If central bankers are to be believed, and I appreciate that in itself requires a leap of faith, interest rates are to remain around current levels for longer than anticipated, until inflation is under control. Inflation is an unpredictable beast and interest rates are a blunt instrument, so the chances are that something will break in the process of taming inflation. Perhaps a recession or black swan is headed our way or maybe, just maybe, the central bankers will have worked a modern-day miracle of taming inflation without breaking anything.

I don’t have the answers beyond that of an interested observer. However, this is the context in which we are investing for the foreseeable future – a 5% interest rate environment, the unpredictability of inflation and a possible recession. These are not easy conditions for investors to navigate and 2023 is proving to be tough going for many, especially those of us with a strong home bias in our portfolios.

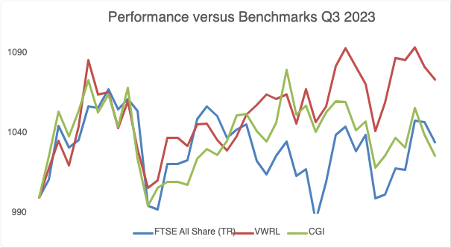

Performance versus Benchmarks Q3

A weak quarter (-2.9%) versus both benchmarks; FTSE All Share (+1.8%) and VWRL (+0.5%) which leaves me lagging on a YTD basis; +2.62% versus +3.71% and 7.41% respectively. Some ill-timed tinkering helped with the underperformance. On a brighter note, dividends are tracking at exactly 75% of my forecast and on target for the full year.

Main Contributors and Detractors in Q3

| Main Contributors | Main Detractors |

| Goodwin +19% | Impax -19% |

| Warpaint London +20% | Record -20% |

While detractors outnumbered contributors over the quarter, all other movements in either direction were single digit.

Portfolio Changes

As I said above, some ill-timed tinkering this quarter, with 7 exits (HINT, POLR, QQ., DIG, ESCT, BMY, FDM) replaced by 7 new holdings (CCH, ADIG, RWS, TPFG, HL., GAMA, PAY), the latter two being repurchases. My main focus has been on adding some resilience to the portfolio. I’d like to say that I’m going to have a trade free fourth quarter but I think we all know that is unlikely!

Is the UK Market Cheap?

Last week there was a thought-provoking masterclass by Stockopedia focused on quality investing in the US market. One of the items under the spotlight was the relative value between the US and UK markets. To illustrate the point I will use the latest index averages (forecast) for the FTSE 100 versus the S&P 500.

| Index | PE Ratio | EPS Growth % | Yield % |

| FTSE 100 | 12.84 | 7.82 | 3.41 |

| S&P 500 | 16.48 | 11.47 | 2.48 |

While the US market might seem more expensive, it has nearly 50% higher growth rate which when compounded over time probably makes the UK market poorer value, at least in the large cap arena. For sake of curiosity, I thought I’d take a look at my own portfolio (CGI) against these metrics and also the FTSE All Share index which is my main benchmark.

| Index | PE Ratio | EPS Growth % | Yield % |

| FTSE All Share | 11.53 | 8.38 | 4.29 |

| CGI | 15.06 | 10.01 | 4.77 |

As a quality focused investor (average ROCE is over 40%), I am used to my portfolio being more expensive than the UK average, compensated by a higher growth rate and interestingly, currently a higher dividend yield than all three indices highlighted here. There are many more metrics that I prefer to analyse but this rough and ready lens indicates that I am in the right ballpark. It also indicates that equity markets have probably now adjusted for a 5% world IF those growth rates can be achieved in 2024.

I have no idea when investor sentiment will shift in favour of UK equities. As I understand it fund flows for UK equities have been negative for nearly two years now but what reverses that trend? In the meantime, my focus is on verifying the investment theses of my holdings while collecting a steady flow of dividends.

One of the more surprising aspects of 2023 has been the lack of takeover activity within my portfolio when it seems as though every other day another UK business goes under the hammer. Perhaps the companies I own are not sought after but more likely, the bias towards founder managers is proving a good defence against low ball bids.

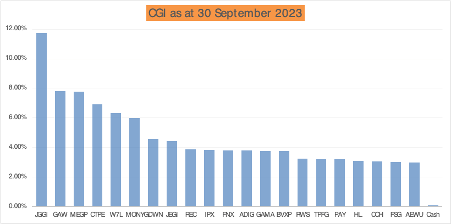

Current Holdings

At the time of writing, my current portfolio holdings are as per the graphic below.

These 21 holdings break down (in round numbers) as follows:

15% Large Cap Equities (non-UK) (JGGI, JEGI)

7% Private Equity (CTPE)

3% Commercial Property (AEWU)

4% Bonds+ (ADIG – this is a trade around the ongoing strategic review)

71% UK Small and Mid Cap Equities (x16 direct holdings)