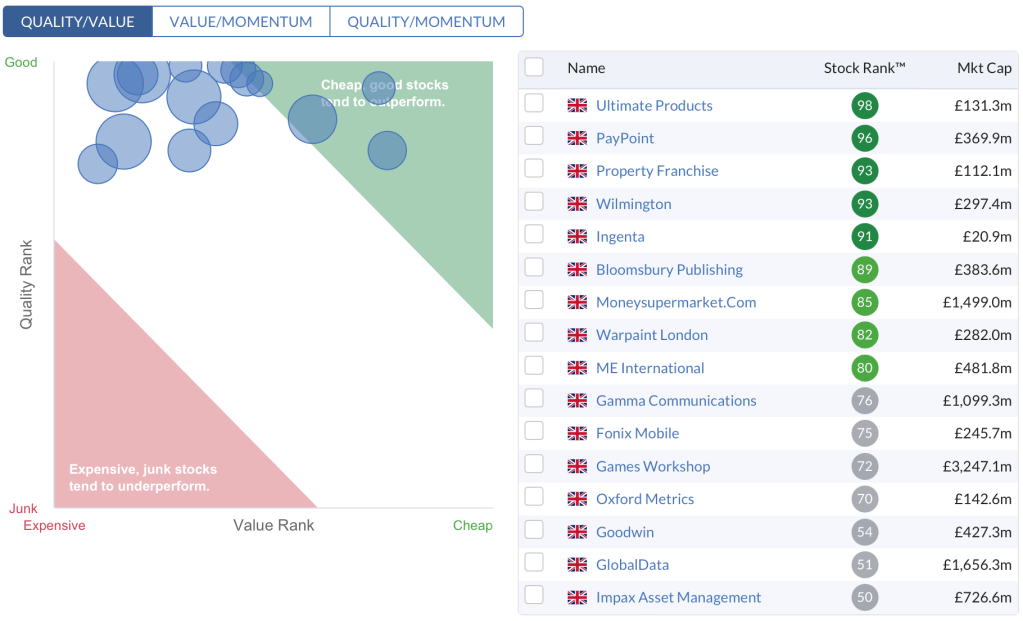

In terms of style consistency, I think the graphic below makes it clear that my portfolio has a Quality & Momentum bias. The Quality part of that is deliberate and sits at the core of my approach to stock picking. The Momentum part is partly deliberate (e.g. owning companies that are growing and usually selling out on profit warnings) whereas I accept that sometimes it is merely reflecting the vagaries of the market.

The flipside of having strong Momentum is that it often means Value moves in the other direction and while there remains a fair bit of value in the portfolio, it is not a basket of bargains.

The Forever Question – Over this quiet last week of the year, one of my favourite Fintwit posters @rhomboid1MF has challenged the community to highlight their potential forever (i.e. 25 years +) holdings. While I am probably more confident in my current portfolio holdings than I have ever been and expect to hold most of them for the next 3-5 years, I cannot hand-on-heart say that my confidence extends to the forever timeframe. The only exception is JP Morgan Global Growth & Income (JGGI) where I trust the organisation, their infrastructure and their process without a reliance on a star fund manager – but even then, I reserve the right to change my mind if these factors falter.

Feedback – If anyone has a comment to make on any names in my portfolio, please do so via Twitter. I am particularly open to hearing the bear case as I would rather have egg on my face than a nasty surprise.

Outlook for 2024

We will find out in 2024 whether the central banks and governments have been able to deliver a soft landing for the economy while taming inflation – the so-called Goldilocks scenario. My own sense is that the UK and US are very close to being in recession while parts of Europe (most notably Germany) are already in recession. The key will be avoiding a deep or protracted recession which will depend on when and how quickly central banks pivot and reduce interest rates which in turn, will be dictated by the trajectory of inflation as the year unfolds. Beware the lag effects!

By and large, broker forecasts are looking quite conservative to me with a lot of bad news already baked into forecasts and the market price. So, we could see some big bounces next year if companies start beating forecasts and raising guidance. But which ones will do that? There are many better stock pickers than me who are more suited to answer that question.

Perhaps the more pressing question for UK focused investors is what will reverse fund flows and bring money back into UK equities, especially small and midcaps? Again, I’m sure there are many more astute investors and commentators better suited to answer this question.

For my part, I am simply focused on owning good companies, mainly purchased at favourable prices and which have a multi-year growth runway. I currently own 16 such companies and maintain a very short watchlist. In the year ahead, my main task is to do nothing other than verify my investment thesis when companies publish results or other material information. You never know, I might even get the sugar rush of a takeover in 2024!

I wish all my readers and followers a happy, healthy and prosperous New Year!

Simon @BrilliantLeader

Disclosure – At the time of writing my portfolio consists of the holdings in the graphic below. If you are reading this in the future, you can view my latest holdings/weightings disclosure here.